Fewer Investors Than Expected Jumping On Sureserve Group plc (LON:SUR)

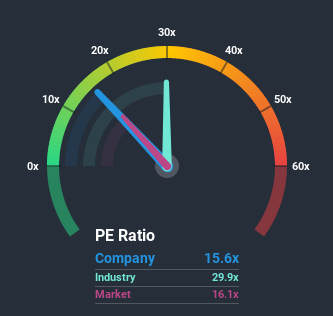

With a median price-to-earnings (or "P/E") ratio of close to 16x in the United Kingdom, you could be forgiven for feeling indifferent about Sureserve Group plc's (LON:SUR) P/E ratio of 15.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been pleasing for Sureserve Group as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Sureserve Group

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sureserve Group.

Does Growth Match The P/E?

Sureserve Group's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 121% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth will be highly resilient over the next year growing by 27%. That would be an excellent outcome when the market is expected to decline by 0.008%.

In light of this, it's peculiar that Sureserve Group's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sureserve Group currently trades on a lower than expected P/E since its growth forecasts are potentially beating a struggling market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader market turmoil. It appears some are indeed anticipating earnings instability, because the company's current prospects should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Sureserve Group with six simple checks on some of these key factors.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance