FinWise Bancorp (FINW) Surpasses Analyst Earnings Estimates in Q1 2024

Net Income: Reported at $3.3 million, surpassing the estimated $2.91 million.

Diluted Earnings Per Share (EPS): Achieved $0.25, exceeding the estimate of $0.23.

Revenue: Total revenue details not provided, but net interest income was $14.0 million.

Loan Originations: Totaled $1.1 billion, down from $1.2 billion in the previous quarter but up from $0.9 billion year-over-year.

Efficiency Ratio: Increased to 60.6%, indicating higher costs relative to revenue, compared to 55.8% in the previous quarter and 52.5% year-over-year.

Non-Performing Loans: Amounted to $26.0 million, showing a decrease from $27.1 million in the previous quarter but a significant increase from $1.8 million year-over-year.

Return on Average Equity (ROAE): Declined to 8.4% from 10.8% in the previous quarter and 11.1% year-over-year, reflecting lower profitability relative to equity.

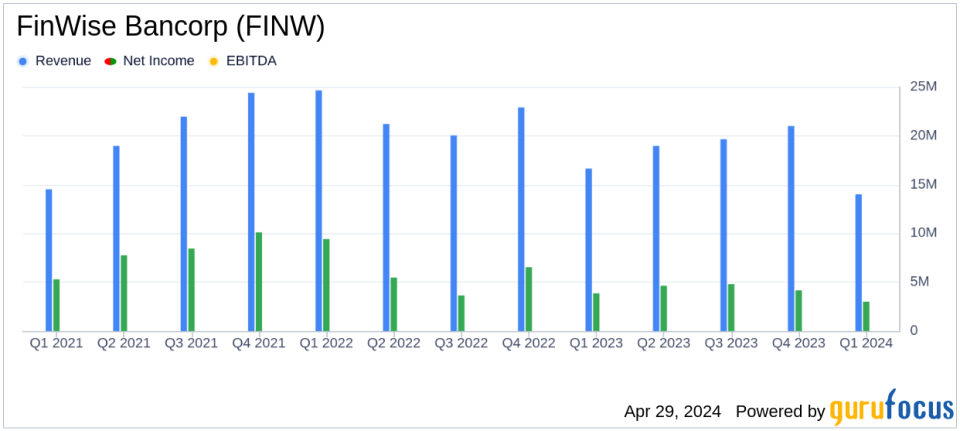

On April 29, 2024, FinWise Bancorp (NASDAQ:FINW), a prominent independent banking institution, disclosed its financial results for the first quarter ended March 31, 2024. The company reported a net income of $3.3 million and diluted earnings per share (EPS) of $0.25, both surpassing the analyst estimates of $2.91 million in net income and an EPS of $0.23. The detailed earnings report can be viewed in their 8-K filing.

About FinWise Bancorp

Headquartered in Murray, Utah, FinWise Bancorp operates through its wholly-owned subsidiary, FinWise Bank. The bank offers a comprehensive range of services to individual and corporate customers, with a strong focus on loans including Small Business Administration, commercial, and real estate loans. Additionally, FinWise has developed strategic programs with various third-party loan origination platforms, enhancing its service delivery through technological advancements.

First Quarter Performance Highlights

The first quarter of 2024 saw FinWise Bancorp achieving a net interest income of $14.0 million, a slight decrease from the previous quarter's $14.4 million but an increase from $12.1 million in the same quarter last year. Loan originations were robust at $1.1 billion, though slightly lower than the $1.2 billion in the preceding quarter. The company's efficiency ratio deteriorated to 60.6%, up from 55.8% in the previous quarter, indicating higher costs relative to revenue.

Challenges and Strategic Initiatives

Despite facing macroeconomic uncertainties, FinWise Bancorp's CEO, Kent Landvatter, expressed satisfaction with the quarter's outcomes, particularly noting strong loan origination volumes and credit quality. The bank has continued to expand its strategic initiatives, including new lending and payments agreements and the development of its Payments Hub and BIN Sponsorship platform. Additionally, the introduction of a new share repurchase program reflects confidence in the bank's financial health.

Financial Metrics and Analysis

FinWise Bancorp's return on average equity (ROAE) was recorded at 8.4%, a decrease from 10.8% in the previous quarter. The net interest margin also saw a reduction to 10.12% from 10.61% in the prior quarter. These shifts highlight pressures from a changing interest rate environment and a strategic shift away from higher-yield, higher-risk loans.

Asset quality remained a focus, with non-performing loans amounting to $26.0 million, a slight decrease from $27.1 million at the end of the previous quarter. This represents an ongoing challenge but also reflects some stabilization in the bank's loan portfolio.

Looking Ahead

FinWise Bancorp's strategic directions, including diversifying its business model and enhancing technological platforms, are set to position the bank for sustainable long-term growth. With a solid start to the year, the bank appears well-equipped to navigate the complexities of the current financial landscape while continuing to deliver value to its stakeholders.

For more detailed financial information and future updates from FinWise Bancorp, investors and interested parties are encouraged to follow their filings with the SEC and check the investor relations section on their website.

Explore the complete 8-K earnings release (here) from FinWise Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance