Fear has clearly given way to greed

By David Nelson, CFA, Chief Strategist at Belpointe Asset Management

After a 4 week post-election rally pushing the Dow (^DJI) upwards, close to 20,000, focus shifts to the Fed and an expected rate hike—the first since last year. There’s little debate on the street as to the announcement this week, but the commentary that follows has investors wondering just how much we’ll learn about the policy path as we head into the New Year. I believe Chair Yellen understands the importance of the Federal Reserve passing the baton to fiscal policy. The Fed missed its window as far back as 2013, but recent data points to an economy primed to climb out of its 2-year-long malaise.

The only real surprise would be if the Fed held its ground and didn’t pull the trigger. If that happened, the Trump Rally would end in a heartbeat, with banks leading the way south. Given the rhetoric, there’s likely no love lost between Yellen and Trump, and many believe the President-elect will replace her at the first opportunity.

I think most professionals, including yours truly, put the odds of no hike at close to zero. “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” The make-believe Mark Twain quote from the popular movie, “The Big Short,” says it all. I see little chance of the Fed taking a pass, but given what we’ve seen over the last several months, nothing would surprise me.

While stocks have soared since election day, the constitution of the rally points to a strong cyclical recovery not unlike what we see coming out of a recession. The rotation from slow-growth—even no-growth stocks, supported by only the dividend—to deep cyclicals like banks (XLF), industrials (XLI), and consumer discretionary (XLY) was driven by the realization that a rollback of regulatory overreach, tax reform and a pro-growth agenda could be the foundation of the next leg of the bull market. Why pay well-above market multiples when there are cheaper stocks ready to explode higher on the back of a stronger economy.

To be fair, what we are seeing is not only about the “Trump effect.” On Friday, I told Fox Business anchor Charles Payne the economy wasn’t as bad as we thought. The second revision of third quarter GDP came in at 3.2%—well above expectations.

I went on to say, “Growth solves a lot of problems, politically and economically.” The prospect of higher growth under the incoming president has driven animal spirits, forcing investors out of safe haven trades into stocks. In addition, Consumer Sentiment and Consumer Confidence surveys have exploded higher since the election, challenging levels not seen since before the financial crisis.

It’s pretty clear that fear has taken a back seat to greed. In the space of 24 hours, perceptions shifted from the glass is empty to the glass is half full.

Before we let our emotions run out of control, it’s important to remember that much of the market’s push higher is on the come.

While I’m excited that real fiscal reforms are just around the corner, markets don’t move in a straight line. Many proposals will be watered down by partisan politics, diluting some and, in turn, their economic benefits.

As I pointed out in a recent post, the repatriation of corporate cash held offshore following a tax holiday may not add as much to the economy as thought. While even the lower taxes paid will go a long way to support proposed infrastructure spending which, in turn, adds jobs—just how much cash CEOs will plow into CAPEX and R&D remains to be seen. We had a similar repatriation in 2004, and much of those funds went into stock buybacks.

The truth is, that unless corporate boards establish new metrics to gauge executive performance, it’s in the CEO’s best interest to focus first on the short-term. Why invest in a factory or increased R&D, when a buyback does more for earnings per share today? The focus on EPS is unfortunate because buybacks do nothing for revenue or real earnings. They only boost earnings per share due to a smaller share count. Until boards restructure compensation packages that balance the future with the needs of today, I’m skeptical just how much benefit the economy will receive from repatriation.

Dow 20,000?

The media’s obsession with Dow 20,000 means next to nothing other than it’s a nice round number and we can all put on our party hats. The price-weighted index relies almost exclusively on the highest-priced stocks in the index to drive returns.

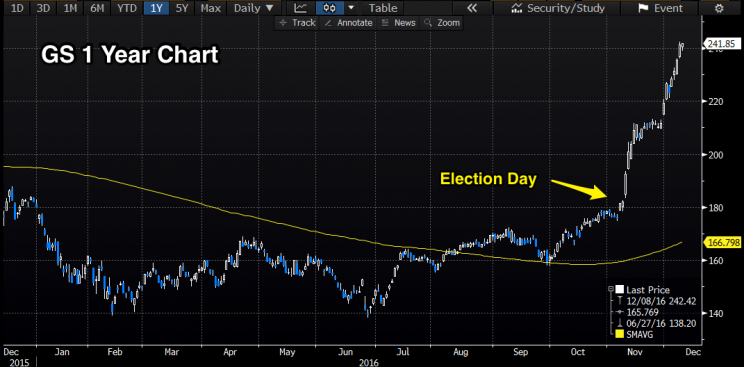

At $241 per share and its nearly 34% return since election day, Goldman (GS) is responsible for the lion’s share of the Dow’s return. Cisco (CSCO), General Electric (GE) and Coca-Cola (KO) hardly matter. If Goldman split its stock today 5:1, it would head to the back of the bus in terms of importance. The more important indices are the S&P 500 (^GSPC) (both market cap and equal weight) as well as the Russell 2000 (^RUT) for small caps, where the real gauge of the economy may reside.

Yahoo Finance

Yahoo Finance