FireEye (FEYE) Down 10.2% Since Earnings Report: Can It Rebound?

It has been about a month since the last earnings report for FireEye, Inc. FEYE. Shares have lost about 10.2% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is FEYE due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

FireEye's Loss Narrows in Q1, Revenues Beat Estimates

FireEye started 2018 on a strong note, posting impressive results for the first quarter. The company’s Q1 performance indicates that its turnaround efforts, which include shifting the business model to a subscription-based one, are apparently paying off. The main highlights of the quarter were sales beating expectations, strong growth in billings, a narrower loss and an upbeat guidance for the full year. And most importantly, the company expects to turn profitable this year.

However, it seemed this was not enough to impress investors, as shares of the cybersecurity company dipped more than 4% during yesterdays’ after-hour trading session. Nevertheless, the company’s performance, for the past two quarters, makes it quite evident that its turnaround initiatives are on track, and there is a high chance that FireEye might return to the growth trajectory by the end of this year.

Now let’s discuss quarterly results in detail.

Revenues

The company’s first-quarter revenues of $199.1 million increased 7.7% year over year and outpaced the Zacks Consensus Estimate of $194 million, as well as management’s guidance of $192-$197 million.

The company noted that its quarterly revenues mainly benefited from shift in the business model from product based to subscription based. This apart, improved sales execution, enhanced relationship with channel partners, and growing adoption of the company’s Helix, iSIGHT Intelligence and Endpoint security solutions were other key growth drivers.

Further, billings climbed 21% year over year to $175.1 million, and came in marginally ahead of management’s guidance of $165-$175 million, mainly attributed to all the factors mentioned above.

Additionally, FireEye continues to secure large deals. Notably, the company renewed one deal of more than $10 million during the reported quarter. Moreover, it closed 29 transactions, with individual value of more than $1 million. The company also added 230 new customers in the recently-reported quarter.

Operating Results

Non-GAAP gross profit increased approximately 7.4% from the year-ago quarter to $147.3 million. Non-GAAP gross margin were almost flat year over year at 74%, which also came in line with management’s expectations.

Non-GAAP operating expenses increased approximately 6% year over year to $153 million, primarily due to elevated expenses related to payroll taxes and other employee-associated costs, and elevated R&D expenditure in connection with buyouts of “Email Laundry in Q4 2017 and X15 in Q1 2018.”

The company posted non-GAAP operating loss of $5.7 million, significantly lower than the year-ago quarter’s loss of $7.3 million. We believe improved operational efficiency and sales productivity are proving conducive to the company’s operating results.

Non-GAAP net loss for the first quarter narrowed down to approximately $7.5 million from the prior-year quarter’s net loss of $9.3 million.

On per share basis, FireEye reported non-GAAP loss of 4 cents, in line with the Zacks Consensus Estimate. Year over year, quarterly loss were narrower than the year-ago quarter’s loss of 5 cents. The quarter’s non-GAAP earnings per share also compared favorably with the mid-point of management’s guidance range of a loss of 3-6 cents (mid-point 4.5 cents). Notably, this is the tenth consecutive quarter of year-over-year improvement for the bottom line.

Balance Sheet & Cash Flow

FireEye exited the reported quarter with cash and cash equivalents, and short-term investments of approximately $886.4 million, up from $896.8 million posted at the end of the previous quarter. Accounts receivable were $103.1 million compared with $146.3 million witnessed at the end of fourth-quarter 2017. During the quarter, the company generated $9.2 million of cash from operating activities.

Guidance

Buoyed by the impressive first-quarter results, improved operational efficiency and sales productivity, as well as healthy demand for intelligence-led security products, FireEye issued an encouraging outlook for the second quarter and raised its revenue, billings and operating cash flow guidance for the full year.

For the second quarter, the company anticipates revenues of $199-$203 million (mid-point: $201 million). Billings are projected at $180-$195 million. Non-GAAP gross margin is estimated to be approximately 74%, while non-GAAP operating margin is estimated in the band of -2% to +1%.

The company forecasts non-GAAP bottom-line results to be between loss per share of 3 and breakeven earnings. Operating cash flow is likely to lie between zero and a negative of $15 million.

For the full year, the company now anticipates revenues of $820-$830 million (mid-point: $825 million), up from the earlier range of $815-$825 million (mid-point: $820 million). Billings are now projected at $815-$835 million, higher than the prior guidance of $810-$830 million.

Non-GAAP operating margin is still estimated in the band of 1-2%. The company continues to project reporting non-GAAP earnings in the range of breakeven to 4 cents per share.

Operating cash flow is likely to lie between $50 million and $60 million, up from the previously guided range of $45-$55 million. Capital expenditure is still estimated to be between $35 million and $40 million.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There have been four revisions higher for the current quarter compared to four lower.

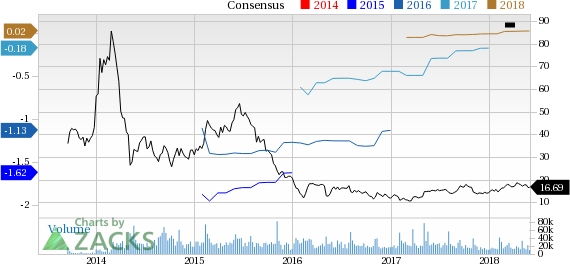

FireEye, Inc. Price and Consensus

FireEye, Inc. Price and Consensus | FireEye, Inc. Quote

VGM Scores

At this time, FEYE has a nice Growth Score of B, a grade with the same score on the momentum front. However, the stock was allocated a grade of F on the value side, putting it in the fifth quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks style scores indicate that the company's stock is suitable for growth and momentum investors.

Outlook

FEYE has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FireEye, Inc. (FEYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance