Federal Realty (FRT) Grows With Virginia Gateway Acquisition

As part of a strategic step in fortifying its portfolio, Federal Realty FRT has acquired Virginia Gateway, a dominant 110-acre retail hub located in Gainesville, VA, for $215 million. This acquisition adds approximately 665,000 square feet of prime retail space to Federal Realty’s portfolio and underscores its commitment to owning and operating high-quality, high-traffic retail properties in affluent markets.

A highly visible and accessible retail center, Virginia Gateway is situated at the bustling intersection of Route 29 and I-66 and is roughly 95% occupied. This prominent retail and entertainment hub, which draws visitors from a wide regional trade area, ranked third in Virginia for annual visits in 2023, per Placer.ai and is placed just behind Tysons Corner. This high foot traffic translates into robust tenant sales across categories, particularly in the food and beverage sector.

Virginia Gateway boasts a diverse tenant mix spread across five distinct sections. This includes the giant food grocery-anchored shopping center, the Promenade featuring national specialty retailers and dining options and the pedestrian-oriented Atlas Walk town center.

Also, Plaza I & II feature major retailers like HomeGoods and Ulta Beauty, and Plaza IV is anchored by Total Wine & More and Hobby Lobby. In addition, Virginia Gateway benefits from shadow anchors like Super Target, Lowe's and BJ's Wholesale Club, enhancing its draw for a broad base of consumers. Moreover, this property includes around 300,000 square feet of small shop space, anticipated to significantly contribute to future growth.

Gainesville, VA, is a thriving community with strong economic and demographic fundamentals. It enjoys a strong population supported by an influx of higher-paying jobs. The average household income within a three-mile radius of Virginia Gateway surpasses $184,000, which exceeds the company's in-place portfolio average. This affluent consumer base, coupled with the area’s job growth driven by the nearby Dulles Technology Corridor, positions Virginia Gateway for sustained high performance and growth.

With this acquisition, Federal Realty’s presence in Northern Virginia expands to 3.6 million square feet, solidifying its influence in one of the nation’s most dynamic regions.

Going forward, Federal Realty’s portfolio of premium retail assets in well-off communities with favorable demographics positions it well for growth. A diverse tenant base and a focus on essential retail ensure steady cash flows. The company’s efforts to diversify its portfolio and develop mixed-use assets are likely to benefit it over the long term. Also, efforts to improve its operating performance through conversion, redevelopment and repurposing of assets are encouraging.

However, higher e-commerce adoption and potential tenant bankruptcies are likely to weigh on Federal Realty. A high interest rate environment adds to its concerns.

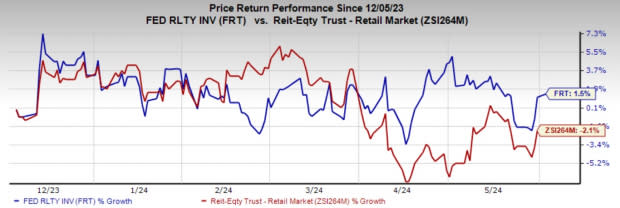

Shares of this Zacks Rank #3 (Hold) company have risen 1.5% in the past six months against the industry's decline of 2.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Kite Realty Group Trust KRG and Acadia Realty Trust AKR, each currently carrying a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for KRG’s 2024 funds from operations (FFO) per share has been revised a cent northward over the past month to $2.05.

The consensus estimate for AKR’s current-year FFO per share has been revised a cent upward over the past two months to $1.28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance