Fever-Tree falls to earth from record high as stocks dive 44%

Fever-Tree briefly saw nearly all its share price gains for the year wiped out in trading today, after it failed to upgrade profit guidance.

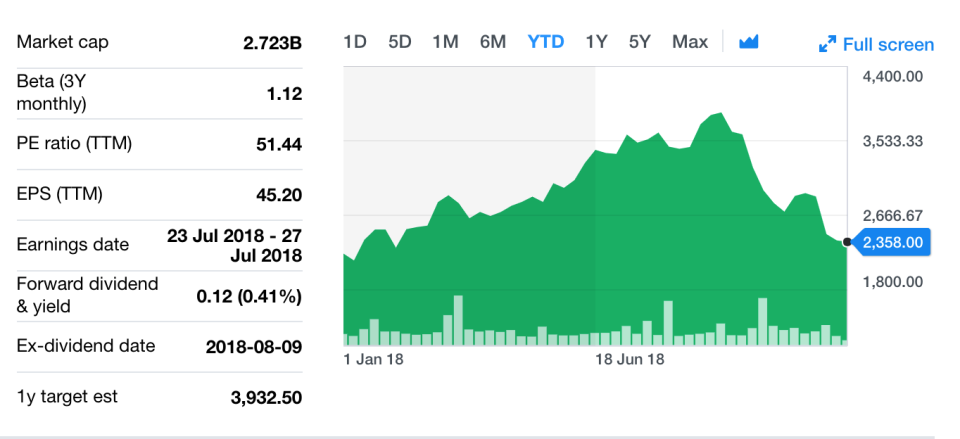

Fevertree Drinks Plc (FEVR.L)’s share price is now down more than 44% on its all-time high reached on 12 September, amid concerns over its ability to maintain growth levels that some regard as already priced into the stock.”

The mixer company has improved its financial predictions in all of its previous updates, but kept guidance in line on this occasion.

The failure to improve guidance appeared to spook investors in the premium tonic maker, and stocks fell as much as 8.2% from the morning’s high to recover to broadly flat in the afternoon’s trading. There is now pressure on the company to see if it can improve its guidance in January’s update.

The stock trades at a trailing price-to-earnings ratio just above 51, suggesting shareholders expect growth to continue for several years.

The company announced in July that its profits would be “comfortably ahead” of expectations. The company reported that its profit margins had been hampered by investment in the US, where it is expanding, and the weakness of the pound against other currencies. The company also announced in July that it had signed a deal with Southern Glazer’s Wine and Spirits to be its distribution partner in bars and restaurants in 29 US states.

In August non-executive deputy chairman Charles Rolls and chief executive Tim Warrillow sold three million shares between them for £103.5m ($132.2m).

The company’s valuation may also have suffered in recent months from the broader market sell-off, which has most severely affected momentum and growth stocks.

Yahoo Finance

Yahoo Finance