Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- North America’s steel industry is gathering in Atlanta as the sector grapples with uninspired US demand, slumping prices and an overabundance of Chinese steel. A key Brazilian sugar report will offer insights on upcoming price moves for the sweetener. And crude oil stockpiles at a key US hub are at their lowest levels since February.

Most Read from Bloomberg

Sydney Central Train Station Is Now an Architectural Destination

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

How the Cortiços of São Paulo Helped Shelter South America’s Largest City

Here are five notable charts to consider in global commodity markets as the week gets underway.

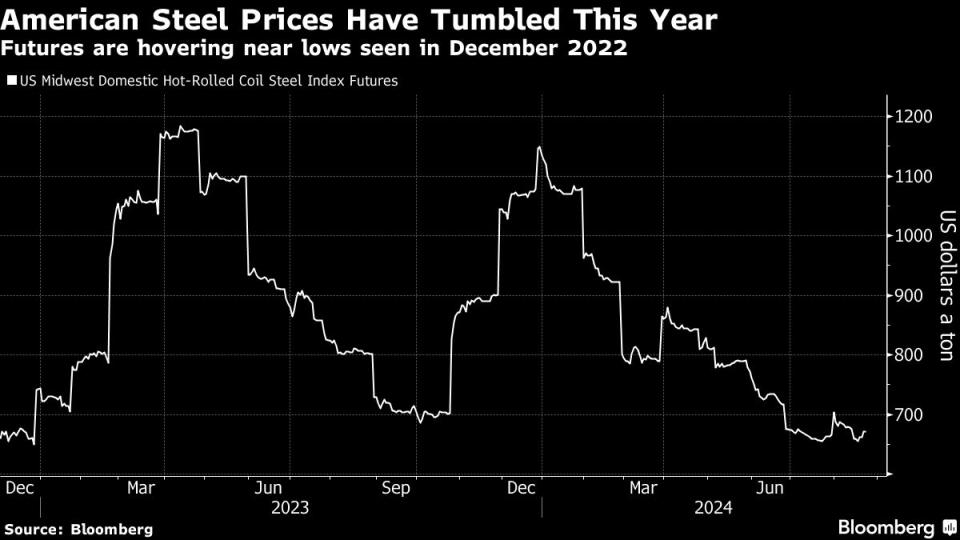

Steel

North America’s steel industry is converging in Atlanta for the annual SMU Steel Summit from Monday to Wednesday. Hot topics are expected to include the impact of surging Chinese exports, which have dragged down prices around the world, and whether lackluster US demand will start to recover. Top of mind for conference participants will be the future direction of the market, with steel prices down more than 40% this year and approaching lows last seen at the end of 2022.

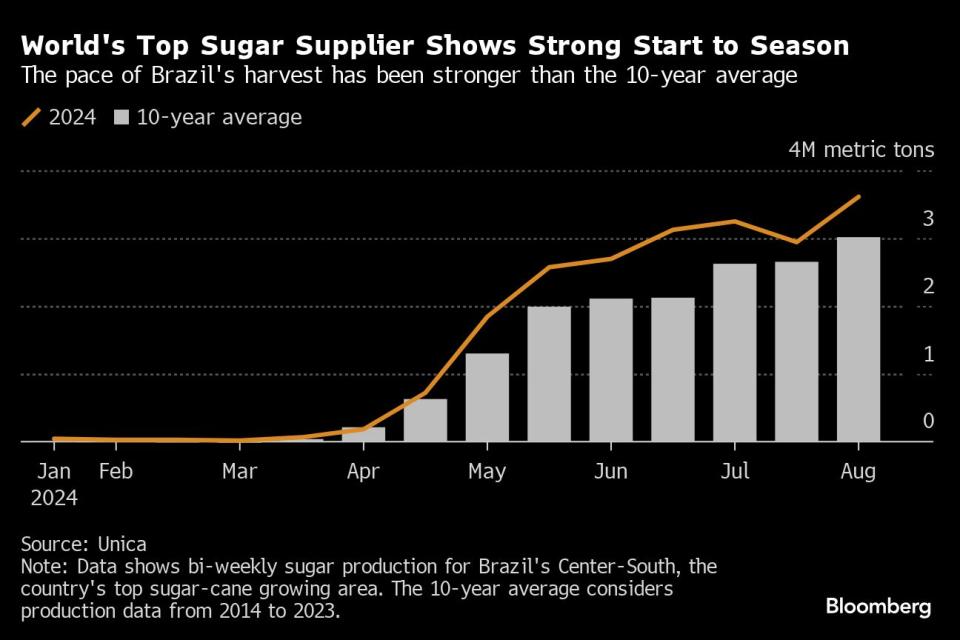

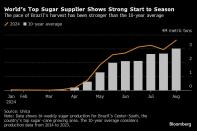

Sugar

Upcoming data for sugar production in Brazil — the world’s top exporter — will be determinant in signaling whether the global market remains well supplied. The country is halfway through its sugar-cane harvest, and so far a stronger-than-usual production pace has helped drive down prices of the sweetener by nearly 12% this year. Still, dry weather is threatening to hurt yields, and traders will look for clues in a report from industry group Unica that’s scheduled to come out this week. Raw sugar futures rose as much as 3.1% on Monday in New York.

Oil

Crude stocks at the key hub of Cushing, Oklahoma, have plunged to six-month lows as refiners in the region ramp up activity following unexpected outages. Declining crude shipments from Canada, which slid to the lowest since April earlier this month, have also contributed to the supply tightness at the storage depot. The drawdowns at Cushing have helped support the bullish backwardation structure in the US crude futures curve, and timespreads could rally further if the streak of declines continues. Oil rose Monday amid Middle East tensions and as Libya’s eastern government said it will halt exports.

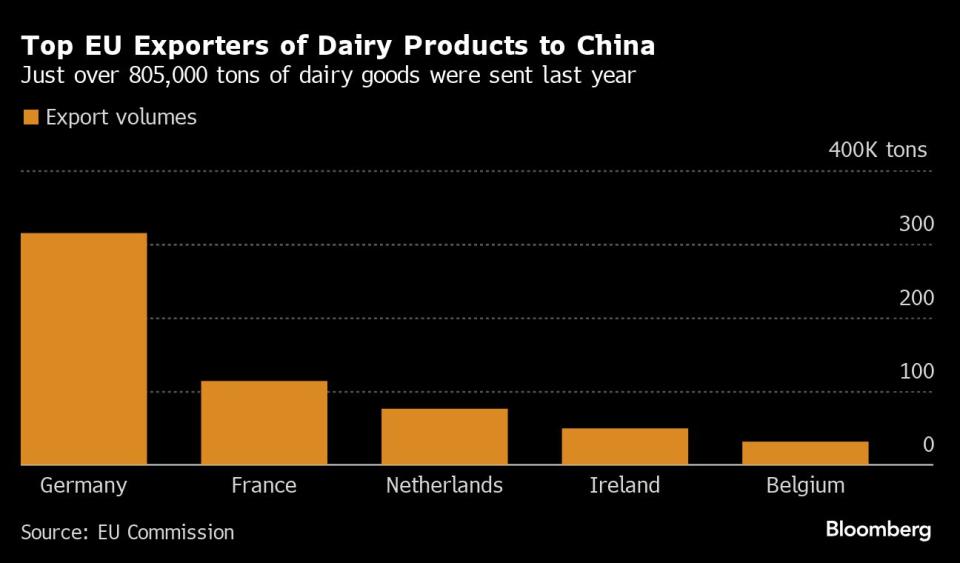

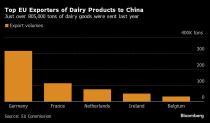

Dairy

China’s anti-subsidy investigation into dairy imports from the European Union last week marks the latest in a tit-for-tat trade dispute. The probe is targeting several dairy products, including fresh and processed cheese, according to China’s Ministry of Commerce. The latest development adds to the trade quarrel between the two that has seen goods such as electric vehicles and pork threatened by the possibility of higher tariffs. China is the second-biggest export market for EU dairy.

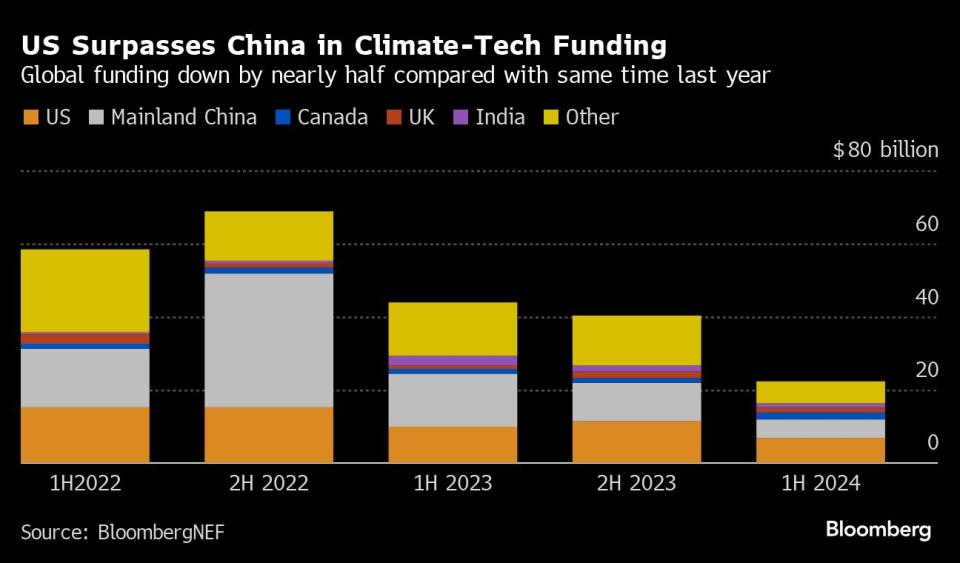

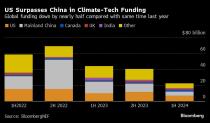

Climate Tech

The US has surpassed China as the leading backer of technology aimed at addressing the climate crisis, according to a recent analysis from BloombergNEF. Though the US led the way, in large part due to effective tax credits and incentives, funding for the sector fell by nearly 50% globally compared with the same period last year. Overall, climate-tech companies, which include categories like electric vehicles, batteries and clean power, raised $22 billion worldwide in the first half of this year.

--With assistance from Doug Alexander, Devika Krishna Kumar and Celia Bergin.

(Adds sugar and oil moves in fourth and fifth paragraph.)

Most Read from Bloomberg Businessweek

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.