First Community's (NASDAQ:FCCO) Dividend Will Be US$0.12

First Community Corporation's (NASDAQ:FCCO) investors are due to receive a payment of US$0.12 per share on 17th of August. Based on this payment, the dividend yield will be 2.3%, which is fairly typical for the industry.

Check out our latest analysis for First Community

First Community's Earnings Easily Cover the Distributions

We aren't too impressed by dividend yields unless they can be sustained over time. However, prior to this announcement, First Community's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 4.3%. Assuming the dividend continues along recent trends, we think the payout ratio could be 30% by next year, which is in a pretty sustainable range.

First Community Has A Solid Track Record

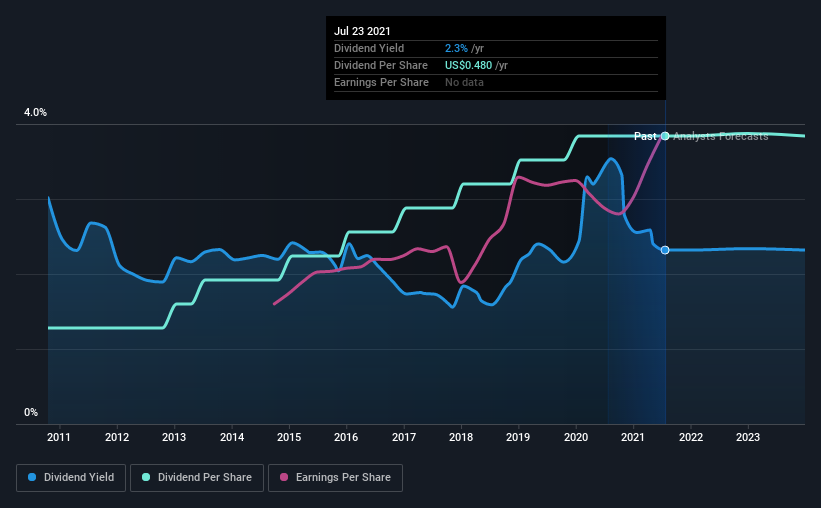

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from US$0.16 in 2011 to the most recent annual payment of US$0.48. This means that it has been growing its distributions at 12% per annum over that time. It is good to see that there has been strong dividend growth, and that there haven't been any cuts for a long time.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see First Community has been growing its earnings per share at 12% a year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

We Really Like First Community's Dividend

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Earnings are easily covering distributions, and the company is generating plenty of cash. All of these factors considered, we think this has solid potential as a dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for First Community for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance