Fears for UK economy as construction suffers sharpest slide in a decade

New orders in the UK construction industry dropped at the fastest rate in more than 10 years in August, a widely watched survey shows.

Building firms are now “braced for a protracted slowdown” as new work dries up, sparking a similarly sharp decline in business optimism to its lowest level since the financial crisis in 2008.

The latest figures reveal shrinking output for the fourth month in a row, raising fresh alarm bells over the health of the UK economy in the run-up to Brexit.

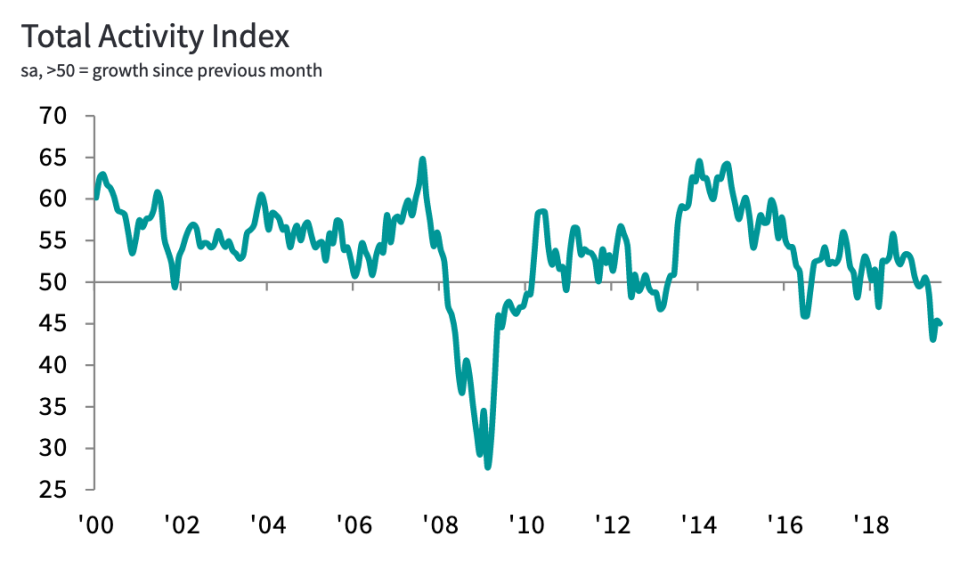

The headline figure in the latest purchasing managers’ index (PMI) in construction was 45 for overall output, down from 45.3 in July.

Figures below 50 on the index, by IHS Markit and the Chartered Institute of Procurement & Supply (CIPS), indicate a decline in trading conditions. Readings above 50 indicate growth.

READ MORE: UK manufacturing crashes to worst performance in seven years

The survey paints a bleak picture as Brexit hits confidence, just a day after UK manufacturing crashed to its worst performance in seven years.

UK manufacturers recorded their worst month in seven years in August, as “immensely feeble” figures showed activity shrank for a fourth month in a row.

House price growth also “ground to a halt” in August in another warning sign for the British economy, with Nationwide figures suggesting prices were unchanged month-on-month. IHS Markit figures for Britain’s dominant services sector will be published on Wednesday.

Duncan Brock, group director at the CIPS, said: “The sector fell deeper into contraction as continuing uncertainty and a weakened UK economy took a sizeable bite out of this month’s construction activity.

“Inevitably business confidence followed suit, dropping like a brick to its worst since December 2008 and close to the lowest depth seen in the previous recession.

“The commercial sector particularly has been devastated by reluctant clients fearful of taking a wrong turn in a confusing landscape and delaying project starts, resulting in the fastest drop in new orders since March 2009.”

READ MORE: UK house price growth ‘ground to a halt’ in August

Brock noted job creation had remained fairly steady and fears of further price hikes for materials eased slightly, but predicted September’s figures would be “even more discouraging.”

Tim Moore, economics associate director at IHS Markit, said the political crisis had clearly “held back” activity as clients showed “rising risk aversion.”

“This provides an early signal that UK construction companies are braced for a protracted slowdown as a lack of new work to replace completed contracts begins to bite over the next 12 months," added Moore.

Gareth Belsham, director at property consultancy and surveyors Naismiths, said: “The flow of new orders has dried up from a drip to a desert. We’re fast approaching the critical point where the pipeline of new work isn’t close to keeping up with the pace at which projects are being completed.

READ MORE: Sajid Javid invests in nurses despite IFS warning on spending spree

“This worsening shortfall is slicing into contractors’ margins and decimating confidence. Little wonder that business sentiment has slumped to its lowest level since the dark days of 2008,” said Belsham.

But Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the sector “could revive quickly if the risk of a no-deal Brexit subsided.”

He said commercial clients did not lack the funds for projects, delaying them only because of Brexit risks, and said falling mortgage rates this year should push up demand for new homes.

Yahoo Finance

Yahoo Finance