Frozen Britain facing energy crisis as gas plant explosion raises prices by a third

British homes and businesses face a potential gas crisis this winter after a perfect storm of shock outages sent prices surging just as demand for heat reached highs not seen in almost five years.

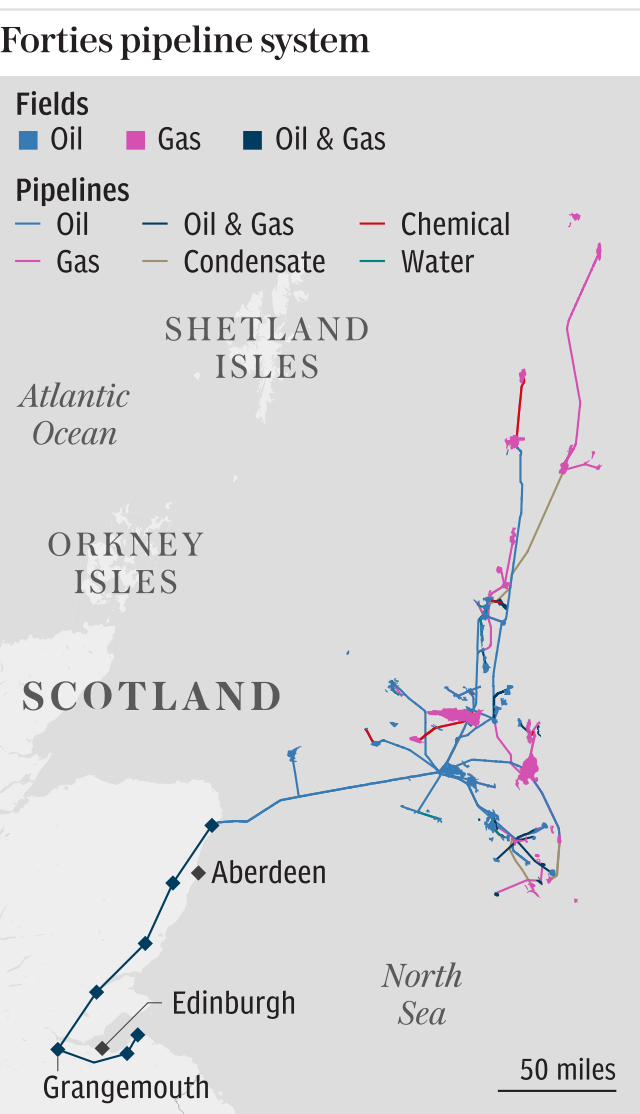

The shutdown of the North Sea’s most important oil and gas pipeline system has been compounded by an explosion at a major gas processing facility in Austria, creating a perfect storm of disruption to gas supply across Europe.

The Baumgarten explosion effectively obstructs the main entry point for Russian gas, which makes up a third of the continent’s overall supplies.

This hit is most painful for Italy, where market prices have already more than doubled, prompting the country to declare a state of emergency to tackle its “serious” energy supply problem.

The reverberations have been keenly felt in the UK, where gas prices have surged to more than 90p a therm from just over 57p last week.

The price for January’s gas has also climbed by almost a third, sparking concern that suppliers may need to lift energy prices.

For smaller suppliers the rocketing price could pose an existential threat if they have not been able to buy enough in advance to meet demand.

The current cold snap in the UK has driven gas demand in homes and businesses to their highest forecast levels since early 2013, according to data from Thomson Reuters.

Overnight, temperatures plummeted to as low as -13C (8.6F) near Shrewsbury, in Shropshire.

The UK is also demanding the highest amount of gas to generate power in four years due to the steady shutdown of older coal plants in recent years.

Oliver Sanderson, a Thomson Reuters analyst, said the “spectacular” confluence of supply problems could drive today’s price spikes through the rest of winter.

“This isn’t just about where we’ll find the gas we need for today - it’s about where to find the gas we’ll need in January,” he told the Telegraph.

The North Sea’s largest pipeline system could remain shut until January, wiping out 40 million cubic metres of gas from the UK’s gas supplies every day, or a third of normal domestic production.

Meanwhile, one of the largest North Sea fields - which is independent of the Forties pipeline - is also struggling to flow gas at its usual rate. The aging Morecambe field is producing around 2 million cubic metres of gas a day, less than half its average 5mcm/day rate.

U.K. gas surges as pinched pipeline compounds cold snap https://t.co/p7oh1yV8bEpic.twitter.com/ssBpQYAuSN

— Bloomberg Markets (@markets) December 12, 2017

The supply fears lay bare the vulnerability of the UK’s aging energy infrastructure. The Forties pipeline is almost 42 years old, while the Morecambe field is only a decade younger. In addition, the Rough gas storage facility off the Yorkshire coast was permanently closed earlier this year after 32 years as the country’s main storage facility.

“On top of that there’s a power supply outage to the main Norwegian gas producing fields, which will cut production from around six hours today. But the most serious of the lot is an explosion which takes out Russian gas flows to South East Europe,” Mr Sanderson said.

“Italy is going to be seriously short of gas in the coming weeks, which means they will need to import the maximum that they can from North West Europe by pipeline and pay more to secure shipments of liquefied natural gas (LNG), in direct competition with the UK, which may need more LNG to replace the loss from the Forties system,” he said.

Yahoo Finance

Yahoo Finance