FEMSA (FMX) to Report Q2 Earnings: What's in the Offing?

Fomento Economico Mexicano, S.A.B. de C.V. FMX or FEMSA is slated to report second-quarter 2020 results on Jul 24. The company significantly beat earnings estimates in the last reported quarter. It reported earnings per share of $1.29 against the Zacks Consensus Estimate of a loss of 5 cents.

The Zacks Consensus Estimate for the company’s second-quarter earnings of $1.61 has been unchanged over the past 30 days. The estimate suggests 96.3% growth from the year-ago quarter’s reported figure. For second-quarter revenues, the consensus mark is pegged at $5.73 billion, suggesting a 14.6% decline from the prior-year quarter’s reported figure.

Factors at Play

The coronavirus outbreak began hurting FEMSA’s performance in late March. While most of the company’s operations are deemed as essential, with drugstores and fuel services being operational, the effects of the restrictions are likely to have resulted in reduced traffic trends in the second quarter. FEMSA did gain from the initial pantry loading trend in March but this represented a smaller portion of its total revenues and the trend has deteriorated in April.

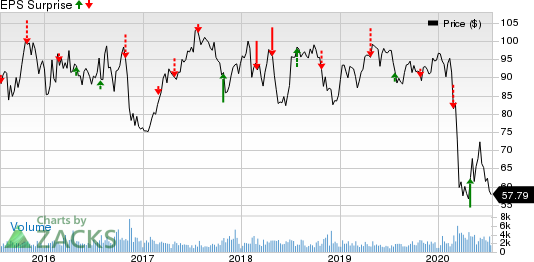

Fomento Economico Mexicano S.A.B. de C.V. Price and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-eps-surprise | Fomento Economico Mexicano S.A.B. de C.V. Quote

Notably, FEMSA Comercio’s Fuel Division is the most exposed one to the current coronavirus situation due to reduced mobility and social distancing. The effects of these were visible on the segment’s results as impacts began to show toward the end of the first quarter, which is likely to have continued in the second quarter as well. Apart from lower revenues, the segment is likely to have witnessed soft margins due to increased operating expenses related to higher wages and improved compensation structure for in-station personnel, aimed at reducing turnover in a tight labor market. Further, maintenance and remodeling expenses related to the transition into the new OXXO gas brand remain incremental costs, which will increase operating expenses.

While its Coca-Cola FEMSA business has been leveraging its large off-premise customers and flexible commercial platforms, the effects of a negative mix and increasing complexities to connect with physical customers are likely to have hurt performance in the second quarter.

Apart from making necessary adjustments to all business units to protect customers and employees, the company adopted aggressive cost-reduction and efficiency measures, citing the uncertain nature of the pandemic, which should have cushioned margins to some extent in the second quarter.

Moreover, FEMSA has been focused on offering customers more options to make more contactless purchases by intensifying digital and technology-driven initiatives across operations. Its Coca-Cola FEMSA division has been leading the way with its omni-channel business, while FEMSA Comercio has been progressing with the adoption of digital initiatives, which is likely to have supported the top line in the second quarter. Within its OXXO store chains, the company has begun investing in digital, loyalty programs and fintech platforms to boost the top line.

What the Zacks Model Unveils

Our proven model does not conclusively predict earnings beat for FEMSA this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FEMSA carries a Zacks Rank #5 (Strong Sell) and Earnings ESP of 0.00%.

Stocks Likely to Deliver Earnings Beat

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Boston Beer Company, Inc. SAM presently has an Earnings ESP of +20.46% and it sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Monster Beverage Corporation MNST currently has an Earnings ESP of +2.35% and a Zacks Rank #2.

The Procter Gamble Company PG has an Earnings ESP of +0.37% and a Zacks Rank #2 at present.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter Gamble Company The (PG) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance