First Merchants Corp (FRME) Q1 2024 Earnings: Misses Analyst Expectations Amidst Economic Challenges

Net Income: Reported at $47.5 million, falling short of the estimated $49.03 million.

Earnings Per Share (EPS): Achieved $0.80, below the estimated $0.82.

Revenue: Total interest income for the quarter was $235.9 million, showing robust growth compared to the previous year.

Capital Ratios: Maintained a strong Common Equity Tier 1 Capital Ratio at 11.25%.

Loan and Deposit Growth: Loans slightly declined by 0.8% quarter-over-quarter, while deposits grew by 1.7% in the same period.

Asset Quality: Nonperforming assets to total assets slightly increased to 0.37% from 0.32% in the previous quarter.

Efficiency Ratio: Improved to 59.21%, indicating better cost management compared to the previous quarter.

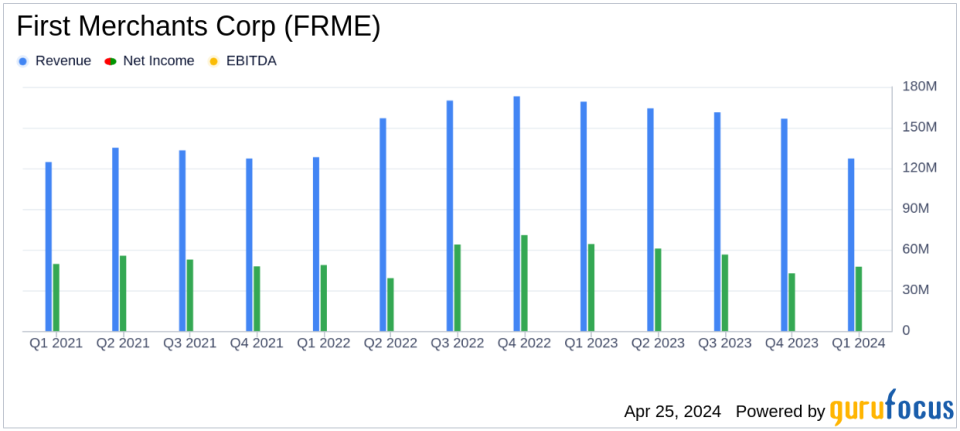

On April 25, 2024, First Merchants Corp (NASDAQ:FRME) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported net income available to common stockholders of $47.5 million, translating to diluted earnings per share (EPS) of $0.80. These figures fell short of analyst estimates which projected an EPS of $0.82 and net income of $49.03 million. The reported revenue for the quarter was not directly stated but can be inferred from the broader financial context provided.

First Merchants Corp, headquartered in Muncie, Indiana, operates primarily through its subsidiary, First Merchants Bank. It offers a comprehensive range of financial services including personal and business banking, real estate mortgage lending, cash management services, brokerage, wealth management, and insurance, focusing on community banking.

Quarterly Financial Performance

The company's performance this quarter reflects a decrease from the $63.6 million net income reported in the first quarter of 2023. This decline is attributed partly to economic pressures such as the inverted yield curve which impacted the net interest margin, now at 3.10%, down from 3.58% a year ago. Despite these challenges, CEO Mark Hardwick noted the stabilization of the net interest margin and highlighted the strength in capital, liquidity, and earnings which supported share repurchase activity during the quarter.

Total loans showed a slight decline on a linked quarter basis but grew by $346.4 million over the past twelve months, excluding certain non-relationship commercial loan portfolio sales. Meanwhile, total deposits increased both on a linked quarter basis and over the last twelve months, indicating sustained customer trust and growth in core banking operations.

Strategic Initiatives and Operational Highlights

Amidst financial headwinds, First Merchants Corp has actively pursued technological enhancements, launching three major initiatives aimed at improving customer experience across various banking channels. These developments are expected to enhance operational efficiency and customer satisfaction in the long term.

Noninterest income saw a marginal increase due to a mix of customer and non-customer related fees, while noninterest expenses were reduced, reflecting lower non-core charges and marketing spend compared to the previous quarter. The efficiency ratio, an indicator of the bank's efficiency in generating income, stood at 59.21%, showing a slight increase in costs relative to income.

Asset Quality and Risk Management

Asset quality metrics such as nonperforming assets to total assets showed a slight deterioration, moving from 0.32% to 0.37%. However, the bank maintains a robust allowance for credit losses, signaling prudent risk management. The bank's capital ratios remain strong, underscoring its financial resilience.

Looking Ahead

While First Merchants Corp navigates through economic uncertainties, its strategic investments in technology and a strong focus on maintaining a robust balance sheet position it well for future stability and growth. Investors and stakeholders will likely keep a close watch on how these strategies unfold in upcoming quarters.

For detailed financial figures and further information, refer to the attached financial statements and the upcoming earnings conference call scheduled for April 25, 2024.

Explore the complete 8-K earnings release (here) from First Merchants Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance