Five Below (FIVE) Q1 Earnings Top Estimates, Sales Rise Y/Y

Five Below, Inc. FIVE came up with first-quarter fiscal 2023 results, wherein the top line missed the Zacks Consensus Estimate while the bottom line beat the same. Net sales and earnings both grew year over year. Management cited that an improved transaction trend and broad-based sales performance contributed to the company’s performance amid macro headwinds.

Let’s Delve Deeper

Five Below posted earnings per share of 67 cents in the first quarter of fiscal 2023, which beat the Zacks Consensus Estimate of 62 cents. The company’s earnings per share increased 13.6% from 59 cents reported in the year-ago period.

Net sales of $726.2 million increased 13.5% year over year but came below the Zacks Consensus Estimate of $729 million. Comparable sales for the quarter under discussion increased 2.7% against a decrease of 3.6% registered in the year-ago period. The comp increase was driven by a growth of 3.9% in comp transactions.

The gross profit grew 13.5% year over year to $234.8 million. Meanwhile, the gross margin remained relatively flat at 32.3%.

We note that selling general and administrative (SG&A) expenses shot up 17% to $192.4 million. SG&A as a percentage of net sales increased by approximately 80 basis points (bps) to 26.5% due to higher marketing costs and an increase in certain store-related expenses.

Operating income inched up 0.2% to $42.4 million for the quarter under discussion. The operating margin decreased approximately 80 bps to 5.8% during the quarter.

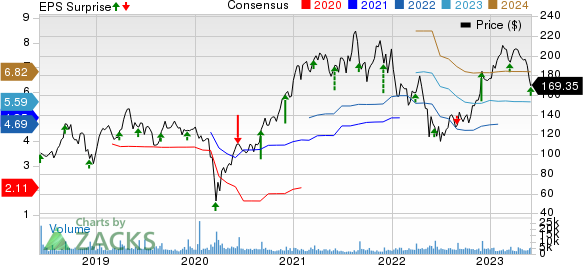

Five Below, Inc. Price, Consensus and EPS Surprise

Five Below, Inc. price-consensus-eps-surprise-chart | Five Below, Inc. Quote

Financials

Five Below ended the fiscal first quarter with cash and cash equivalents of $335.3 million and short-term investment securities of $88.2 million. Total shareholders’ equity was $1,387.3 million as of Apr 29, 2023. Five Below did not make any repurchases during the quarter.

Five Below anticipates gross capital expenditures of approximately $335 million in fiscal 2023, excluding tenant allowances.

Store Update

Five Below opened 27 new stores in the reported quarter. This took the total count to 1,367 stores in 43 states as of Apr 29, 2023, reflecting an increase of 11.6% from the year-ago count. The company plans to open about 200 new stores in fiscal 2023 and convert over 400 stores to the new Five Beyond format in the same period.

Guidance

Five Below envisions second-quarter fiscal 2023 net sales in the range of $755 million to $765 million, up from $668.9 million reported in the second quarter of fiscal 2022.

The company expects comparable sales to increase in the range of 2-3% in the second quarter. Management also expects an operating margin in the range of 7.5% to 7.9% in the same period.

Management anticipates second-quarter earnings per share between 80 cents and 85 cents compared with 74 cents reported in the year-ago period.

Management now projects fiscal 2023 net sales in the band of $3.50 billion to $3.57 billion, compared with $3.49 billion to $3.59 billion projected earlier. This compares with $3.1 billion reported in fiscal 2022. For fiscal 2023, Five Below now anticipates comparable sales to be up 1-3% compared with the 1-4% increase guided previously.

Management now anticipates earnings per share between $5.31 and $5.71 for fiscal 2023 compared with $5.25-$5.76 predicted earlier. This indicates an increase from $4.69 reported in the year-ago period.

Shares of this Zacks Rank #4 (Sell) company have decreased 2.9% in the past six months compared with the industry’s decline of 11%.

3 Red-Hot Stocks

Some better-ranked stocks are Tecnoglass TGLS, Arcos Dorados Holdings Inc. ARCO and The Kroger Co. KR.

Tecnoglass manufactures and sells architectural glass and aluminum products for the residential and commercial construction industries. TGLS currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share suggests growth of 18.1% and 23.8%, respectively, from the corresponding year-ago reported figures. TGLS has a trailing four-quarter earnings surprise of 22.7%, on average.

Arcos Dorados operates as a franchisee of McDonald's restaurants and currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Arcos Dorados’ current financial-year sales suggests growth of 13.4%, while earnings per share are expected to rise by 4.4% from the corresponding year-ago reported figures. ARCO has a trailing four-quarter earnings surprise of 23.5%, on average.

Kroger Co. operates in the thin-margin grocery industry. It currently carries a Zacks Rank #2. KR has a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Kroger’s current financial year sales and earnings suggests growth of 2.5% and 6.6%, respectively, from the prior-year reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Kroger Co. (KR) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance