Is Finablr (LON:FIN) Using Debt Sensibly?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Finablr PLC (LON:FIN) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Finablr

What Is Finablr's Net Debt?

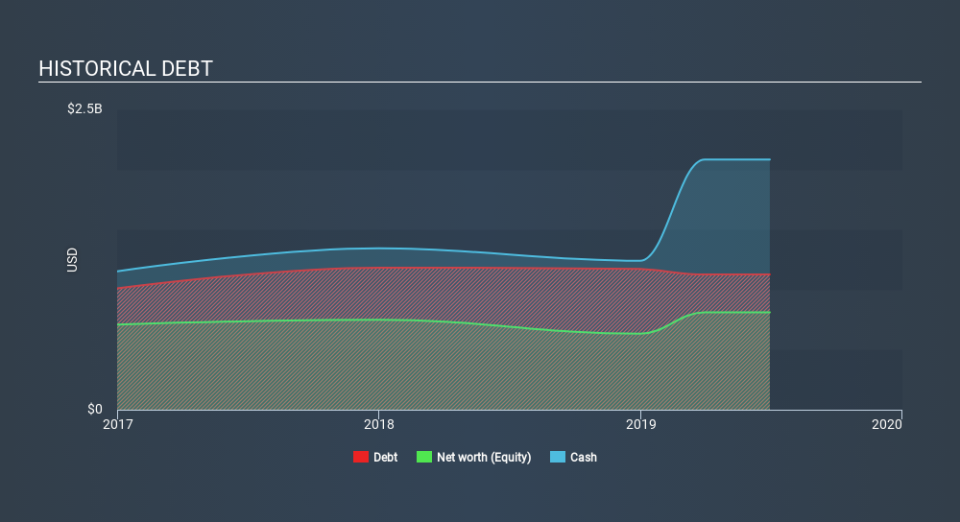

As you can see below, Finablr had US$1.13b of debt at June 2019, down from US$1.18b a year prior. But it also has US$2.08b in cash to offset that, meaning it has US$956.3m net cash.

How Strong Is Finablr's Balance Sheet?

According to the last reported balance sheet, Finablr had liabilities of US$2.35b due within 12 months, and liabilities of US$1.23b due beyond 12 months. On the other hand, it had cash of US$2.08b and US$316.2m worth of receivables due within a year. So it has liabilities totalling US$1.19b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$271.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Finablr would likely require a major re-capitalisation if it had to pay its creditors today. Given that Finablr has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Finablr's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Given it has no significant operating revenue at the moment, shareholders will be hoping Finablr can make progress and gain better traction for the business, before it runs low on cash.

So How Risky Is Finablr?

Although Finablr had negative earnings before interest and tax (EBIT) over the last twelve months, it generated positive free cash flow of US$521m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for Finablr that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance