Fast-Food Stocks: What to Watch in 2018

If you invested in fast-food stocks last year, you likely earned healthy, if not market-thumping returns. Many companies in the industry posted strong operating results, and those financial gains were boosted as refranchising initiatives raised profitability for most of the national chains.

Below, we'll look at a few of the big questions facing the major fast-food players in the year ahead.

Will Mickey D's keep winning?

McDonald's (NYSE: MCD) was 2017's runaway winner for a good reason. Namely, the industry leader posted three consecutive quarters of accelerating customer traffic, which powered its fastest expansion pace in over five years. The 6% comparable-store sales gain it logged in the third quarter blew past large and small rivals alike, including Burger King, Yum Brands! KFC, and Shake Shack.

Image source: Getty Images.

Mickey D's made several popular changes to its menu during the year, including bulking up its all-day breakfast choices and shifting to healthier, more natural ingredients and food preparations. The chain committed to using cage-free eggs and antibiotic-free chicken, for example, and is in the process of shifting its iconic Quarter Pounder sandwich to fresh beef from frozen.

Still, it will be difficult for the fast-food titan to top that result in 2018. Executives are hoping that, by covering both the value and premium ends of the market, Mickey D's can keep rivals at bay. The company is taking the offense, too, with a push into online ordering that could see it quickly become one of the world's biggest delivery companies. Even if these initiatives don't pan out, I wouldn't bet against this stock given that refranchising moves should push profitability to the mid 40% range by 2019 -- up from 33% in 2017.

Who wants to order pizza?

Domino's (NYSE: DPZ) could have a strong year following the increased market share and soaring profits it posted in 2017. Comps rose 8% in the most recent quarter, and while that result marked a slowdown from the prior quarter's spike, it still trounced the 1% uptick that both Pizza Hut and Papa John's posted.

There are big risks involved in buying this high-performing food chain, though. Domino's carries over $3 billion of debt on its books, for one, and the interest payments on those loans eat up a steep 5% of sales. Yet, its locations are cheap to build and maintain, which is a key reason the company could expand quickly in large international markets.

Yet investors would reap higher returns as Domino's puts more distance between itself and competitors in the core U.S. segment. Even though peers all essentially sell the same product, the chain's share of the pizza delivery industry touched 27% at the start of 2017, up from 19% a decade earlier. That result suggests Domino's has some enduring competitive advantages it can continue exploiting.

Will Starbucks become a lunch destination?

Starbucks (NASDAQ: SBUX) has been trying for years to push deeper into the food business. Executives know that a popular food menu would boost average spending while increasing store traffic during those non-peak hours in the later morning and around lunchtime.

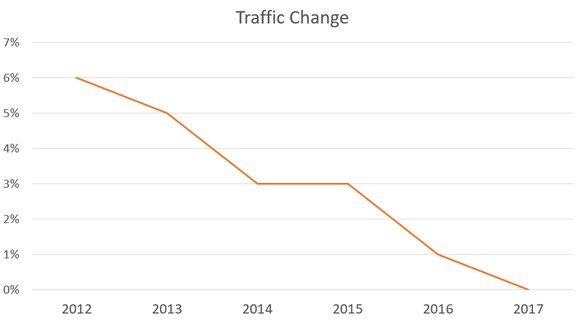

The coffee titan sure could use help on these metrics, considering customer traffic growth was flat in fiscal 2017 to mark its second straight decline, year over year.

Customer traffic change by year. Chart by author. Data source: Starbucks filings.

But in the latest quarter, Starbucks managed its best result yet in terms of food sales. The unit was responsible for 21% of the business and helped nudge the segment above the 19% mark that it has been stuck at since 2015.

CEO Kevin Johnson and his team believe a new lunch menu might push that figure to as high as 25% by 2021 and spark a sales growth rebound in the U.S. market beginning this year. As Starbucks rolls the offering out nationally, investors will learn just how achievable that aggressive food-selling goal was.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of McDonald's and Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool is short shares of Shake Shack. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance