Five questions you must ask before swapping your final salary pension for cash

A staggering 80,000 people have given up their “final salary” pension entitlements in the past 12 months alone, prompting renewed fears that they are not being adequately warned about the value of what they are relinquishing.

Final salary schemes promise to pay members guaranteed, inflation-protected incomes for life.

The downside is that the way in which you draw an income is tightly controlled. Nor is it usually possible to pass on any of the pension other than to your partner.

Alternative, and generally less valuable, “defined contribution” pensions are far more flexible – but savers have to bear the risk their investment might underperform. These are becoming the norm as employers seek to limit their liability to the unknown costs of meeting final salary promises.

But another way in which they are limiting risk is to “buy” employees out of their final salary entitlements, often by offering very large sums. This has led to a surge in the number of final salary “pension transfers”.

One firm of pension transfer specialists told Telegraph Money it is moving around £50m a month out of final salary schemes.

In many cases savers are required by law to take financial advice before making such a move. For many, the transfer may be an appropriate move. Others may come to regret the decision.

Here Telegraph Money lists the five questions you should ask yourself before ditching your pension.

1. Are you looking at the right numbers?

The first step in transferring from a final salary scheme is to request a “cash equivalent transfer value”. This figure is how much the scheme will pay you in exchange for your pension.

The “transfer value” is straightforward enough, but finding what to compare it to is harder.

Schemes can provide up to four different figures showing the value of the annual pension you are giving up.

These include the annual income at the time you left the scheme and became a “deferred member”; a projected income based on assumptions about inflation; an income discounted due to early access (normally because of severe ill health); and an income “revalued” to the present day.

Alistair Cunningham, of Wingate Financial Planning, said people often exaggerate the generosity of the offer by using the wrong number.

For instance, the value of the pension at the time you became a “deferred member” might have been £5,000 a year. Against a transfer value of £225,000 that looks like a good deal – a 45 times multiple in cash. But a “revalued” figure could be closer to £10,000. Suddenly the multiple has dropped to a more sober 22.

Mr Cunningham said this basic misunderstanding means many people think the deal they are being offered is more generous than it is.

2. Is this the best time to transfer?

All other things being equal, the nearer to retirement the larger the transfer value should be. But there are a host of reasons why a scheme will offer more or less than expected.

The “funding position” of the scheme – the ratio of assets to liabilities – is a key factor. Because of the way liabilities are measured it is incredibly difficult to predict a scheme’s future funding position. If certain investments perform well, the funding position will improve dramatically and transfer values could be higher. Conversely, if a scheme is struggling and underfunded it may discount the transfer values offered.

Members often fear they will be left with nothing if the employer backing the scheme fails. But the Pension Protection Fund underwrites all final salary pensions, capped at 90pc for those yet to retire and 100pc for those already retired.

Rachel Vahey, a pensions expert at Nucleus Financial, advised asking the scheme if they offer “partial” transfers. Rare but growing in popularity, this allows some of the pension to be transferred while keeping some guaranteed income.

3. Are you single or in ill health?

Final salary schemes typically offer a “spouses’ pension” that will pay out half or two-thirds of the member’s pension to a surviving partner. But schemes do not normally allow this benefit to be turned off, even if a member is single or their partner doesn’t need the extra income.

In this case, transferring out of the scheme may better suit your circumstances. Similarly, if you are in ill health, the “death benefits” available through defined contribution pensions may be more appropriate.

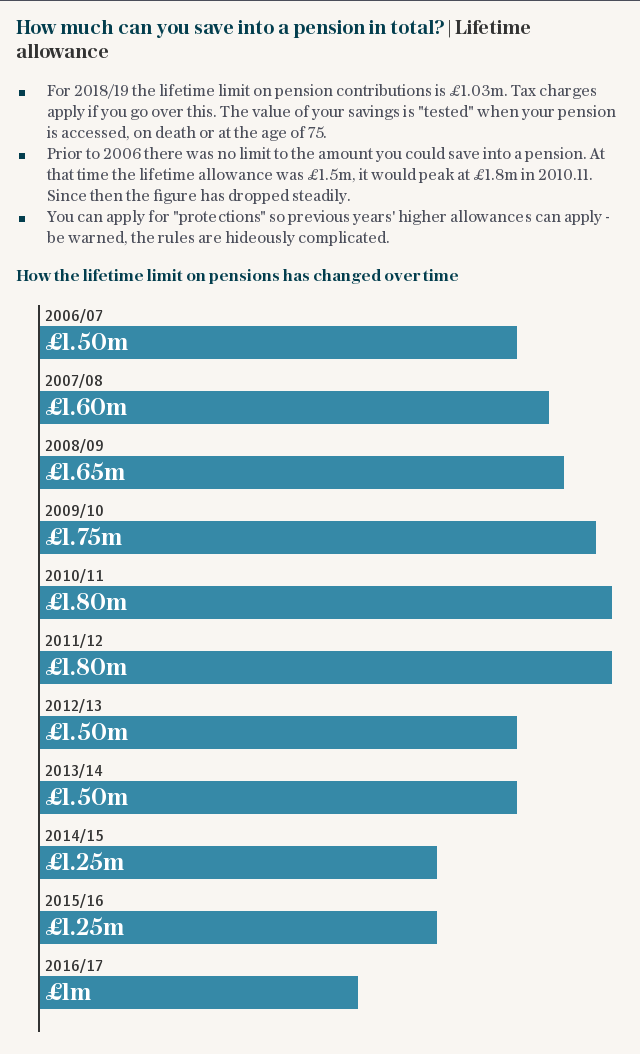

4. Will you break the “lifetime allowance”?

All types of pension are subject to a £1m lifetime cap. Amounts in excess of the cap are subject to a charge once the pension is “crystalised” – when an income is taken or at the age of 75. Final salary pensions are treated more generously by the system. The annual pension income is multiplied by 20 when tested against the lifetime allowance. With transfer value multiples of 35 or more common, savers could easily find they breach the £1m limit simply by transferring. If taken as cash, the excess over the limit faces a 55pc tax charge.

5. Do you trust the Government to leave the rules unchanged?

Defined contribution pension rules currently allow incredibly generous flexibility. Yet successive governments have changed the rules on pensions almost every year.

The tax efficiency of passing pensions down the generations in particular looks vulnerable. Who’s to say the rules won’t change over the 20 or so years of your retirement?

sam.brodbeck@telegraph.co.uk

Yahoo Finance

Yahoo Finance