First Republic: Wall St pledges billions to rescue California bank as Credit Suisse lifted by liquidity line

Larger US banks have agreed to deposit $30bn in San Francisco-based First Republic Bank as a sign of confidence in the banking system.

A consortium of Bank of America, Wells Fargo, Citigroup, and JP Morgan will deposit approximately $20bn, while Goldman Sachs and Morgan Stanley will deposit another $5bn, and Truist, PNC, US Bancorp, State Street, and Bank of New York Mellon will deposit around $1bn each.

Stocks rallied Thursday off the back of the news with the S&P 500 rising 68.35 points to 3,960.28, the Dow Jones gaining 1.2 percent to 32,246.55 and the Nasdaq jumping 2.5 percent to 11,717.28.

On Thursday morning, Treasury Secretary Janet Yellen told the Senate Finance Committee that the US banking system remains sound and Americans can feel confident that their deposits will be there when needed.

In remarks at a budget hearing, Yellen said “decisive and forceful” actions taken this week by the US government to shore up public confidence in the banking system after the collapse of Silicon Valley Bank underscored its resolve to protect depositors.

During the hearing, Democratic Senator Elizabeth Warren slammed a 2018 piece of legislation that deregulated the financial industry as contributing to SVB’s collapse.

Specifically, the Massachusetts lawmaker cited a 2018 piece of legislation that former president Donald Trump signed called the Economic Growth, Regulatory Relief, and Consumer Protection Act and said it led to the Federal Reserve’s actions and to the collapse of the bank.

“Believe me, I have questions for a lot of the banking regulators,” she said. “But Congress handed chair Powell the flame thrower that he aimed at the banking rules.”

Meanwhile, troubled Swiss bank Credit Suisse saw its shares jump by more than 30 per cent as trading opened in Zurich on Thursday after turning to the central bank in a bid to temper fears over its finances. The lender would borrow up to 50bn Swiss francs (£44bn, $54bn) from the Swiss National Bank to strengthen its liquidity.

Key Points

Dow closes up 370 points as Wall St banks step to aid First Republic

11 banks to deposit $30bn in First Republic

Yellen says US banking system ‘remains sound’ and Americans should be ‘confident’

DOJ and SEC to probe stock sales ahead of Silicon Valley Bank collapse, report says

‘Rapid deterioration’ of operating environment sees Moody’s cut US banking outlook

Dow Jones closes 280 points lower, dogged by fears for future of Credit Suisse

Wednesday 15 March 2023 20:50 , Oliver O'Connell

The Dow Jones Industrial Average closed 280 points (0.87%) lower on Wednesday, dogged by concerns over the future of Credit Suisse, which has a large US and international presence beyond its home base in Switzerland.

The S&P ended the day down 0.7% at 3,891.97, and the Nasdaq Composite managed to creep up 0.05% at 11,434 by the close of trading.

At one point the Dow was down 725 points and the S&P briefly saw all of this year’s gains erased.

There was something of a rebound in the afternoon when Swiss regulators announced that the country’s central bank would give Credit Suisse liquidity if needed, helping mitigate earlier concerns when it was reported by Reuters that Saudi National Bank, the institution’s largest investor, said it couldn’t provide further funding.

Credit Suisse had earlier said it had found “certain material weaknesses in our internal control over financial reporting” for the years 2021 and 2022.

Fears over the future of the bank stem from the crisis that emerged in US regional banks following the collapse of Silicon Valley Bank and Signature Bank over the weekend.

Worst one-day performance for London stockmarket since start of Covid pandemic

Wednesday 15 March 2023 22:50 , Oliver O'Connell

Fears that the economy might be on the edge of another “2008-style crisis” caused shares in top European banks to plunge and dragged London’s FTSE 100 down to its lowest level this year.

Troubled bank Credit Suisse saw its share price drop by as much as a quarter to a new record low, causing its shares to be temporarily suspended on the Swiss market.

Investors were shaken by the collapse of Silicon Valley Bank (SVB) in the US over the weekend, sparking concerns about the viability of the “too big to fail” Credit Suisse.

London stock market suffers heavy losses as banking crisis fears intensify

Why did Silicon Valley Bank collapse?

Thursday 16 March 2023 00:50 , Oliver O'Connell

The collapse of the 16th largest bank in the US sent ripples through global markets on Monday as governments and businesses scrambled to figure out what the impact would be and how it could be contained.

Silicon Valley Bank collapsed on Friday after failing to raise new capital last week.

On Monday, the UK government said that HSBC would take over the UK wing of the bank.

But what was SVB, why did it collapse, and are other banks at risk? We examine these questions here.

Why did Silicon Valley Bank collapse and are other lenders at risk?

Bank runs now happen at speed of social media

Thursday 16 March 2023 02:50 , Oliver O'Connell

A bank run conjures images of “It’s a Wonderful Life,” with anxious customers crammed shoulder to shoulder, desperately pleading with a harried George Bailey to hand over their money.

The failure of Silicon Valley Bank last week had the panic but few other similarities, instead taking place on Twitter, message boards, cell phones and bank websites.

What made the failure of Silicon Valley Bank unique compared to past failures of large banks was how quickly it collapsed. Last Wednesday afternoon, the $200 billion bank announced a plan to raise fresh capital; by Friday morning it was insolvent and under government control.

Read more:

Bank runs used to be slow. The digital era sped them up

Credit Suisse to borrow up to £44.5bn

Thursday 16 March 2023 04:56 , Alisha Rahaman Sarkar

Credit Suisse is planning to borrow up to £44.5bn from Switzerland’s central bank in a bid to boost its liquidity and calm investors.

Credit Suisse plunged and dragged down other major European lenders in the wake of bank failures in the US.

The lender’s stock dropped about 30 per cent, to about £1.42, before clawing back to a 24 per cent loss at £1.51 at the close of trading on the SIX stock exchange.

At its lowest, the price was down more than 85 per cent from February 2021.“This additional liquidity would support Credit Suisse’s core businesses and clients as Credit Suisse takes the necessary steps to create a simpler and more focused bank built around client needs,” the bank said.

Credit Suisse said the borrowing will be made under the covered loan facility and a short-term liquidity facility, and it will be collateralised by high quality assets.

Premium: Has enough been done to calm Wall Street over the banking crisis?

Thursday 16 March 2023 05:15 , Oliver O'Connell

James Moore wrote this week:

Just what we needed right now: another banking crisis. But after the bloodbath at the beginning of the week, a rally quickly got underway. Regional banks in the United States – in real danger of experiencing a run on their deposits while larger rivals benefit from inflows – found some support.

Perhaps Wall Street’s nail-biters had worked out that the doomed Silicon Valley Bank (SVB) had a rather unique financial and client structure. Ditto New York-based lender Signature, which shut down over the weekend. Interventions by the US Federal Reserve do seem to have helped calm nerves.

Has enough been done to calm Wall Street over the banking crisis?

Gold rallies over 1% after Credit Suisse crash

Thursday 16 March 2023 06:15 , Alisha Rahaman Sarkar

Gold prices climbed over 1 per cent to their highest since early February as a fresh crisis in the banking sector turned investors away from seemingly riskier assets.

Spot gold jumped 1.2 per cent to $1,924.63 per ounce. The US gold futures gained 1.1 per cent to settle at $1,931.30.

Gold prices in sterling hit a record high while bullion in euros also spiked towards all-time peaks hit last year.

“People are going to the US Treasuries, gold, silver, and the dollar. They’re exiting riskier assets like US equities and economically-sensitive metals like copper, platinum and palladium,” Phillip Streible, chief market strategist at Blue Line Futures in Chicago, told Reuters.

How Washington reacted to the Silicon Valley Bank failure

Thursday 16 March 2023 07:15 , Oliver O'Connell

There was a frenetic weekend of nonstop briefings with regulators, lawmakers, administration officials and President Joe Biden himself about how to handle the demise of the nation’s 16th-biggest bank and a go-to financial institution for tech entrepreneurs. At the core of the problem was tens of billions of dollars — including money companies needed to meet payrolls — sitting in Silicon Valley Bank accounts that were not protected by federal deposit insurance that only goes up to $250,000.

Something needed to be done, federal officials agreed, before Asian stock markets opened Sunday evening and other banks faced the potential for waves of panicked withdrawals Monday morning.

Here’s how it unfolded:

Washington reacts on the fly to Silicon Valley Bank failure

FTSE 100 hit by worst day since Covid

Thursday 16 March 2023 08:15 , Alisha Rahaman Sarkar

Fears the global economy might be hit by a fresh banking crisis wiped billions of pounds off the value of top firms yesterday during growing uncertainty over the future of troubled Credit Suisse.

Jitters spread through global markets as shares in the struggling Swiss lender crashed to a record low, dragging London’s FTSE 100 down 3.8 per cent.

It closed at 7,344 points, more than wiping out the gains that the index has made since the beginning of the year. It was a bigger one-day decline than last year’s mini-Budget and the day that Russia launched the full-scale invasion of Ukraine.

Alastair Jamieson reports.

Stock market hit by worst day since Covid amid fears of new banking crisis

Share price rises after £44bn bailout from Swiss national bank

Thursday 16 March 2023 09:07 , Emily Atkinson

Credit Suisse shares shot up by more than 30 per cent as trading opened in Zurich on Thursday after turning to the central bank in a bid to temper fears over its finances.

It was announced last night that the lender would borrow up to 50bn Swiss francs (£44bn) from the Swiss National Bank to strengthen its liquidity.

The troubled banking giant said it was taking decisive action to shore up its finances after its shares nosedived 30 per cent on Wednesday.

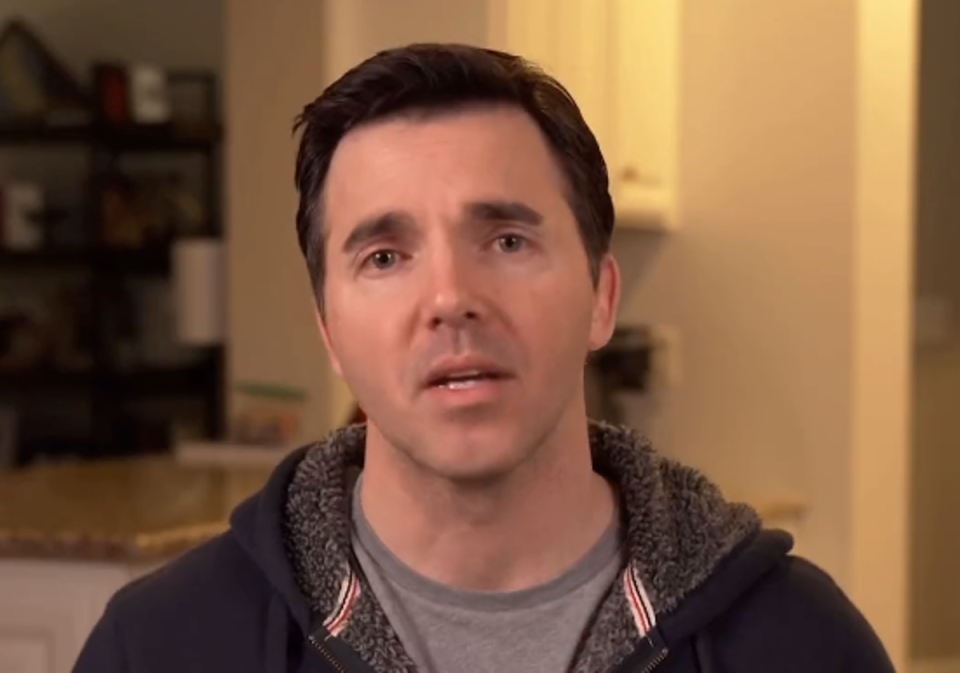

Lawmaker goes viral with video explanation of Silicon Valley Bank’s collapse

Thursday 16 March 2023 09:15 , Oliver O'Connell

A congressman has been widely praised for posting a two-and-a-half-minute video to Twitter and TikTok clearly laying out the Silicon Valley Bank situation.

North Carolina Democrat Jeff Jackson, originally from Chapel Hill, was elected to the US House of Representatives for the state’s 14th District in 2022.

At 2am on Monday morning, he filmed a video for social media explaining how the Silicon Valley Bank crisis began, what was being done about it, and to discourage panic.

Read on:

North Carolina lawmaker’s video explanation of the SVB collapse earns praise online

Jeremy Hunt ‘encouraged’ by efforts to boost Credit Suisse liquidity

Thursday 16 March 2023 09:35 , Adam Forrest

Chancellor Jeremy Hunt said he welcomed efforts to boost the liquidity of Credit Suisse, with its share price drop sparking fresh fears about the health of financial institutions.

The UK chancellor told Times Radio: “All I will say is of course I monitor what is going on in the markets, the Bank of England governor monitors carefully what is going on; he keeps me informed. I think the news we have heard from the Swiss authorities overnight is welcome.”

Earlier, Mr Hunt told Sky News he was monitoring developments “very closely” and said the news from the Swiss authorities was “encouraging”.

Deadline given for SVB and Signature Bank bids, reports suggest

Thursday 16 March 2023 09:50 , Emily Atkinson

Banks interested in acquiring Silicon Valley Bank and Signature Bank must submit bids by 17 March, people familiar with the matter have told Reuters.

It is the second attempt of the US Federal Deposit Insurance Corp (FDIC) at selling SVB after a failed effort on Sunday.

Reuters adds:

The FDIC is aiming to sell both SVB and Signature in their entirety, while offers for parts of the banks could be considered if whole company sales do not happen, two of the sources said.

Only bidders with an existing bank charter will be allowed to study the banks’ financials ahead of submitting their offer, a move which is aimed at giving traditional lenders an advantage over private equity firms, the two sources said.

Any buyer of Signature must agree to give up all the crypto business at the bank, the two sources added.

Sunak has much to do to stem the flow of London stocks to New York

Thursday 16 March 2023 10:15 , Alisha Rahaman Sarkar

As two major firms leave the City, it’s essential the government shows a better understanding of big business, writes Chris Blackhurst.

Sunak has much to do to stem the flow of London stocks to New York

Nasdaq futures rise

Thursday 16 March 2023 10:30 , Emily Atkinson

Nasdaq futures rose on Thursday as the Swiss central bank’s lifeline for Credit Suisse calmed global markets.

US-listed shares of Credit Suisse rose 3 per cent in premarket trading, after the bank secured a credit line of up to $54 billion from the Swiss National Bank to shore up liquidity and investor confidence, which had nosedived after the lender’s shares slumped on Wednesday.

Wall Street’s main indexes were under severe selling pressure in the previous session after troubles at Credit Suisse reignited fears of a banking crisis, which had eased following emergency measures by U.S. authorities after the collapse of SVB Financial and Signature Bank.

“We believe fears about bank solvency are overdone, and most banks retain strong liquidity positions,” Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a note.

“But tight funding conditions can still pose a challenge for a small number of individual banks, and sector profitability faces headwinds more broadly.”

Tough decisions ahead for the Federal Reserve

Thursday 16 March 2023 10:45 , Oliver O'Connell

The Federal Reserve is facing stinging criticism for missing what observers say were clear signs that Silicon Valley Bank was at high risk of collapsing into the second-largest bank failure in US history.

The Fed was the primary federal supervisor of the bank based in Santa Clara, California, that failed last week. The bank was also overseen by the California Department of Financial Protection and Innovation.

Critics point to many red flags surrounding Silicon Valley Bank, including its rapid growth since the pandemic, its unusually high level of uninsured deposits and its many investments in long-term government bonds and mortgage-backed securities, which tumbled in value as interest rates rose.

Fed, under criticism for bank failure, faces tough decisions

Yellen tells senators US banking system ‘remains sound’

Thursday 16 March 2023 11:06 , Emily Atkinson

The US banking system remains sound and Americans can feel confident that their deposits will be there when needed, treasury Secretary Janet Yellen will tell the Senate Finance Committee later today.

In remarks prepared for a budget hearing, Yellen said “decisive and forceful” actions taken this week by the US government to shore up public confidence in the banking system after the collapse of Silicon Valley Bank underscored its resolve to protect depositors.

“I can reassure the members of the committee that our banking system remains sound, and that Americans can feel confident that their deposits will be there when they need them,” Yellen said in the remarks.

“This week’s actions demonstrate our resolute commitment to ensure that depositors’ savings remain safe.”

She made no reference in the prepared remarks to the situation surrounding Credit Suisse, which saw its shares plunge on Wednesday before regulators pledged a liquidity lifeline to the flagship Swiss lender.

Banking crisis fears intensify as shares in top lenders plunge

Thursday 16 March 2023 11:15 , Alisha Rahaman Sarkar

Shares in top European banks have plunged as concerns over weaknesses in the global banking sector intensify, prompting fears of another “2008-style” financial crisis.

The sell-off of banking stocks took a turn for the worse yesterday, leading to reports that some major shares had been temporarily suspended.

Swiss bank Credit Suisse was driving the panicked mood after one of its top investors, Saudi National Bank, said it could not increase its stake in the struggling lender.

It led to sharp falls in the share price of other big banks, with London-listed Barclays plunging by more than 8 per cent, and European banks like Societe Generale and BNP Paribas showing losses of around 10 per cent.

Read more here.

Banking crisis fears intensify as shares in top lenders plunge

Asian stocks slide

Thursday 16 March 2023 11:45 , Alisha Rahaman Sarkar

Asian stocks tumbled today and investors bought gold, bonds and the dollar as fear of a banking crisis was reignited by fresh troubles at Credit Suisse.

Japan’s Nikkei fell 2 per cent in early trade. Australian shares slumped 2 per cent as well, led by losses for banking stocks, while miners dropped heavily too as the spectre of worldwide banking stress has traders getting out of all kinds of growth-sensitive assets.

Hang Seng futures were down 2 per cent.

Oil has slumped to 15-month lows. Gold touched a six-week high overnight. In New York the S&P 500 fell 0.7 per cent but the focus was on banks and in Europe where Credit Suisse shares crashed 30 per cent to a record low after its biggest shareholder, Saudi National Bank, said it could not provide further financial help.

(Reuters)

NY bank’s demise: Contagion or a problem with the business?

Thursday 16 March 2023 12:15 , Alisha Rahaman Sarkar

Signature Bank’s collapse came stunningly fast, leaving behind the question of whether there was a fundamental flaw in the way it did business — or if it was just a victim of the panic that spread after the failure of Silicon Valley Bank.

There were few outward signs that Signature Bank was crumbling before the New York Department of Financial Services on Sunday seized the bank’s assets and asked the Federal Deposit Insurance Corp. take over its operations.

The FDIC will run it as Signature Bridge Bank until it can be sold.

But leading up the takeover, there were calls on social media warning depositors to get their funds out of the bank — and those were followed with a real-life frenzy of withdrawals. There hasn’t yet been a public accounting of exactly how much money was withdrawn from the bank with a history of being friendlier than most in the US to the cryptocurrency industry.

Read more here.

NY bank's demise: Contagion or a problem with the business?

ICYMI | Biden says no losses will be borne by taxpayers

Thursday 16 March 2023 12:45 , Alisha Rahaman Sarkar

Joe Biden has reassured Americans that the nation’s banking system is “safe” after the collapse of Silicon Valley Bank and Signature Bank.

The US president also said that “no losses will be borne by the taxpayers” and “instead the money will come from the fees that banks pay into the deposit insurance fund.”

“Americans can have confidence that the banking system is safe,” Mr Biden said.He added that the management of the collapsed banks would be “fired”.

Watch here.

‘No losses’ will be borne by taxpayers after Silicon Valley Bank collapse, Biden says

Bank turmoil casts shadow over Europe interest rate decision

Thursday 16 March 2023 13:15 , Emily Atkinson

European Central Bank President Christine Lagarde said last week that a big interest rate increase was “very likely” at Thursday’s meeting. That was before Silicon Valley Bank collapsed in the U.S. and European bank shares plunged as fears spread of more widespread troubles at a time when banks are adjusting to rapidly rising interest rates.

Markets are watching to see if the ECB will stick to its path of steep rate increases aimed at fighting inflation or dial back to a quarter-point hike.

Lagarde and the ECB have not made a public statement on the recent banking upheaval, including a stock plunge from major Swiss lender Credit Suisse and its move for financing from the Swiss central bank this week. ECB officials typically observe a silent period a week before a rate decision to avoid excessive market swings and speculation based on officials’ comments.

More on this story here:

Bank turmoil casts shadow over Europe interest rate decision

European Central Bank hikes rates despite bank turmoil

Thursday 16 March 2023 13:26 , Oliver O'Connell

The European Central Bank has announced a further rate hike of 50 basis points, despite turmoil in banking stocks.

Here’s the moment the announcement broke on CNBC:

BREAKING: The European Central Bank announced a further rate hike of 50 basis points, despite turmoil in banking stocks. @steveliesman reports. https://t.co/yL6KXt8vcb pic.twitter.com/HSv87mKCUL

— CNBC (@CNBC) March 16, 2023

Wall Street falls on opening

Thursday 16 March 2023 14:07 , Oliver O'Connell

Stocks on Wall Street fell again on Thursday as regional banks once again felt the brunt of fears of a banking crisis in the US and Europe.

The Dow Jones Industrial Average was down 243 points (0.8%) but recovered some of those losses in the first 30 mins of trading. The S&P 500 lost 0.5% and the Nasdaq Composite dropped 0.4%.

Despite news that embattled Credit Suisse will borrow up to $54bn from the Swiss National Bank to assure short-term liquidity, fears persist on Wall Street that an impending crisis remains a possibility and that the sector is not yet out of the woods.

The closures of Silicon Valley Bank and Signature Bank over the weekend have drawn bank stocks into sharp focus this week as investors fear contagion to the rest of the industry.

First Republic Bank considering sale, report says

Thursday 16 March 2023 14:24 , Oliver O'Connell

According to reporting by Bloomberg, US regional lender First Republic Bank is considering a sale among other options. The outlet cites people familiar with knowledge of the matter.

The San Francisco-headquartered lender could attract interest from larger banks should a sale go ahead. Other options being explored include ways to boost liquidity.

On Wednesday, S&P Global and Fitch cut First Republic’s credit rating to junk status over concerns depositors could pull funds from the lender in a bank run similar to that which occurred at Silicon Valley Bank.

“We believe the risk of deposit outflows is elevated at First Republic Bank despite the actions of federal banking regulators and the bank actively increasing its borrowing availability to mitigate risk associated with the bank failures over the last week,” S&P Global Ratings analysts Nicholas Wetzel and Rian Pressman wrote.

Since the tech-heavy Santa Clara-based Silicon Valley Bank collapsed last Friday, First Republic has assured customers of its own liquidity. The bank said on Sunday it is getting $70bn of additional funding from the Federal Reserve and JP Morgan Chase.

First Republic’s share price is down 82.6 per cent year-to-date.

Yellen: US banking system ‘sound’ after two collapses in one week

Thursday 16 March 2023 14:35 , Oliver O'Connell

Treasury Secretary Janey Yellen is speaking to the Senate Finance Committee. She began her remarks with an update on the recent developments in the banking system.

This week the government took decisive and forceful actions to stabilize and strengthen public confidence in our financial system.

First, we worked with the Federal Reserve and FDIC to protect all depositors of the two failed banks. On Monday morning customers were able to access all of the money in their deposit accounts, so they could make payroll and pay the bills. Shareholders and debt holders are not being protected by the government. Importantly, no taxpayer money is being used or put at risk with this action deposit protection is provided by the Deposit Insurance Fund, which is funded by fees on banks.

Second, the Federal Reserve is providing additional support to the banking system with the new lending facility. This will help financial institutions meet the needs of all of their depositors.

I can reassure the members of the committee that our banking system is sound, and that Americans can feel confident that their deposits will be there when they need them. This week’s actions demonstrate our resolute commitment to ensure that our financial system remains strong, and that depositors’ savings remained safe.

Watch: Yellen remarks to Senate committee

Thursday 16 March 2023 14:43 , Oliver O'Connell

.@SecYellen: "I can reassure the members of the committee that our banking system is sound and that Americans can feel confidant that their deposits will be there when they need them." pic.twitter.com/EEgc1S4esu

— CSPAN (@cspan) March 16, 2023

.@SecYellen: "This week the government took decisive and forceful actions to stabilize and strengthen public confidence in our financial system." pic.twitter.com/9zYIEuLLg8

— CSPAN (@cspan) March 16, 2023

Is a takeover of Credit Suisse on the cards?

Thursday 16 March 2023 15:00 , Oliver O'Connell

With speculation about the possible sale of First Republic Bank in California, what about the future of Credit Suisse?

Per Reuters:

Credit Suisse shares jumped over 20% on Thursday after the company secured a lifeline from the Swiss central bank to shore up investor confidence, though some analysts said the market relief could be shortlived.

The Swiss bank's announcement that it would make use of a $54-billion loan from the Swiss National Bank helped stem heavy selling in financial markets in Asia on Thursday and prompted a modest rally in European equities.

While many in the market cheered the news, others were cautious. JPMorgan analysts said the loan from the SNB would not be enough to soothe investor concerns and the "status quo was no longer an option", leaving a takeover of Credit Suisse as the most likely outcome.

Earlier: European markets regain poise

Thursday 16 March 2023 15:25 , Oliver O'Connell

London’s FTSE 100 Index has rebounded after suffering its worst one-day performance since the start of the pandemic amid hopes a £45 billion emergency loan for Credit Suisse will calm fears over a banking crisis.

The top tier rose 0.7%, up 50.1 points to 7394.6, in morning trading as banking stocks regained their poise following hefty declines, which saw the FTSE 100 close 3.8% lower on Wednesday.

The deepening crisis at Credit Suisse, just days after Silicon Valley Bank and Signature Bank collapsed in the US, has sparked fears the banking sector is heading for a full-blown crisis.

Holly Williams reports.

European markets regain poise as Credit Suisse emergency loan calms bank fears

Deadline given for SVB and Signature Bank bids, reports suggest

Thursday 16 March 2023 15:45 , Oliver O'Connell

Banks interested in acquiring Silicon Valley Bank and Signature Bank must submit bids by 17 March, people familiar with the matter have told Reuters.

It is the second attempt of the US Federal Deposit Insurance Corp (FDIC) at selling SVB after a failed effort on Sunday.

Reuters adds:

The FDIC is aiming to sell both SVB and Signature in their entirety, while offers for parts of the banks could be considered if whole company sales do not happen, two of the sources said.

Only bidders with an existing bank charter will be allowed to study the banks’ financials ahead of submitting their offer, a move which is aimed at giving traditional lenders an advantage over private equity firms, the two sources said.

Any buyer of Signature must agree to give up all the crypto business at the bank, the two sources added.

Big banks rallying around First Republic, report says

Thursday 16 March 2023 15:58 , Oliver O'Connell

More details have emerged of a plan to shore up First Republic Bank, The Wall Street Journal reports.

The largest banks in the US, including JPMorgan Chase are discussing a joint rescue of the San Francisco-based lender including a sizable capital infusion.

Citing people familiar with the details, the Journal reports that JPMorgan is working with Citigroup, Bank of America, and Wells Fargo to put together a lifeline for the bank.

The same people said that Morgan Stanley, Goldman Sachs, US Bancorp, and PNC Financial Services are also involved.

A deal may be made public as soon as today, though there is no certainty yet as to what the final package may look like and regulator approval would be required.

Full story: Yellen says US banking system ‘remains sound’ and Americans should be ‘confident’

Thursday 16 March 2023 16:15 , Oliver O'Connell

Treasury Secretary Janet Yellen on Thursday told the Senate Finance Committee that the US banking system is “sound” and Americans can feel “confident” about their deposits in the wake of the second-largest bank collapse in America’s history late last week.

Speaking at the outset of a hearing to examine President Joe Biden’s budget request for the Treasury during the next fiscal year — the first appearance by an administration official at the Capitol since Mr Biden said the Federal Deposit Insurance Corporation would protect uninsured money at Silicon Valley Bank and Signature Bank, a move that some observers have criticised as a “bailout” — Ms Yellen said the decision showed the administration’s “resolve” to maintain Americans’ confidence in the US financial system.

Here’s the latest from Capitol Hill:

Janet Yellen says US banking system ‘remains sound’ and Americans can be ‘confident’

What is happening to banks and why are people talking about a crisis?

Thursday 16 March 2023 16:45 , Oliver O'Connell

Global banks have been in the eye of the storm this week, with fears growing over the stability of the banking sector and some likening the current situation to the 2008 financial crash.

Two events have fuelled the sense of panic. First, the collapse of Silicon Valley Bank in the US, and second, the woes at Swiss bank Credit Suisse that led it to take a £45 billion emergency loan from the central bank.

But how are these events linked and should we be worried?

Anna Wise reports.

What is happening to banks and why are people talking about a crisis?

Senior Democrats hand back Silicon Valley Bank donations

Thursday 16 March 2023 17:15 , Oliver O'Connell

Top Democrats in Congress are vowing to return campaign contributions tied to Silicon Valley Bank (SVB), the tech industry lender which failed last week after a bank run and was temporarily taken over by federal legislators.

Josh Marcus has the details.

Democrats hand back Silicon Valley Bank donations following bank’s collapse

Lacking insight and loving a buzzword, GOP claims ‘woke banks’ to blame

Thursday 16 March 2023 17:45 , Oliver O'Connell

For months, right-wing media figures and Republican elected officials have blamed a “woke” agenda for what they perceive is the collapse of American institutions, from its schools and workplaces to the banks that facilitate their businesses.

The historic failure of Silicon Valley Bank is likely the result of a host of compounded factors that have nothing to do with so-called “wokeness,” from Donald Trump-era cuts to regulations that were put in place during the last financial crisis to the bank’s untenable concentration in an explosion of venture capital firms and tech startups as it careened into reality, rising interest rates and panic.

Yet Republican lawmakers have continued to return to their catch-all scapegoat – using “woke” as an umbrella term for anything related to diversity, progressive political platforms, LGBT+ inclusivity, antiracism initiatives or environmental activism – while advancing a nationwide legislative agenda singularly devoted to its destruction.

Alex Woodward reports.

Republicans blame ‘wokeness’ for Silicon Valley Bank’s collapse

Credit Suisse shares rebound but doubters remain

Thursday 16 March 2023 18:00 , Oliver O'Connell

Credit Suisse shares rebounded on Thursday after getting a lifeline from the Swiss central bank to shore up investor confidence but the rally lost ground against a febrile backdrop.

The Swiss bank’s announcement that it would make use of a $54bn loan from the Swiss National Bank helped stem heavy selling in financial markets on Thursday and prompted a modest rally in European equities.

Some in the market welcomed the news, others were cautious. JP Morgan analysts said the loan from the SNB would not be enough to soothe investor concerns and the “status quo was no longer an option”, leaving a takeover of Credit Suisse as the most likely outcome.

Last week’s collapse of two regional US banks has raised made investors and bank customers worry about the resilience of the financial system in the face of rising global interest rates.

Reuters

AP Factcheck: Are ‘woke’ policies linked to bank’s demise

Thursday 16 March 2023 18:15 , Oliver O'Connell

As Wall Street reels from the swift demise of Silicon Valley Bank — the biggest American bank failure since the 2008 financial meltdown — some social media users are honing in on a single culprit: its socially aware, or “woke,” agenda.

But the Santa Clara-based institution’s professed commitment to diversity, equity and inclusion, or DEI, wasn’t a driver of the bank’s collapse, say banking and financial experts. Its poor investment strategies and a customer base prone to make devastating bank runs were.

Here’s a closer look at the facts.

FACT FOCUS: Claims link ‘woke’ policies to bank’s demise

More details on big US banks possibly bolstering First Republic

Thursday 16 March 2023 18:22 , Oliver O'Connell

Per CNBC:

A group of financial institutions are in talks to deposit $30bn in First Republic in what’s meant to be a sign of confidence in the banking system, sources told CNBC’s David Faber.

The deal is not done yet, the sources said, and the amounts were a moving target. The plan does not call for an acquisition of First Republic.

Bank of America, Wells Fargo, Citigroup and JPMorgan Chase will contribute about $5bn apiece, while Goldman Sachs and Morgan Stanley will deposit around $2.5bn, the sources said. Truist, PNC, US Bancorp, M&T Bank and Capital One will deposit about $1bn each.

Signature Bank’s rapid collapse stunned the industry — what happened?

Thursday 16 March 2023 18:45 , Oliver O'Connell

Signature Bank’s collapse came stunningly fast, leaving behind the question of whether there was a fundamental flaw in the way it did business — or if it was just a victim of the panic that spread after the failure of Silicon Valley Bank.

There were few outward signs that Signature Bank was crumbling before the New York Department of Financial Services on Sunday seized the bank’s assets and asked the Federal Deposit Insurance Corp to take over its operations. The FDIC will run it as Signature Bridge Bank until it can be sold.

But leading up to the takeover, there were calls on social media warning depositors to get their funds out of the bank — and those were followed by a real-life frenzy of withdrawals. There hasn’t yet been a public accounting of exactly how much money was withdrawn from the bank with a history of being friendlier than most in the US to the cryptocurrency industry.

Read more:

NY bank's demise: Contagion or a problem with the business?

What’s at stake if Credit Suisse goes bust?

Thursday 16 March 2023 19:15 , Oliver O'Connell

Thomas Kingsley breaks down how the Swiss lender and investment bank got into its current position and whether we should be worried.

What happened to Credit Suisse and what’s at stake if it goes bust?

London market recovers some lost ground, but remains depressed

Thursday 16 March 2023 19:45 , Oliver O'Connell

Shares in the FTSE 100 managed to regain some of their lost ground on Thursday after a yo-yo session which saw the index fluctuate as much as 130 points between its high and low point.

The bounce-back helped the index jump to 7,410 by the end of the day, a rise of 65.58 points or 0.9% after Swiss authorities agreed an emergency £45 billion loan with Credit Suisse overnight.

But it was far from enough to regain the losses from Wednesday, when the FTSE had its worst single day of trading in three years – since the early days of the Covid-19 pandemic.

Read more:

FTSE recovers some lost ground, but remains depressed amid global jitters

11 banks to deposit $30bn in First Republic

Thursday 16 March 2023 19:56 , Oliver O'Connell

A group of financial institutions has agreed to deposit $30 billion in First Republic to demonstrate confidence in the US banking system, the banks announced on Thursday afternoon.

Bank of America, Wells Fargo, Citigroup and JPMorgan Chase will contribute about $5bn each, while Goldman Sachs and Morgan Stanley will deposit approximately $2.5bn, the banks said in a news release.

Truist, PNC, U.S. Bancorp, State Street, and Bank of New York Mellon will deposit around $1bn each.

Powell, FDIC Chairman Gruenberg and Acting Currency Comptroller Hsu. (2/2)

— Steve Herman (@W7VOA) March 16, 2023

Dow closes up 370 points as Wall St banks step to aid First Republic

Thursday 16 March 2023 20:19 , Oliver O'Connell

Wall Street’s main indexes rebounded strongly on Thursday after news and then confirmation that some of the US’s largest financial institutions were coming to the aid of First Republic Bank.

The banks have agreed to deposit $30bn in First Republic Bank to demonstrate confidence in the US banking system.

Bank of America, Wells Fargo, Citigroup and JPMorgan Chase will contribute about $5bn each, while Goldman Sachs and Morgan Stanley will deposit approximately $2.5bn, the banks said in a news release.

Truist, PNC, U.S. Bancorp, State Street, and Bank of New York Mellon will deposit around $1bn each.

The Dow Jones Industrial Average index went up 371.98 points, or 1.17%, to close at 32,246.55 points. The S&P 500 added 1.76% to close at 3,960.34. The Nasdaq Composite increased by 2.48% to 11,717.28.

Elizabeth Warren: GOP gave Fed chairman ‘flamethrower that he aimed at the banking rules’

Thursday 16 March 2023 20:30 , Oliver O'Connell

Senator Elizabeth Warren slammed a 2018 piece of legislation that deregulated the financial industry as contributing to the collapse of Silicon Valley Bank.

The Massachusetts Democrat and longtime critic of the financial industry made the remarks during a Senate Finance Committee hearing with Treasury Secretary Janet Yellen.

Eric Garcia has the full story.

Warren says Republicans handed Fed chairman ‘flamethrower’ aimed at banking rules

Premium: Cracks exposed in global banking system – but this isn’t a 2008 rerun yet

Thursday 16 March 2023 20:45 , Oliver O'Connell

James Moore writes:

It’s been a case of lather, rinse, repeat in banking this week, with with the collapse of Silicon Valley Bank followed by a much bigger crisis in the form of Credit Suisse.

Mid-sized SVB was more systemically significant than many had assumed, raising big questions about US oversight.

But there was never any doubt about the dangers from a stricken Credit Suisse, a pillar of the Swiss banking establishment and a (shaky) member of the top table.

Read on:

Cracks exposed in global banking – but this isn’t a 2008 rerun yet

Meanwhile, here’s how the trading day unfolded in London

Thursday 16 March 2023 21:20 , Oliver O'Connell

London’s top shares faced a rollercoaster session on Thursday, with traders sending the FTSE 100 up and down throughout the day, but despite turbulent trading it managed to close on a high.

Coming off the index’s worst day for three years on Wednesday amid worries over the future of banking giant Credit Suisse, Thursday trading was highly erratic.

The top tier index initially gained ground, looking set for a rebound as trading opened after Swiss authorities extended a £45 billion emergency loan to the under-pressure bank.

But through the day it was knocked around like a yo-yo, at one point even dipping into negative territory. By the end of the day it had gained 0.9%.

Read on:

Market turmoil calms after Credit Suisse gets £45bn loan

Big US banks benefit from surge in deposits

Thursday 16 March 2023 21:50 , Oliver O'Connell

The collapse of Silicon Valley Bank and Signature Bank has sent some customers rushing to pull their money out of smaller banks, which has resulted in a windfall of new deposits for larger institutions.

Wells Fargo, Citigroup and Bank of America have all reported significant increases in deposits since SVB collapsed last week, CNN reports, citing sources familiar with the figures.

Graig Graziosi reports.

Big US banks benefit from surge in deposits after SVB and Signature Bank collapses

Why are banks needing new bailouts?

Thursday 16 March 2023 22:20 , Oliver O'Connell

Markets are steadying on Thursday night amid hopes that the new lifelines will limit any “contagion” to other banks.

Thomas Kingsley and Alastair Jamieson take a look at what’s happening.

What happened to Credit Suisse and why are banks needing bailouts again?

ICYMI: DOJ and SEC to probe Silicon Valley Bank collapse

Thursday 16 March 2023 23:20 , Oliver O'Connell

The US Department of Justice and the Securities and Exchange Commission are investigating the collapse of Silicon Valley Bank, The Wall Street Journal reports, citing people familiar with the matter.

The tech and start-up-focused lender based in Santa Clara, California, was taken over by regulators on Friday during a run on its deposits, making it the second-largest bank failure in US history.

SVB: Justice Department and SEC to probe stock sales ahead of collapse

Premium: Relief for UK tech firms over SVB rescue – but important lessons must be learnt

01:20 , Oliver O'Connell

Let’s start off with the good thing that has emerged from the collapse of Silicon Valley Bank, which handled roughly a quarter of the companies in the UK tech sector and had been threatening a meltdown.

The UK arm has been rescued via a deal put together over the weekend by the Bank of England, the government, and HSBC – the bank that is picking up the pieces after “a competitive process” and (so we are told) sparing the taxpayer a nasty wallop in the process.

There is something comfortingly old-school about the way this was brokered behind closed doors. The end result is that the business will be shifted to HSBC UK, meaning that depositors will be able to get their money and tech workers their wages.

The lessons that must be learnt from the SVB collapse and rescue

Premium: This isn’t a 2008 rerun yet - but cracks have been exposed in the global banking system

05:20 , Oliver O'Connell

James Moore writes:

It’s been a case of lather, rinse, repeat in banking this week, with with the collapse of Silicon Valley Bank followed by a much bigger crisis in the form of Credit Suisse.

Mid-sized SVB was more systemically significant than many had assumed, raising big questions about US oversight.

But there was never any doubt about the dangers from a stricken Credit Suisse, a pillar of the Swiss banking establishment and a (shaky) member of the top table.

Read on:

Cracks exposed in global banking – but this isn’t a 2008 rerun yet

Earlier: Dow closes up 370 points as Wall St banks step to aid First Republic

07:00 , Oliver O'Connell

Wall Street’s main indexes rebounded strongly on Thursday after news and then confirmation that some of the US’s largest financial institutions were coming to the aid of First Republic Bank.

The banks have agreed to deposit $30bn in First Republic Bank to demonstrate confidence in the US banking system.

Bank of America, Wells Fargo, Citigroup and JPMorgan Chase will contribute about $5bn each, while Goldman Sachs and Morgan Stanley will deposit approximately $2.5bn, the banks said in a news release.

Truist, PNC, U.S. Bancorp, State Street, and Bank of New York Mellon will deposit around $1bn each.

The Dow Jones Industrial Average index went up 371.98 points, or 1.17%, to close at 32,246.55 points. The S&P 500 added 1.76% to close at 3,960.34. The Nasdaq Composite increased by 2.48% to 11,717.28.

ICYMI: What’s at stake if Credit Suisse goes bust?

07:45 , Oliver O'Connell

Thomas Kingsley takes a close look at the Swiss bank at the centre of this week’s financial ructions.

What happened to Credit Suisse and why are banks needing bailouts again?

Premium: Has enough been done to calm Wall Street over the banking crisis?

08:30 , Oliver O'Connell

James Moore gives his view on whether a lesson has been learned from the collapse of Silicon Valley Bank.

Has enough been done to calm Wall Street over the banking crisis?

Big US banks benefit from surge in deposits

09:00 , Oliver O'Connell

The collapse of Silicon Valley Bank and Signature Bank has sent some customers rushing to pull their money out of smaller banks, which has resulted in a windfall of new deposits for larger institutions.

Wells Fargo, Citigroup and Bank of America have all reported significant increases in deposits since SVB collapsed last week, CNN reports, citing sources familiar with the figures.

Graig Graziosi reports.

Big US banks benefit from surge in deposits after SVB and Signature Bank collapses

Why are banks needing new bailouts?

09:30 , Oliver O'Connell

Markets are steadying on Thursday night amid hopes that the new lifelines will limit any “contagion” to other banks.

Thomas Kingsley and Alastair Jamieson take a look at what’s happening.

What happened to Credit Suisse and why are banks needing bailouts again?

Yahoo Finance

Yahoo Finance