Britain suffering financial crime 'epidemic', watchdog warns

Britain is facing a fraud “epidemic” that “destroys” lives, the chair of the UK’s top financial watchdog has warned.

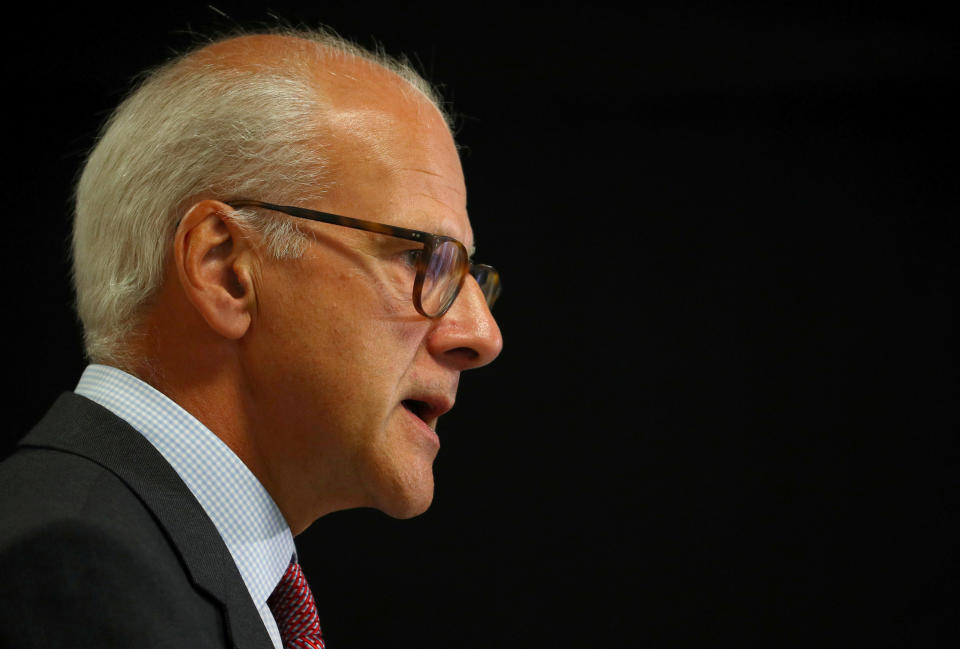

Charles Randell, the chair of the UK’s Financial Conduct Authority (FCA), on Thursday said the public are increasingly being targeted by fraudulent mini-bond scams, inappropriate pensions investments, and cryptocurrency or foreign exchange scams.

“We can’t say exactly how much financial crime there is, but it’s a very serious epidemic,” Randell said in a speech at the Cambridge Economic Crime Symposium.

“The Crime Survey for England and Wales for 2018/19 puts the total volume of fraud affecting individuals at 3.8 million cases, around one-third of the total volume of 11.2 million crimes. The figures for financial crimes against businesses are on top of that.”

READ MORE: Government 'unsympathetic' to major bust bond scheme investors

Randell called for a coordinated approach between regulators, police, finance firms, tech companies, and data businesses to help tackle the problem.

“The scale of the challenge calls for concerted action from everyone involved, pooling our resources and expertise to maximise impact,” he said.

Randell said the impact of financial crime was “devastating” and said: “Fraud can destroy not just the victim’s savings but also their mental and physical wellbeing.”

Yahoo Finance UK has reported on the damaging impact of financial crime. Dr Saboor Mir, an 87-year-old retired eye surgeon, this week told Yahoo Finance UK how he lost £50,000 investing in a mini-bond scheme that went bust, leaving him with only enough money to pay for “piecemeal” care.

New rules needed

Financial fraud and inappropriate investment has been a major topic for regulators and politicians this year, after a series of high profile failures and scams. Around £1bn has been lost due to the collapse of unregulated firms that issued mini-bonds.

The Treasury has opened an independent inquiry into the collapse of London Capital & Finance, which went bust earlier this year after raising over £200m through mini-bonds.

READ MORE: Savers targeted with ads on Google for 'bonds' that put all their money at risk

The inquiry will consider whether reform of the rules is needed to protect consumers. Randell urged the Treasury to give the FCA more powers to regulate financial promotions and advertisements.

“Unless the issue or approval of financial promotions is made a regulated activity … I’m not confident that the financial promotions regime can provide much better protection than it does at present – which is not enough,” he said.

Randell called for a ban on terms like “secure” and “asset-backed” in investment adverts, which he said “are often highly misleading.”

Advertisers ‘profit from these crimes’

Yahoo Finance UK has highlighted how adverts for high-risk and inappropriate mini-bond investments still appear alongside Google searches for terms like “savings” and “high interest savings.”

Randell said companies like Google that advertise these products “profit from these crimes.”

“Quite frankly, they don’t always play their part in remedying the harm they create,” he said.

Randell praised Facebook for introducing a scam reporting tool and called for Google follow suite.

READ MORE: Watchdog criticises Google over high-risk bond ads: 'We want to see significant progress'

“I wouldn’t support imposing unreasonable expectations on the big tech companies but as a minimum I would expect them to take down suspected fraudulent content immediately when requested to do so by the authorities, and ensure that their terms and conditions give them the right to do so,” he said.

“And I would expect them to use their extraordinary resources to work with law enforcement and regulators to develop algorithms and machine learning tools to identify potentially fraudulent content.”

Randell said the spike in financial scams was partly down to reforms that “allows, and sometimes now demands, that individuals take potentially very difficult and risky decisions about their savings.”

He highlighted Pension Freedoms, the 2015 reforms that allowed savers to invest their own pensions rather than simply buy annuities upon retirement.

“As a regulator, we must deliver the best protection for consumers that we can, in the light of choices made by politicians,” Randell said. “But even when we are at our very best, more individual responsibility and freedom of choice are likely to mean more risk to consumers.”

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Retired doctor who lost £50,000 on risky bonds calls for rule change

UBS chairman: Climate change occurring at 'astonishing' speed

Government 'unsympathetic' to major bust bond scheme investors

Brits splurge on credit cards as spending hits all-time high

Yahoo Finance

Yahoo Finance