First Northwest Bancorp Q1 2024 Earnings: A Turnaround Story with Modest Gains

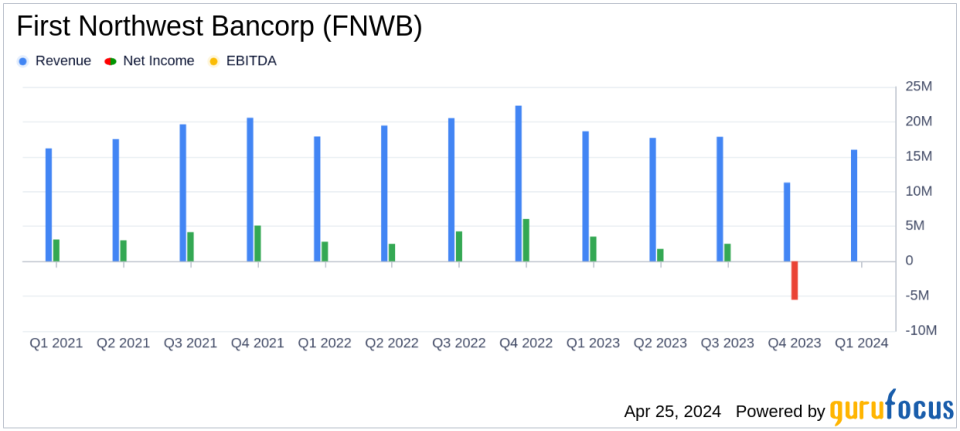

Net Income: Reported $0.4M for Q1 2024, a significant recovery from a $5.5M loss in Q4 2023, but below the $3.5M from Q1 2023 and analyst estimates of $1.10M.

Earnings Per Share (EPS): Achieved $0.04 in Q1 2024, recovering from a loss of $0.62 in Q4 2023, yet fell short of the $0.39 in Q1 2023 and below estimates of $0.12.

Revenue: Total revenue net of interest expense reached $16.1M in Q1 2024, up from $11.3M in Q4 2023, but fell short of $18.6M in Q1 2023 and estimates of $16.5M.

Dividends: Declared a quarterly cash dividend of $0.07 per common share, payable on May 24, 2024, to shareholders of record as of May 10, 2024.

Share Repurchase: Completed the 2020 stock buyback plan and approved a new plan for up to 10% of the shares currently outstanding.

Net Interest Margin: Decreased to 2.76% in Q1 2024 from 2.84% in the previous quarter and down from 3.46% in Q1 2023.

Loan Growth: Total loans grew by $51.4 million or 3.1% to $1.71 billion in Q1 2024, with a weighted-average yield on new loans of 8.2%.

On April 25, 2024, First Northwest Bancorp (NASDAQ:FNWB) disclosed its financial results for the first quarter of 2024, showcasing a return to profitability with earnings that slightly surpassed analyst expectations. The detailed earnings can be explored through their recent 8-K filing. This report comes after a challenging previous quarter, highlighting significant strategic adjustments and operational optimizations.

First Northwest Bancorp, a bank holding and financial holding company, operates primarily through its subsidiary, First Fed Bank. The company focuses on a broad range of banking activities, including significant lending operations such as mortgage, commercial real estate, and consumer loans, supplemented by other financial services.

Financial Highlights and Strategic Initiatives

For Q1 2024, FNWB reported a net income of $0.4 million, or $0.04 per share, a stark improvement from a net loss of $5.5 million in Q4 2023. This performance aligns closely with the estimated earnings per share of $0.12 and surpasses the estimated net income of $1.10 million. Total revenue for the quarter was $16.1 million, slightly missing the estimated $16.5 million but showing resilience in a competitive environment.

President and CEO Matthew P. Deines highlighted the successful balance sheet restructuring initiated in Q4 2023, which has started to yield positive results. The bank has increased its focus on higher-yield assets, reducing reliance on term deposits, and enhancing digital and business banking platforms. Notably, term deposits decreased by $39.9 million, while non-maturity deposits rose by $29.7 million, reflecting a strategic shift in deposit composition.

Operational and Asset Quality Review

FNWB's operational strategy included managing operating expenses, which declined to $14.3 million from $17.0 million in the previous quarter, showcasing effective cost control measures. Asset quality remained stable with nonperforming assets to total assets at 0.87%, and the net charge-off ratio slightly increased to 0.19%. The bank also completed a stock buyback plan and announced a new plan to repurchase up to 10% of outstanding shares, underlining confidence in its financial stability.

Challenges and Outlook

Despite the positive turnaround, FNWB faces challenges, including competitive deposit rates and an evolving economic landscape that could impact interest income and loan quality. The bank's net interest margin decreased to 2.76% from 2.84% in the previous quarter, reflecting ongoing pressures in generating interest income amidst rising deposit costs.

Looking ahead, FNWB plans to continue its strategic initiatives, including further balance sheet optimization and enhancing digital banking capabilities. The board declared a quarterly cash dividend of $0.07 per common share, reinforcing its commitment to shareholder returns.

Conclusion

First Northwest Bancorp's first quarter of 2024 marks a period of recovery and cautious optimism. With strategic realignments beginning to bear fruit, the bank is poised to build on its foundational strengths, despite some ongoing challenges. Investors and stakeholders will likely watch closely as FNWB continues to navigate through a dynamic banking environment.

For detailed financial figures and future projections, interested parties are encouraged to review the full earnings report and stay tuned for upcoming filings and announcements.

Explore the complete 8-K earnings release (here) from First Northwest Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance