First Community And Two Other US Dividend Stocks To Consider

Recent movements in the U.S. stock market have showcased a dynamic interplay of factors influencing investor sentiment, from fluctuating lithium prices impacting the electric vehicle sector to shifts in consumer spending habits affecting retail and technology stocks. In this context, dividend stocks like First Community offer a potential avenue for investors seeking stability amidst market volatility. A good dividend stock typically combines reliable payouts with strong business fundamentals, making it an appealing choice during uncertain economic times highlighted by current market events.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 6.93% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.73% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.97% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.92% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 4.96% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.30% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.74% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.21% | ★★★★★☆ |

East West Bancorp (NasdaqGS:EWBC) | 3.02% | ★★★★★☆ |

Southside Bancshares (NasdaqGS:SBSI) | 5.33% | ★★★★★☆ |

Click here to see the full list of 203 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

First Community

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Community Corporation, serving as the bank holding company for First Community Bank, offers a range of banking products and services to small-to-medium sized businesses, professionals, and individuals, with a market capitalization of approximately $124.81 million.

Operations: First Community Corporation generates revenue primarily through Commercial and Retail Banking ($50.66 million), with additional contributions from Investment Advisory and Non-Deposit services ($4.80 million), Corporate activities ($4.23 million), and Mortgage Banking ($4.18 million).

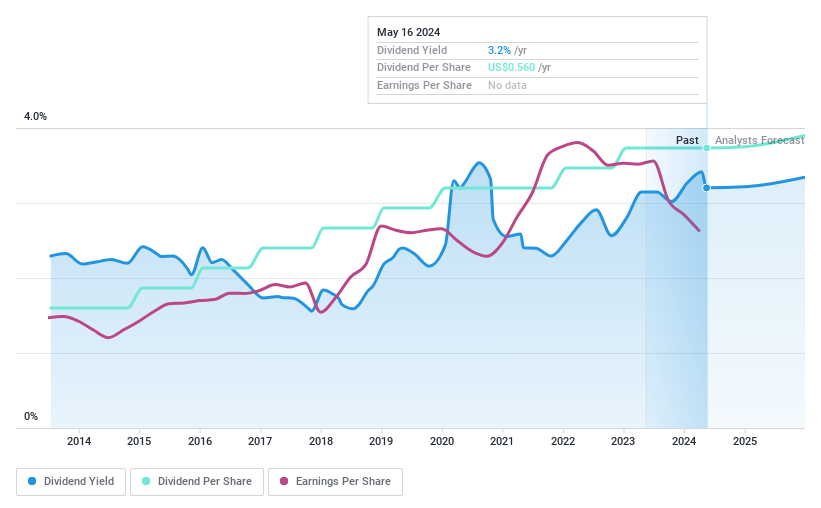

Dividend Yield: 3.2%

First Community has demonstrated a consistent ability to grow dividends, with payments increasing over the past decade and a stable dividend yield currently at 3.21%. Despite trading 52.8% below its estimated fair value, the company's payout ratio is comfortably low at 38.7%, suggesting that dividends are well covered by earnings. However, it's worth noting that First Community was recently dropped from several Russell indexes but added to the Russell Microcap Growth Index, indicating potential shifts in market perception. Additionally, the company announced a share repurchase program valued at US$7.1 million valid until May 2025, reflecting confidence in its financial health despite reported declines in net income and interest income for Q1 2024.

Columbia Banking System

Simply Wall St Dividend Rating: ★★★★★★

Overview: Columbia Banking System, Inc., functioning as the holding company for Umpqua Bank, offers a range of banking, private banking, mortgage, and other financial services in the United States with a market capitalization of approximately $4.22 billion.

Operations: Columbia Banking System, Inc. generates its revenue primarily through its banking segment, which amounted to $1.92 billion.

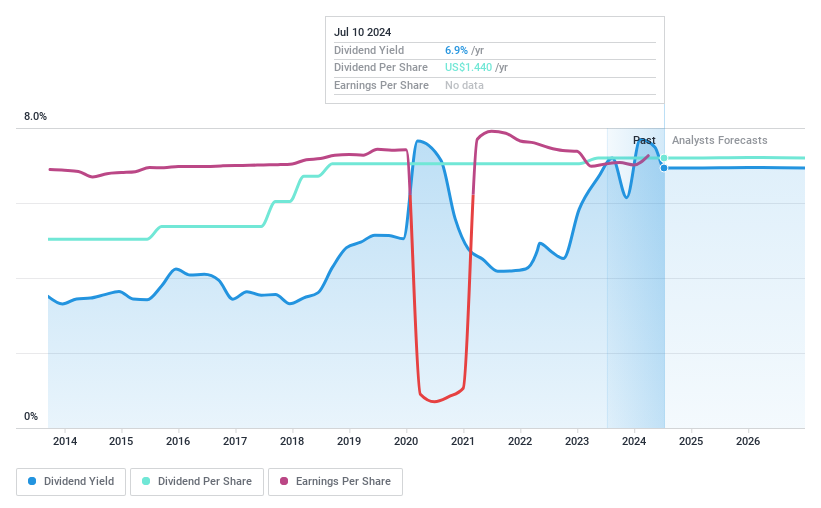

Dividend Yield: 6.9%

Columbia Banking System offers a robust dividend yield of 6.93%, ranking in the top 25% of US dividend payers. Its dividends per share have shown stability and growth over the past decade, supported by a reasonable payout ratio of 61.6%. Despite recent index drops, Columbia's earnings surged by 110.2% last year with forecasts suggesting continued growth at 6.66% annually. Recent affirmations of quarterly dividends and significant shelf registration filings underscore ongoing financial commitments and operational expansions.

First Hawaiian

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Hawaiian, Inc., a bank holding company for First Hawaiian Bank, offers various banking products and services to consumer and commercial clients in the United States, with a market capitalization of approximately $2.68 billion.

Operations: First Hawaiian, Inc. generates revenue primarily through its Retail Banking and Commercial Banking segments, with contributions of $565.97 million and $240.64 million respectively.

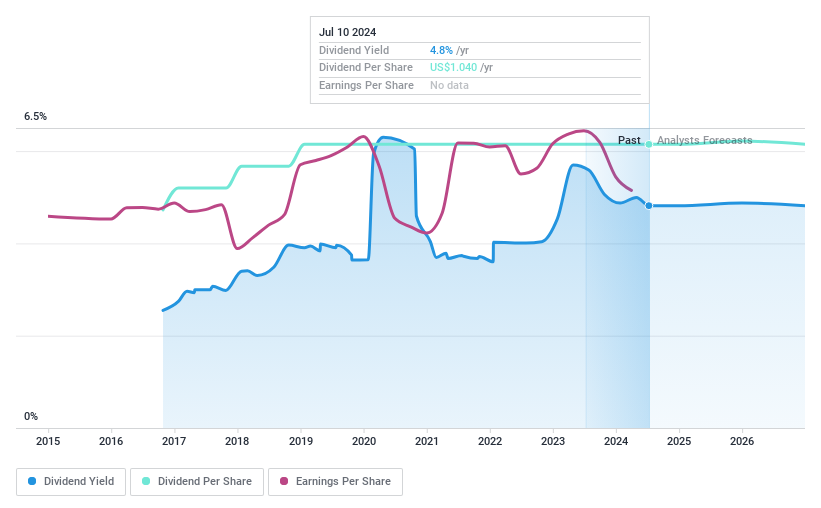

Dividend Yield: 4.8%

First Hawaiian offers a compelling 4.82% dividend yield, positioning it well within the top quartile of US dividend stocks. Despite its relatively short history of dividend payments—only eight years—the dividends are secure, backed by a stable payout ratio of 59.7%. Recent financials show a dip in net income and interest income for Q1 2024, but the firm's commitment to returning value to shareholders remains evident with consistent dividend affirmations and low net charge-offs.

Next Steps

Explore the 203 names from our Top US Dividend Stocks screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FCCO NasdaqGS:COLB and NasdaqGS:FHB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance