Fears mount over negative rates hit to pensions

Negative interest rates could send final salary pension schemes plunging further into the red and hammer firms seeking to recover from the Covid crisis, analysts have said.

It is feared that below-zero rates being considered by the Bank of England would crush the returns made by company retirement plans, leaving them unable to pay what has been promised to members.

This would force employers to divert billions of pounds into plugging the gap - money which could not be used to invest in growth, hire staff or pay down pandemic debts as a result.

It comes after experts warned on Monday that negative rates could bring an end to free bank accounts for the general public by crushing lenders' profits.

Former Conservative pensions minister Baroness Altmann said negative interest rates would make the problem even worse.

She said: “Negative rates make it even more difficult to fund pensions as final salary pensions cannot fall in value unless the employer is becoming insolvent.

“Ever since 2009, the Bank of England has not taken the problem of pension funding seriously enough. Meanwhile, schemes have closed as they are desperately searching for higher returns than government or top-rated bonds.

"The firms sponsoring final salary schemes are having to put huge sums into their pension schemes rather than productive investment in their business. They could – and should – be using their assets to invest in economic recovery, build infrastructure or social housing which can deliver better long-term returns.”

The Pension Protection Fund estimated that the deficit of Britain's 5,422 final salary pension schemes - the difference between what they owe members and the value of their assets - widened to £166bn at the end of September.

It cited plummeting gilt yields as one of the main reasons for the jump, driven down by rock-bottom central bank interest rates that stand at just 0.1pc.

Andrew Bailey dismissed the idea of cutting interest rates below zero when he became the Governor of the Bank of England in March but there has been growing debate about the move at Threadneedle Street as officials plot to shore up the economy in the face of a second Covid wave.

This week deputy governor Sam Woods asked commercial banks what steps they would need to take if official borrowing costs were pushed into negative territory.

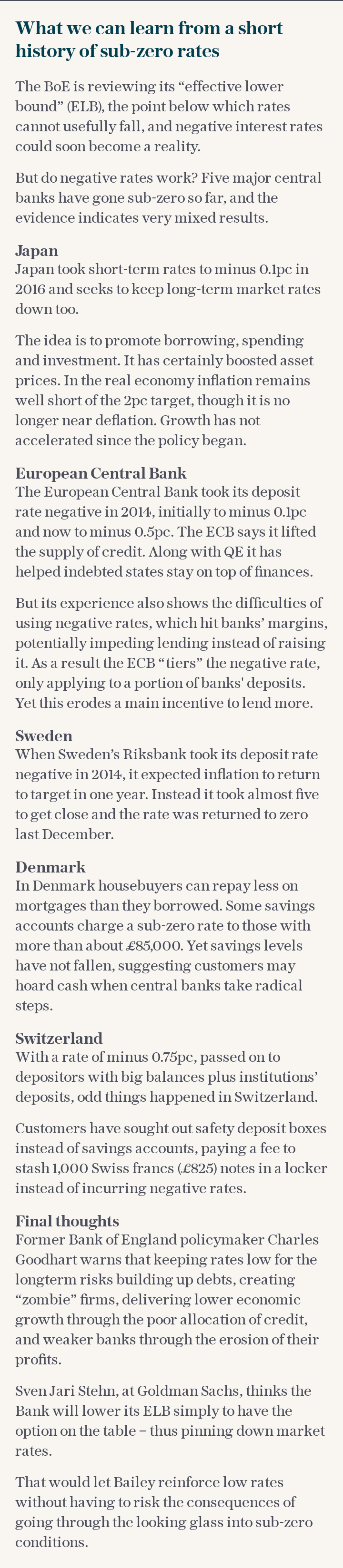

Some members of the Monetary Policy Committee (MPC), including Silvana Tenreyro and Jonathan Haskel, have suggested they are open to using negative rates to boost the coronavirus recovery, citing the experience of other countries as encouraging.

Peter Schaffrik at Royal Bank of Canada predicted that the Bank would cut rates in February next year given that the Government’s decision not to extend the furlough scheme is likely to drive up unemployment, hitting consumer spending and economic growth.

Mr Schaffrik added that even if a European Union trade deal is reached, the UK economy is heading for “a perfect storm” in the first quarter of next year that would nudge the MPC to cut rates by minus 0.25 points to minus 0.15pc.

He said: “The European Central Bank has dispelled the notion that zero is the lower bound,” he added.

Sir Steve Webb, a former pensions minister and now partner at consultant LCP, said that prolonged low interest rates would be harmful for pensions and the broader economic recovery from Covid.

He said: “Low interest rates mean pension promises you make today are more expensive.

“That matters enormously for corporate Britain because if companies make pension promises that are expensive, it appears on their balance sheets, instead of them investing now. You can’t spend the same pound twice."

Yahoo Finance

Yahoo Finance