Fed does nothing

The Federal Reserve delivered a monetary policy announcement in line with Wall Street expectations, standing pat on interest rates and confirming the timeline for winding down its $4.5 trillion balance sheet.

The Federal Open Market Committee concluded its two-day policy meeting, voting unanimously to hold its benchmark federal funds rate between 1.00% and 1.25% and to continue the process of balance sheet normalization, which began in October.

Economic outlook

The Fed’s cautious, yet generally positive, economic statement follows a slew of mixed data, including better-than-expected third quarter GDP and soft inflation numbers.

Unemployment has held solidly below 5% for over a year, a level many economists consider to be near full employment. The unemployment rate sank to 4.2% in September, close to its lowest level in a decade. However, the number of US jobs shrank, as non-farm payrolls fell by 33,000 — mostly due to hurricane-related disruptions.

“[E]conomic activity has been rising at a solid rate despite hurricane-related disruptions. Although the hurricanes caused a drop in payroll employment in September, the unemployment rate declined further,” the Fed wrote in its statement. “Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters.”

Meanwhile, the Fed’s preferred inflation reading has continued to run below its 2% target. The core Personal Consumption Expenditures index remained at 1.3% year-over-year in September. Another measure of inflation, the core Consumer Price Index, held steady at 1.7% for the month.

“Gasoline prices rose in the aftermath of the hurricanes, boosting overall inflation in September,” the central bank noted. “[H]owever, inflation for items other than food and energy remained soft.”

Within the past month, Fed chair Janet Yellen has expressed concern about persistently low inflation. Other Fed officials have joined her, including Robert Kaplan of the Dallas Fed and Charles Evans of the Chicago Fed.

At the June meeting, the Fed revealed plans to gradually reduce its $4.5 trillion balance sheet by decreasing its reinvestment of principal payments. Payments will only be reinvested when they exceed gradually rising caps, which start at $6 billion per month for Treasuries and $4 billion per month for agency debt and MBS.

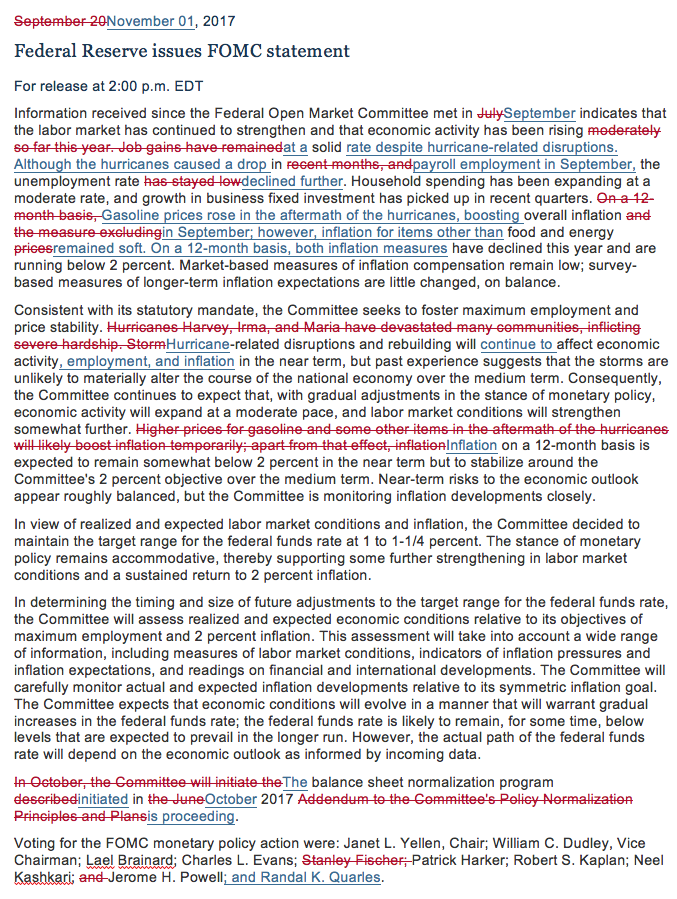

A redline of the Fed statement is below.

Yahoo Finance

Yahoo Finance