Fed Signals One Rate Cut This Year, But Keeps Door Open to Two

(Bloomberg) -- Federal Reserve officials dialed back their expectations for interest-rate cuts this year, though Chair Jerome Powell kept the door open for more as he emphasized the new forecasts represented a conservative approach.

Most Read from Bloomberg

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Fed Officials Dial Back Rate Forecasts, Signal Just One ‘24 Cut

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

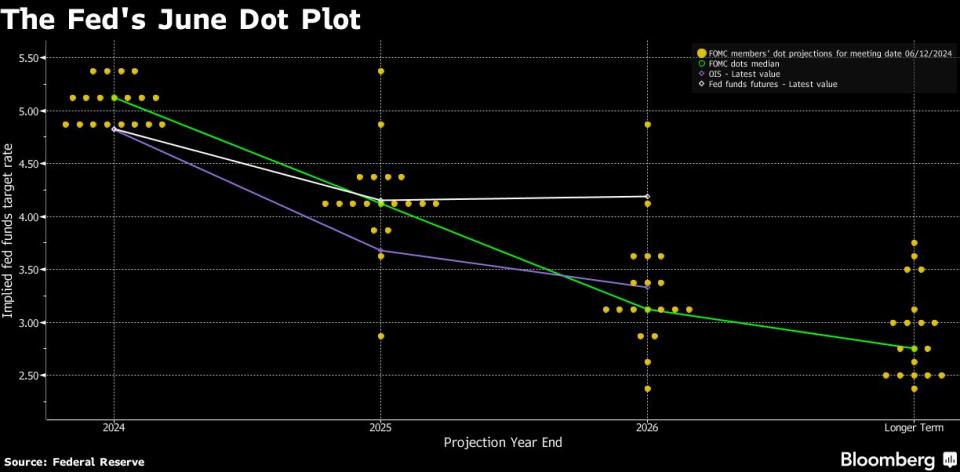

Policymakers’ updated economic projections, published after a two-day policy meeting in Washington on Wednesday, showed they expected to lower borrowing costs only once in 2024 instead of the three reductions penciled in previously, according to their median estimate.

They also raised their forecasts for inflation, even after better data on consumer prices published earlier in the day provided cause for optimism.

“There’s still the possibility of two rate cuts this year, starting as soon as September, but they need the data to comply and kind of bolster their confidence,” said Kathy Bostjancic, chief economist at Nationwide Mutual Insurance Co. “Being conservative, it’s understandable. They are erring on the side of conservatism. I think the door’s still wide open.”

The US central bank’s policy-setting Federal Open Market Committee decided to hold its benchmark rate steady in a range of 5.25% to 5.5%, the highest level in more than two decades, for a seventh straight meeting. Investors currently see two rate cuts this year, with better-than-even odds of an initial reduction in September, according to futures.

Earlier in the day, the Bureau of Labor Statistics published figures showing a key measure of underlying inflation cooled for a second straight month in May, following elevated readings to begin the year.

Powell called the numbers “encouraging,” and hinted that the new consumer price index figures may not be fully reflected in policymakers’ latest quarterly projections.

Although the committee was briefed on them, he said “most people generally don’t” update their projections when such data arrive in the middle of policy meetings. Officials marked up their forecast for inflation excluding food and energy to 2.8% in 2024 from 2.6%, implying little additional progress over the course of the year from current levels.

“Chair Powell used the press conference to diminish the importance of these projections and made a point of indicating that ‘most’ officials likely did not incorporate today’s softer-than-expected inflation reading in their economic projections and ‘dots,’ rendering them stale,” Citigroup Inc. economists led by Andrew Hollenhorst said in a note to clients, referring to the “dot plot” of rate projections.

In trying to determine the appropriate timing for rate cuts, the Fed is grappling with uncertainty over the impact tight monetary policy is having on the economy. Job growth and consumer spending have been surprisingly resilient despite high borrowing costs. Inflation, meanwhile, has cooled substantially following a sharp acceleration during the pandemic, though it still remains above the Fed’s 2% target.

Close Split

The Fed chair said officials are carefully considering both upside and downside risks. He also emphasized a split within the committee: The “dot plot” showed seven officials expected one rate cut this year, while eight saw two and four expected none.

“Powell really leaned into the close split between the one-cut median and the two-cut mode, whereas last time, when the March median implied three cuts — with many for fewer — he was quite happy to leave it be,” said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

Officials also lifted their estimates of where rates will settle in the longer term to 2.8%, from 2.6% at the March gathering, according to the median projection. The increase, following a slight bump in March, has been fueled in part by the recent resilience of the economy.

“People have gradually been writing it up because I just think people are coming to the view that rates are less likely to go down to their pre-pandemic levels,” Powell said.

Some officials, including Dallas Fed President Lorie Logan, have said higher borrowing costs may not be slowing the economy as much as previously thought. Others, like New York Fed President John Williams, maintain policy is well-positioned to bring inflation down to the Fed’s goal.

“The question of whether it’s sufficiently restrictive is going to be one we know over time,” Powell said. “The evidence is pretty clear that policy is restrictive and is having the effects that we would hope for.”

--With assistance from Steve Matthews, Catarina Saraiva and Jonnelle Marte.

Most Read from Bloomberg Businessweek

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

Israeli Scientists Are Shunned by Universities Over the Gaza War

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance