Fed Says Rate Hike Nearing End: 5 Tech Stocks to Buy on the Dip

In its March FOMC meeting, the Fed raised the benchmark interest rate by 25 basis points to the range of 4.75% to 5%. This is the highest level of the Fed fund rate since late 2007. However, Fed Chairman Jerome Powell signaled that rate hike cycle is approaching its end.

March FOMC Meeting

Fed’s latest projection shows that the terminal interest rate at the end of 2023 will be 5.125%. This implies that just one more 25-basis point hike in the benchmark lending rate will complete this cycle. This is exactly what the central bank had projected after its December FOMC meeting.

However, a sudden spike in the inflation rate in January and a series of strong economic data for January and February compelled Powell to say that the higher interest regime will continue for a longer period in his testimony before the U.S. Congress. Several Fed officials estimated that terminal interest rate should be 5.375% or more at the end of 2023.

Meanwhile, the recent liquidity crisis of the banking sector in the United States and Europe has shaken the global financial markets. Market participants remain highly concerned regarding a recession this year. These developments have changed the entire landscape forcing the Fed to take a relatively dovish stance.

Although no rate cut is anticipated in 2023, Powell signaled that the Fed fund rate will be reduced by 0.8% in 2024 and another 1.2% cut is expected in 2025.

Tech Stocks Likely to Gain

Growth-oriented sectors like technology, communication services and consumer discretionary are highly susceptible to interest rate movements. A high interest rate is detrimental to growth stocks. This was evident in the recent pandemic-induced turmoil.

During the pandemic-ridden 2020 and 2021, the Fed kept the benchmark interest rate as low as 0-0.25%. Consequently, the tech sector witnessed an unprecedented rally that enabled Wall Street to exit a coronavirus-induced short bear market and form a new bull market.

However, as the Fed hiked interest rate by 4.5% in 2022 to combat the 40-year high inflation, the growth sectors, especially technology stocks suffered the most. With the central bank stating that rate hike is approaching its end, technology stocks are likely to gain in the short to mid-term.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) U.S.-based technology stocks with attractive valuations. The stocks have strong growth potential for 2023 and have seen positive earnings estimate revision in the past 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

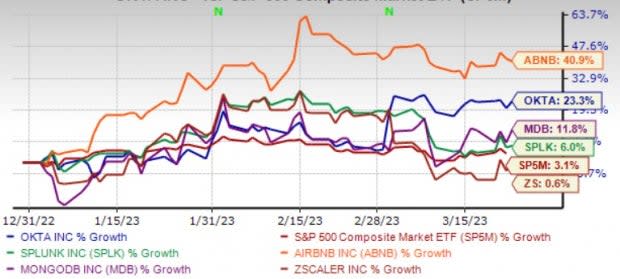

The chart below shows the price performance of our five picks yhear to date.

Image Source: Zacks Investment Research

Airbnb Inc. ABNB is riding on an improvement in the travel industry. Continued recovery in both longer-distance and cross-border travel owing to a reduction in travel restrictions is benefiting ABNB’s Nights & Experience bookings. Additionally, growth in average daily rates and gross booking value is a tailwind.

Growing active listings in Latin America, North America and EMEA are contributing well to the top line. Growing sales and marketing initiatives along with continuous efforts to upgrade various aspects of the Airbnb service are helping the company gain momentum among hosts and guests.

Zacks Rank #1 Airbnb has an expected revenue and earnings growth rate of 14.9% and 21.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 20.7% over the past 60 days. The stock price of ABNB is currently trading at a 32.8% discount from its 52-week high.

Splunk Inc. SPLK has been gaining traction from healthy customer engagement, evident from the consistently high net retention and competitive win rates alongside solid momentum with large orders overall.

SPLK is improving the resilience and security of its critical system and driving efficiencies within its own internal operation. Also, the business transition from perpetual licenses to subscription or renewable model is expected to benefit it in the long run. SPLK’s top line is benefiting from high demand for its cloud solutions.

Zacks Rank #1 Splunk has expected revenue and earnings growth rates of 6.1% and 4.8%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 10.6% over the past 30 days. The stock price of SPLK is currently trading at a 39.5% discount from its 52-week high.

Okta Inc. OKTA provides identity management platforms for enterprises, small and medium-sized businesses, universities, non-profits, and government agencies in the United States and internationally.

OKTA’s products consist of Okta Information Technology Products and Okta for Developers. Okta IT Products include Single Sign-On, Mobility Management, Adaptive Multi-Factor Authentication, Lifecycle Management and Universal Directory. Okta for Developers include Complete Authentication, User Management, Application Programming Interface Access Management and Developer Tools.

Zacks Rank #2 OKTA has expected revenue and earnings growth rates of 16.6% and more than 100%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the past 30 days. The stock price of OKTA is currently trading at a 47.9% discount from its 52-week high.

Zscaler Inc. ZS is benefiting from the rising demand for cyber-security solutions owing to the slew of data breaches. The increasing demand for privileged access security on digital transformation and cloud-migration strategies is a key growth driver of ZS.

Zscaler’s portfolio boosts its competitive edge and helps add users. Moreover, a strong presence across verticals, such as banking, insurance, healthcare, the public sector, pharmaceuticals, telecommunications services, and education, is safeguarding Zscaler from the pandemic’s negative impact. Also, recent acquisitions, like Smokescreen and Trustdome, are expected to enhance ZS’ portfolio.

Zacks Rank #2 Zscaler has expected revenue and earnings growth rates of 43.2% and more than 100%, respectively, for the current year (ending July 2023). The Zacks Consensus Estimate for current-year earnings has improved 19.4% over the past 30 days. ZS stock is currently trading at a 55.6% discount from its 52-week high.

MongoDB Inc. MDB provides general purpose database platform worldwide. MDB offers MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premise, or in a hybrid environment, MongoDB Atlas, a hosted multi-cloud database-as-a-service solution, and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

MongoDB also provides professional services comprising consulting and training. MDB serves financial services, government, healthcare, media and entertainment, technology, retail and telecommunications industries.

Zacks Rank #2 MongoDB has expected revenue and earnings growth rates of 16.6% and 27.2%, respectively, for the current year (ending January 2024). The Zacks Consensus Estimate for current-year earnings has improved 6.3% over the past 30 days. The stock of MDB is currently trading at a 53.4% discount from its 52-week high.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

MongoDB, Inc. (MDB) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance