Fed leaves interest rates unchanged but signals three cuts this year

The Federal Reserve announced on Wednesday that it would leave US interest rates at a 25-year high as it continues to assess their impact on cooling inflation and the wider economy.

After a two-day meeting, the Fed announced rates would be unchanged at 5.25% to 5.5%, where they have been since July. But the Fed signaled it still expects to cut rates three times this year.

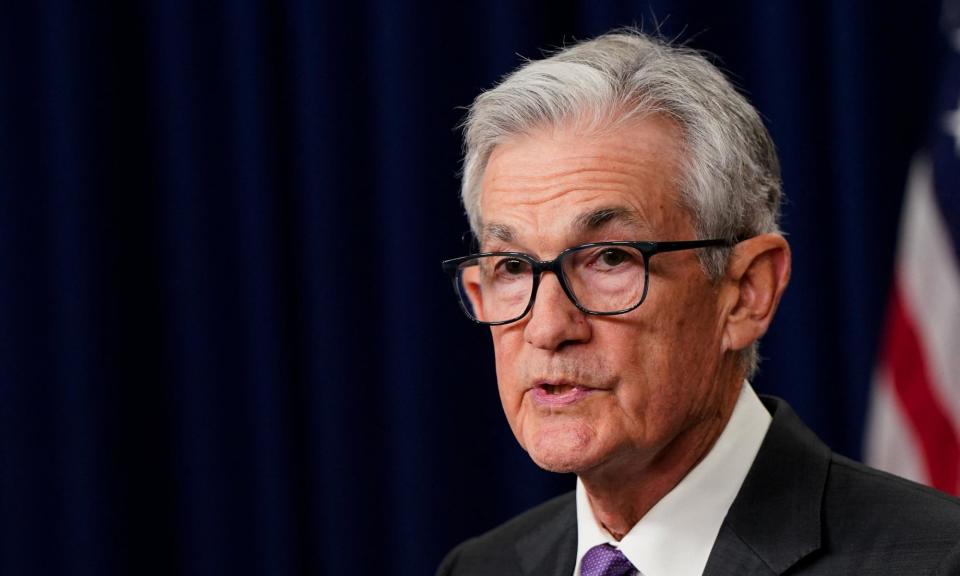

The Fed chair, Jerome Powell, has indicated that the central bank may soon start cutting rates following a series of hikes aimed at tackling a generational surge in prices triggered by the Covid pandemic.

“Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated,” the Fed said in a statement.

Economists had predicted the Fed would cut rates three times this year, but doubts remain, as recent economic data suggests that the pace of decline in the rate of inflation is slowing and, at 3.2%, remains above the Fed’s 2% target.

“The committee wants to see more data that gives us higher confidence that inflation is moving down sustainably toward 2%,” Powell said. “We don’t see this in the data right now.”

The Fed has a dual mandate: stable prices and maximum employment. Hiring in the US has remained robust despite higher interest rates. The US added 275,000 new positions last month, and while the unemployment rate ticked up to 3.9%, it has remained below 4% for two years – the longest such streak since after the Vietnam war.

Inflation has cooled from a high of more than 9% in June 2022, but ticked up slightly last month as the cost of shelter, airline fares, clothes and other items rose.

Yahoo Finance

Yahoo Finance