Farmers National Banc Corp Reports First Quarter Earnings for 2024

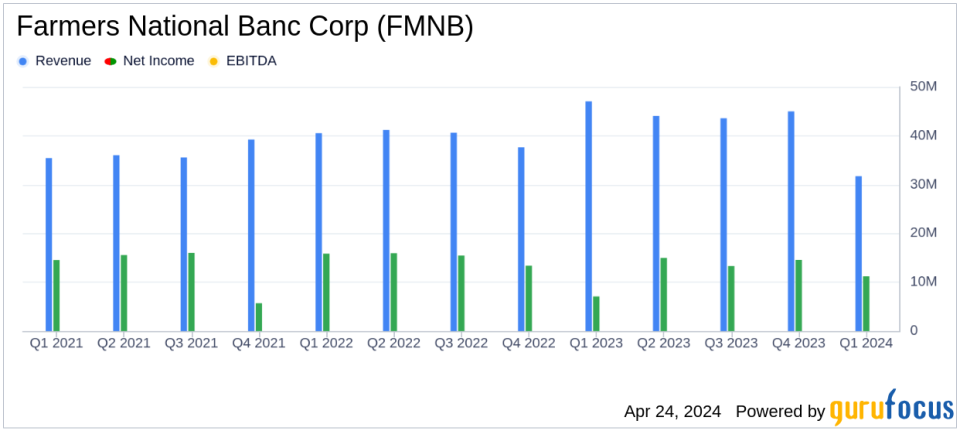

Net Income: Reported at $11.2 million for Q1 2024, up from $7.1 million in Q1 2023, falling short of the estimated $12.20 million.

Earnings Per Share (EPS): Achieved $0.30 per diluted share, below the estimated $0.33.

Revenue: Total interest income for Q1 2024 stood at $55.05 million, with net interest income after expenses at $31.7 million.

Asset Quality: Improved with non-performing loans decreasing to $12.0 million at the end of Q1 2024 from $15.1 million at the end of 2023.

Loan Portfolio: Slightly decreased to $3.18 billion at the end of Q1 2024 from $3.20 billion at the end of 2023, reflecting a cautious approach in a challenging economic environment.

Deposits: Grew to $4.20 billion at the end of Q1 2024, up from $4.18 billion at the end of 2023, indicating sustained customer trust and market stability.

Dividends: Maintained a consistent dividend payout of $0.17 per share, underscoring a commitment to shareholder returns.

On April 24, 2024, Farmers National Banc Corp (NASDAQ:FMNB) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net income of $11.2 million, or $0.30 per diluted share, which, when adjusted for a one-time loss of $2.1 million from the sale of investment securities, amounts to $12.9 million, or $0.34 per diluted share. These figures fall slightly short of analyst expectations, which projected earnings of $0.33 per share and net income of $12.20 million.

Farmers National Banc Corp, a stalwart in financial services rooted in Canfield, Ohio, operates primarily through its banking and trust segments, deriving the majority of its revenue from banking operations. The company's strategic focus remains on maintaining high asset quality and leveraging investments to bolster its balance sheet, amidst a fluctuating economic and interest rate landscape.

Financial Performance Overview

In the first quarter of 2024, Farmers National Banc Corp reported total assets steady at $5.08 billion. The loan portfolio saw a slight decrease to $3.18 billion from $3.20 billion at the end of 2023, reflecting the company's cautious approach in a challenging economic environment. The bank anticipates modest loan growth of 1-2% for the year. On the deposits front, total deposits saw a marginal increase to $4.20 billion from $4.18 billion in the previous quarter, indicating stable customer trust and bank liquidity.

The bank's net interest income for the quarter was $31.7 million, down from $36.6 million in the same period last year, primarily due to higher funding costs surpassing the increase in asset yields. Noninterest income also declined to $8.4 million from $10.4 million year-over-year, largely due to the $2.1 million loss on the sale of securities. However, the bank managed to reduce its noninterest expenses to $27.0 million from $30.7 million, reflecting effective cost management.

Asset Quality and Capital Adequacy

Farmers National Banc Corp showed improvement in asset quality with non-performing loans decreasing to $12.0 million from $15.1 million at the end of 2023. The bank's proactive management of credit risk is evident from the reduction in the provision for credit losses, which was a recovery of $449,000 this quarter compared to an expense of $8.6 million in the first quarter of the previous year.

The bank's capital ratios remained robust, with a Common Equity Tier 1 Capital Ratio of 10.88% and a Total Risk-Based Capital Ratio of 14.33%, ensuring the bank's resilience against potential financial distress.

Strategic Initiatives and Outlook

President and CEO Kevin J. Helmick highlighted the bank's strategic initiatives aimed at improving the balance sheet and asset quality amidst ongoing economic pressures. The bank's efforts in restructuring its securities portfolio and focusing on high-quality asset growth are pivotal in navigating the current interest rate environment.

As Farmers National Banc Corp continues to adapt to the evolving economic landscape, its commitment to operational excellence and community service positions it well to manage future challenges and opportunities. The bank's focus on maintaining a strong balance sheet and improving efficiency ratios underscores its strategic direction towards sustainable growth.

For detailed financial figures and further information, refer to the full earnings report and supplementary financial data provided by Farmers National Banc Corp.

Explore the complete 8-K earnings release (here) from Farmers National Banc Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance