FireEye Investors Shouldn't Miss These Red Flags

FireEye (NASDAQ: FEYE) is having a hard time hitting its stride despite opportunities in the cybersecurity space. The company's customer growth has been patchy at best due to the tough competition prevalent in the industry, so it wasn't surprising to see investors pressing the panic button when FireEye issued tepid guidance for the second quarter, overlooking its decent sales growth and narrower than anticipated loss in the first quarter.

Investors don't seem to be buying FireEye's promise of achieving an adjusted profit of $0.02 per share for the full year. And you can't blame them for being pessimistic, as the company isn't currently on track to achieve this target. It reported a non-GAAP net loss of $0.04 a share in the first quarter, and for the second quarter, it expects an adjusted net loss of $0.03 to breakeven.

So FireEye will have to execute a big turnaround in the second half of the fiscal year to hit its full-year non-GAAP net income target between breakeven and $0.04 a share. That's going to be easier said than done.

Image Source: Getty Images.

FireEye has lost customer traction

FireEye added 230 new customers during the quarter that ended in March, seven fewer than what it added in the year-ago period. It blamed the long sales cycle of its endpoint and antivirus products that were launched a couple of quarters ago for this slowdown. But management tried to assuage concerns by pointing out that it has been witnessing healthy customer growth in the ongoing quarter.

FireEye believes that its new products will typically take six to nine months to sell, so it is possible that the company could see a meaningful spike in its customer base later in the year. However, a closer look indicates the customer growth rate has been trending down over the past several quarters.

Data from FireEye quarterly reports. Chart by author.

This means that FireEye is going the other way in a market that's otherwise growing quite impressively. Cybersecurity Ventures, for instance, forecasts that cybersecurity spending will increase at an annual rate of 12% to 15% through 2021, but FireEye doesn't look likely to capitalize on those gains as its customers have stopped spending big bucks on its products and services.

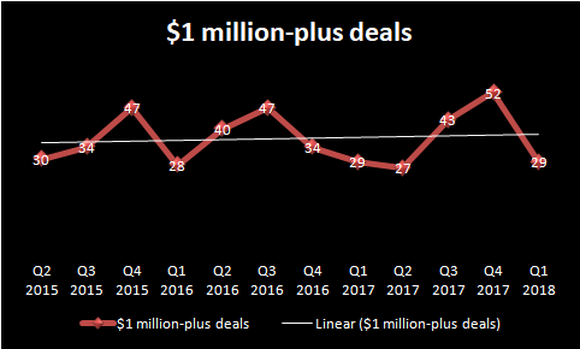

Last quarter, FireEye struck 29 transactions that were $1 million or greater, flat from the year-ago period. A closer look at this trend indicates that the number of large transactions struck by the company has averaged almost flat over the past three years.

Data from FireEye quarterly reports. Chart by author.

This combination of weak customer growth and stagnant deal size isn't something that inspires confidence in FireEye's ability to fulfill its promise of hitting non-GAAP profitability this year.

Deferred revenue growth has hit a speed bump

Deferred revenue is the amount of revenue received by a company for services to be delivered at a later date. A company recognizes the deferred revenue as actual revenue on its income statement when the actual service or product delivery takes place, so it is an indicator of potential top-line growth.

In FireEye's case, however, deferred revenue growth has stagnated over the past few quarters, with the metric falling slightly year over year last quarter from $888 million to $886 million.

Data from FireEye quarterly reports. Chart by author.

This is another red flag for FireEye investors. Ideally, the growth in the company's subscription business should have been accompanied by higher deferred revenue. This is because customers buying annual or longer subscription plans would have added to the company's deferred revenue base until the service was actually delivered, but that hasn't been the case.

This once again shows that customers aren't too excited about what FireEye is offering, which is why its key growth metrics aren't showing progress. As such, it doesn't seem to make sense for investors to buy into FireEye's promise of delivering an adjusted profit this year in light of the warning signs highlighted above. Instead, one should look at other attractive cybersecurity plays, or possibly wait for concrete signs of growth in FireEye's business before deciding to invest in the stock.

More From The Motley Fool

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool recommends FireEye. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance