First Mover Americas: BTC Steadies, but 10% Monthly Loss Questions Nasdaq Rally

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

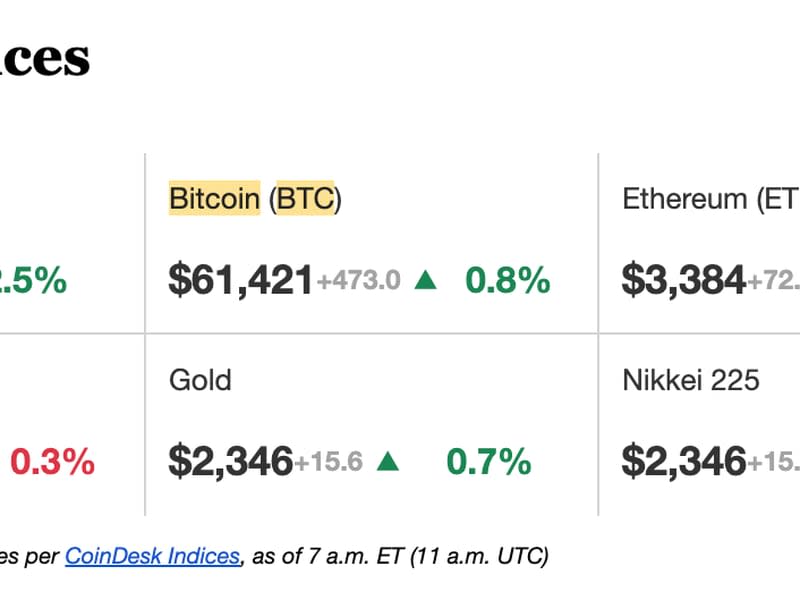

Latest Prices

Top Stories

The crypto market regained some poise early Tuesday as analysts said supply overhang concerns stemming from defunct exchange Mt. Gox's planned distribution of 140,000 BTC are overdone. Bitcoin traded above $61,000, having hit a low of $58,580 on Monday. The broader market gauge of the CoinDesk 20 Index (CD20) bounced to 2,083 points from 2,020. Still, BTC, a liquidity proxy for macro traders, is down almost 10% for the month, starkly contrasting with a 5% gain in Wall Street's tech-heavy index, Nasdaq. The differing trajectories might foreshadow a tightening of liquidity conditions in financial markets and be a bearish signal for Nasdaq. "If Bitcoin serves as a liquidity gauge, then it would tell us that liquidity in the market is falling and that the Nasdaq 100 should eventually follow suit and move lower as well," Mott Capital Management founder Michael Kramer said in his daily analysis. “It may not be such a good sign for Nvidia, either, because Nvidia has tracked Bitcoin fairly well, too.”

Traders on the decentralized predictions platform Polymarket have already chosen a winner in the 2024 U.S. Presidential Elections, and it's not incumbent Joe Biden. A Polymarket contract asking who would win the election showed Republican candidate Donald Trump as the clear favorite, with a 57% chance of winning versus 35% for Biden. Meanwhile, another contract showed Biden winning the popular vote, which merely represents the proportion of votes cast for each candidate and carries no electoral weight. Trump’s favorable stance on crypto means BTC and the wider market could emerge as a bet on Trump’s presidency in the lead up to the Nov. 4 election.

The impending U.S.-based spot ether ETFs could see less demand than their already live BTC peers, broker Bernstein said in a report Monday, echoing recent comments by investment banking giant JPMorgan. "ETH should not see as much spot ETH conversion due to the lack of an ETH staking feature in the ETF," analysts Gautam Chhugani and Mahika Sapra wrote, adding that the basis trade will likely find takers over time and this should contribute to healthy liquidity in the ETF market. Spot ether ETFs are close to becoming available to investors in the U.S. after the Securities and Exchange Commission (SEC) approved key regulatory filings from issuers last month. The excitement surrounding their debut has investors anticipating higher ether price swings than bitcoin. Some analysts believe it is unfounded.

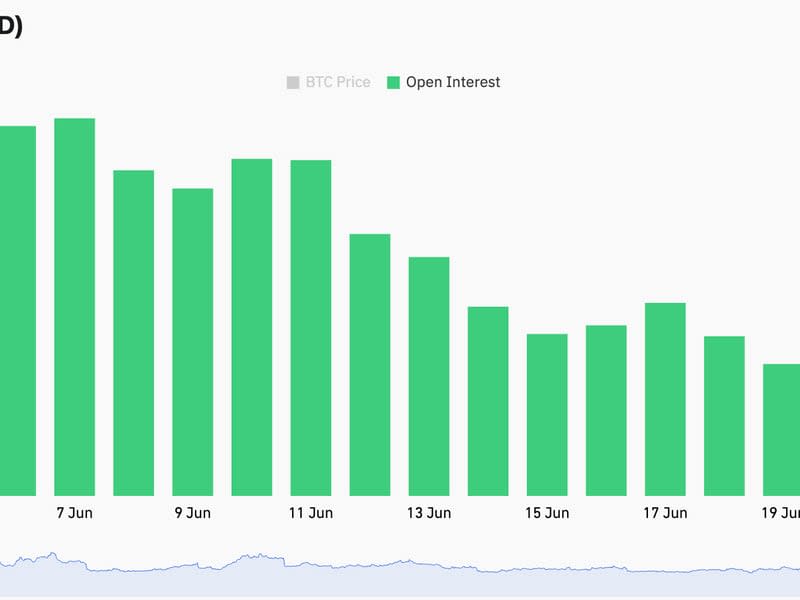

Chart of the Day

The notional open interest in bitcoin futures listed across centralized exchanges has declined by 14% to $37 billion since June 7.

The decline represents the unwinding of carry/basis trades due to negative funding rates, according to analysts at Bitfinex.

Source: Coinglass

- Omkar Godbole

Yahoo Finance

Yahoo Finance