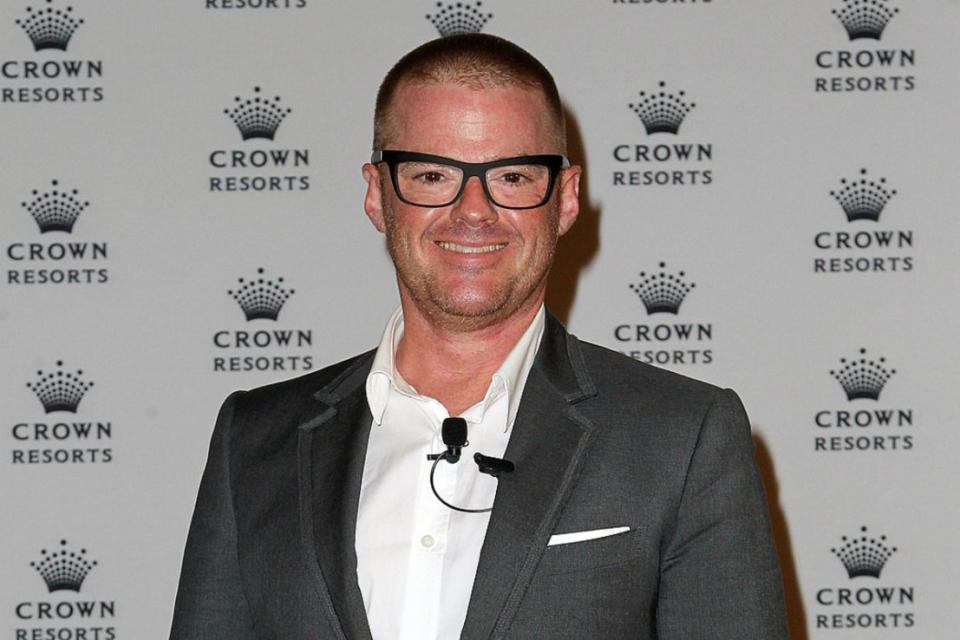

The Fat Duck: Group behind Heston Blumenthal’s restaurant slips into the red

The group behind celebrity chef Heston Blumenthal’s restaurant The Fat Duck has slipped back into the red as it continues to battle with rising wages and running costs.

The group, which owns the three Michelin star restaurant The Fat Duck, suffered a pre-tax loss of almost £1.4m in the year ending May 28, 2023, despite making a profit of £2.3m the previous period.

Wages and salaries across the businesses increased by around 18 per cent year on year to just over £3.8m.

The accounts have only just been filed with Companies House, four months after the deadline of February 2024. The firm’s results for its most recent financial year are due to be filed by February 2025.

Heston Blumenthal’s holding company SL6 said in a report published on Companies House: “We will continue to navigate our way out of these legacy headwinds and by taking into account that there is currently no consensus on when the general economic uncertainty for individuals will turn the corner.

“We will continue to see inflationary pressures in the cost of labour and in many areas of our end-to-end supply chain.

“We have invested in our customers by not passing all the inflationary costs to them. We’re protecting and growing our customer base by delivering value and a superior customer experience.

“This is giving us the platform to generate more sales to existing and new customers.”

Turnover at the group, which also includes Heston Blumenthal’s gastropub The Hind’s Head, his production company Snail Porridge, consultancy firm Tapestry Management, and SL6 Appliances, fell to £9.5m during the period, down from £11.5m the year before.

The results reveal a return to widening losses for SL6, which before the success seen in the previous period, hadn’t made a profit since the financial year ended May 29, 2016.

However the group said it expected inflation and pressure on the labour market to “ease a little” in the second half of 2024, and that it believed it would find itself in “a stronger position” to manage the ongoing challenges.

Yahoo Finance

Yahoo Finance