First Horizon (FHN) Stock Down 3.6% on Q1 Earnings Miss

Shares of First Horizon National Corporation FHN have declined 3.6%, following the release of first-quarter 2020 results. Its adjusted earnings per share of 5 cents missed the Zacks Consensus Estimate of 22 cents. Further, the bottom line was 85.7% higher than the year-ago figure.

Results reflect First Horizon’s improved deposit balance and higher revenues. In addition, efficiency ratio contracted during the quarter, indicating increased profitability. However, rising expenses and provisions were major drags.

Net income available to common shareholders was $12.1 million or 4 cents per share, down from $99 million or 31 cents per share recorded in the prior-year quarter.

Segment wise, quarterly net income for regional banking plunged 81% year over year to $21.2 million. The fixed income segment’s net income of $19.5 million increased by a wide margin from the year-ago quarter. Also, the non-strategic segment reported income of nearly $2 million, down 71% year over year. The corporate segment incurred net loss of $26.1 million.

Revenue Growth Offsets Higher Expenses

Total revenues for the first quarter were $477.6 million, up 10% on a year-over-year basis. Also, the top line surpassed the consensus estimate of $473.9 million.

Net interest income for the reported quarter improved 3% year over year to $302.8 million. Net interest margin shrunk 15 basis points (bps) to 3.16%. Also, non-interest income was $174.7 million, up 24% year over year.

Non-interest expenses increased 5% year over year to $311.3 million.

Efficiency ratio was 65.19% compared with 66.19% in the year-ago quarter. It should be noted that a fall in the efficiency ratio indicates increase in profitability.

Total period-end loans, net of unearned income, totaled $33.4 billion, up 7% from the previous quarter. However, total period-end deposits were $34.4 billion, up 6% sequentially.

Credit Quality

Allowance for loan losses was $444.5 million, significantly up from $184.9 million year over year. In addition, non-performing assets increased 5% year over year to $189.8 million. Also, during the quarter, the company recorded $145.4 million in provision for loan losses, up considerably from $13.4 million a year ago.

However, as a percentage of period-end loans on an annualized basis, allowance for loan losses was 1.33%, up 67 bps year over year. The quarter witnessed net charge-offs of $7.2 million compared with $4.5 million in the prior-year quarter.

Capital Position

Common Equity Tier 1 ratio was 8.52% compared with 9.62% at the end of the year-earlier quarter. Additionally, total capital ratio was 10.75%, down year over year from 11.78%.

Our Viewpoint

First Horizon’s top-line growth was supported by higher net interest income and non-interest income. Further, improvement in the efficiency ratio is anticipated to support profitability. Nevertheless, escalating expenses are expected to hamper bottom-line growth. Furthermore, rising provision for loan losses in response to the coronavirus outbreak is also concerning.

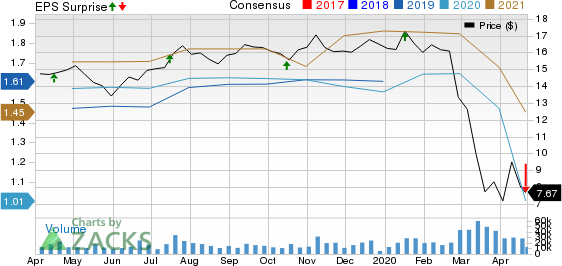

First Horizon National Corporation Price, Consensus and EPS Surprise

First Horizon National Corporation price-consensus-eps-surprise-chart | First Horizon National Corporation Quote

Zacks Rank

First Horizon currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

M&T Bank Corporation MTB pulled off first-quarter 2020 positive earnings surprise of 26% on higher mortgage banking revenues. Net operating earnings per share of $1.95 surpassed the Zacks Consensus Estimate of $1.55. However, the bottom line compared unfavorably with $3.35 per share reported in the year-ago quarter.

Truist Financial’s TFC first-quarter 2020 adjusted earnings of 87 cents per share surpassed the Zacks Consensus Estimate of 54 cents. However, the bottom line declined 22.3% from the prior quarter.

Regions Financial Corporation RF reported first-quarter 2020 adjusted earnings of 15 cents per share, missing the Zacks Consensus Estimate of 19 cents. The figure plummeted 59.5% year over year.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

First Horizon National Corporation (FHN) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance