FinVolution Group (NYSE:FINV) Share Prices Have Dropped 84% In The Last Three Years

Every investor on earth makes bad calls sometimes. But you want to avoid the really big losses like the plague. So consider, for a moment, the misfortune of FinVolution Group (NYSE:FINV) investors who have held the stock for three years as it declined a whopping 84%. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 30% in the last year. On the other hand, we note it's up 9.4% in about a month.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for FinVolution Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

FinVolution Group became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

It's quite likely that the declining dividend has caused some investors to sell their shares, pushing the price lower in the process. In contrast it does not seem particularly likely that the revenue levels are a concern for investors.

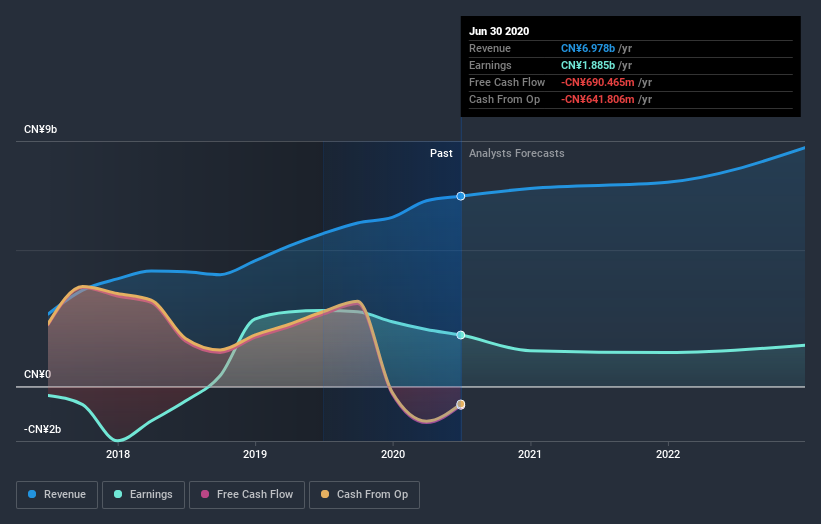

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how FinVolution Group has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

The last twelve months weren't great for FinVolution Group shares, which cost holders 25%, including dividends, while the market was up about 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 22% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - FinVolution Group has 5 warning signs (and 2 which make us uncomfortable) we think you should know about.

We will like FinVolution Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance