First signs of rising rents as buy-to-let investors pass on higher tax

The first widespread evidence of landlords raising rents in response to a range of tax increases has led to commentators insisting that buy-to-let remains a viable investment for many.

According to research by Your Move, the letting agents, the average rent in England and Wales has risen by £75 since January, which could signal the first response from landlords to the tax squeeze.

Government data shows that average rents had remained stagnant at around £650 a month for much of the past two years. But the Your Move index suggests they have begun steadily rising in the past 12 months, with a spike since the tax relief changes began to bite making the average rent £873.

From April 2017, buy-to-let investors can no longer offset all their mortgage interest against profits before calculating a tax liability. Over coming years the amount of interest that can be offset declines until 2020, when it cannot be offset at all. Instead, a 20pc tax credit will be applied. Lower-income landlords who do not pay 40pc tax should therefore not be hit. Worst affected will be higher-rate taxpayers who have large mortgages on their buy-to-lets.

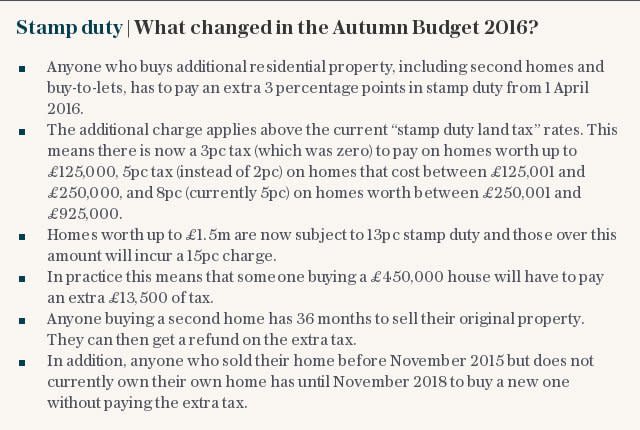

The introduction last year of a 3pc stamp duty surcharge on buy-to-let property purchases was a further blow.

But Richard Waind, a director at Your Move, said these factors were not deterring investors.

“From a landlord’s point of view it’s actually quite a good time to invest,” he explained.

“Mortgage rates are the lowest they have ever been, purchase prices have dipped slightly and tenancies are lasting longer. If you’re a good landlord who looks after their tenants then they will stay.

“There are still good reasons for getting into buy-to-let and buyers should definitely continue to consider putting their money in it.”

However he did admit that stamp duty reform had pushed down supply, while growing numbers of tenants, combined with the tax relief changes, appeared to be driving rents higher. In January the average rent was £797.85, while in July this had risen to £873.50.

The new tax relief rules mean landlords are only able to offset 75pc of mortgage interest against their taxable income in this financial year. Mr Waind said that as this increased in future years it was likely rents would rise further.

“We are now seeing a rising number of tenants year-on-year and, coupled with the lack of properties on the market, that’s only going to do one thing to rents,” he said.

“I certainly suspect this isn’t what the Government wanted from its policy, and if it is an unwanted reaction perhaps they might need to review that policy.”

The Your Move report also cited wide regional differences - the average rent in London of £1,283 a month is more than double the £542 paid by tenants in the north east. Mr Waind said that part of the country continues to offer the best return on investment in terms of rental income - but that slow price growth in the south had created parallel investment opportunities.

“The best yields tend to be in the north and the north west and that’s where we have seen the longest yield growth,” he added. “There’s an argument to say the south east has seen a bigger dip in capital prices, so that might create some value in the next few years.

“If you are looking for yield the north and north west are still best, but there’s some good value in the south and south east.”

Yahoo Finance

Yahoo Finance