Fears over 280,000 pensions as Barclays dumps final salary scheme on 'casino bank'

Barclays has attracted stinging criticism over plans to give responsibility for its giant staff pension fund to its "riskier" investment banking division.

Frank Field MP, who chairs the influential Work and Pensions parliamentary committee, has written to the chief of the Pensions Regulator over concerns that 280,000 savers' pensions have been put under threat by the move.

Barclays offered staff a generous "final salary" pension scheme until 2012, when it was replaced with a "defined contribution" plan. The final salary fund is one of Britain's largest with £34.6bn of assets but a funding deficit of £7.9bn.

But as part of the restructuring of Barclays into a new "ringfenced" British retail bank and an investment division, the giant pension fund is staying with the latter.

As part of the arrangement, pension fund trustees, who include members of the scheme, have been promised access to assets worth £9bn in the event the bank collapses. Trustees have approved the plans.

The bank is being split as part of regulations brought in after the financial crisis to better protect customer deposits, and prevent the Government from having to fund a future bailout. Unlike Lloyds, RBS and others, Barclays avoided a state bailout in the crisis.

I am struggling to fathom how being shackled to the expendable half provides long term reassurance to the pension scheme members

Mr Field said: "The whole point of splitting banks in two is to protect the safe retail bank that can’t be allowed to fail from the 'casino' bank that can go bust come the next crash. I am struggling to fathom how being shackled to the expendable half provides long-term reassurance to the pension scheme members."

A spokesman for Barclays said the scheme would be backed by both parts of the bank until 2025 and that the Pensions Regulator had been informed of the plans.

Regulations bar the watchdog from casting judgement over a company's pension plans until the company deems its actions to have the potential to bring a "material detriment" to the schemes. Experts are warning that the regulator's powers are too weak to protect pensions when corporate deal go awry.

This was the case with retailer BHS, which was sold by Sir Philip Green with seemingly little regard for whether the purchaser, Dominic Chappell, had the financial means to meet pension payments.

Tom McPhail, a pensions expert at Hargreaves Lansdown, the fund shop, said: "After the BHS saga, we should have learned lessons about a need for the regulator to intervene at an early stage in corporate actions to protect pension scheme members further down the line.

"This looks like a classic example of where this should be happening. To what extent has the regulator probed the investment bank's ability to pay pensions in the future?"

A spokesman for the Pensions Regulator said: "We are aware of this plan and have discussed it with Barclays and the scheme’s trustees. Barclays has not made a clearance application, nor have we approved the bank’s plans. As clearance has not been provided, all of our powers remain available to us."

The bank added: "Barclays’ primary objective in its ringfencing plans has been to safeguard the interests of our pensioners.

"We believe that we have achieved this through the agreement reached with the trustees and their advisers, which involve both of Barclays’ operating companies being liable for the pension fund until December 2025 and up to £9bn of assets being committed to fully secure its obligations; and we have discussed our plans with the Prudential Regulation Authority, the Pensions Regulator and the independent expert reporting to the court, Grant Thornton."

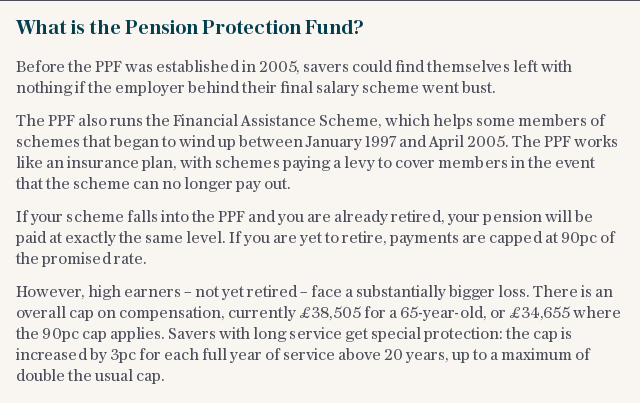

Final salary schemes have come under intense scrutiny following funds previously sponsored by Tata Steel, BHS and Carillion falling into the Pension Protection Fund, the lifeboat scheme.

When this happens the pensions of those already retired are protected but younger savers face a reduction in payouts of at least 10pc.

sam.brodbeck@telegraph.co.uk

Yahoo Finance

Yahoo Finance