Flotek Industries Inc (FTK) Q1 2024 Earnings: A Mixed Financial Picture Amidst Revenue Decline

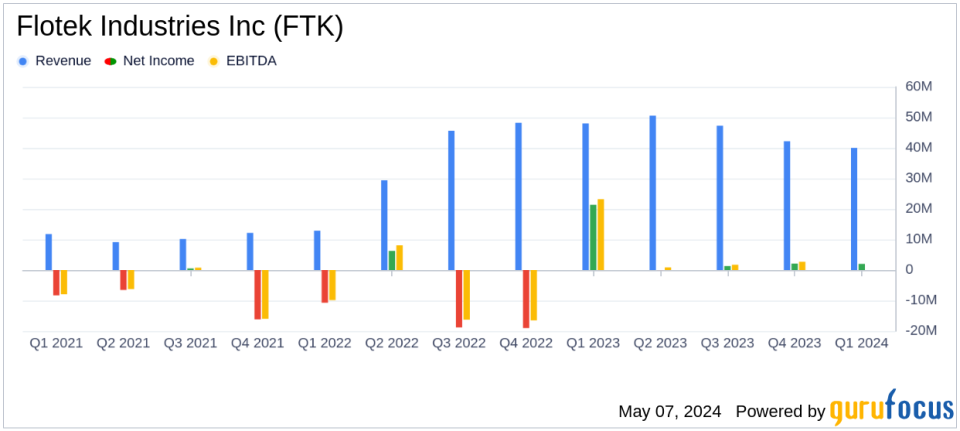

Revenue: Reported $40.4 million in Q1 2024, dropping 16% from $48.0 million in Q1 2023, and falling short of estimates of $45.09 million.

Net Income: Achieved $1.56 million in Q1 2024, a significant drop from $21.34 million in Q1 2023, yet exceeding estimates of $1.10 million.

Earnings Per Share (EPS): Recorded $0.05 in Q1 2024, aligning with estimates.

Gross Profit: Increased to $8.82 million in Q1 2024 from $1.88 million in Q1 2023, reflecting a 369% improvement year-over-year.

Adjusted EBITDA: Improved to $4.03 million in Q1 2024 from a negative $3.85 million in Q1 2023, marking the 11th consecutive quarter of improvement.

Debt Reduction: Reduced borrowings under the Asset Based Loan by 58% compared to year-end 2023.

Future Outlook: Expects substantial increases in margins and adjusted EBITDA for 2024, forecasting adjusted EBITDA to range between $10 million and $16 million.

On May 7, 2024, Flotek Industries Inc (NYSE:FTK) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company, known for its commitment to environmentally conscious chemical solutions and data analytics for the energy sector, reported a decrease in total revenues but a significant improvement in profitability compared to the same quarter in the previous year.

Company Overview

Flotek Industries Inc is a pioneer in providing green specialty chemicals and real-time data analytics to the oil and gas industry. These products and services are designed to enhance operational efficiency and reduce the environmental impact of energy operations. The majority of Flotek's revenue is generated from its Chemistry Technologies segment.

Financial Performance

For Q1 2024, Flotek posted revenues of $40.4 million, a decrease of 16% from $48.0 million in Q1 2023. This decline was primarily due to reduced related party activity, partially offset by a 13% increase in revenue from external customers. Despite the drop in revenue, the company saw a substantial rise in gross profit to $8.8 million from $1.9 million in the prior yeara 369% increase. This improvement was largely attributed to cost reductions in freight, logistics, and materials, alongside revenue from ProFrac supply agreements.

Net income for the quarter stood at $1.6 million, or $0.05 per diluted share, compared to a net income of $21.3 million in Q1 2023, which included significant non-cash gains. Excluding these gains, net income for Q1 2024 actually shows an improvement of $10.8 million over the adjusted prior year figure.

Operational Highlights and Future Outlook

Dr. Ryan Ezell, CEO of Flotek, noted the continuation of positive trends from 2022, with the first quarter marking the third consecutive quarter of net income and significant year-over-year improvements in adjusted EBITDA. The company anticipates substantial growth in margins for 2024, projecting an adjusted gross profit margin between 18% and 22%, up from 15% in 2023.

Furthermore, Flotek expects a dramatic increase in adjusted EBITDA for the full year, estimating it to be between $10 million and $16 million, compared to just $1.5 million in 2023. This optimistic outlook is supported by ongoing cost reductions and efficiency gains.

Challenges and Market Position

Despite the promising improvements in profitability, the reduction in total revenue poses challenges, particularly in maintaining growth momentum. The seasonal decline in external chemistry customer sales, although expected to rebound in Q2, underscores the volatility in the market that Flotek operates within. However, the company's strategic adjustments and focus on high-margin products may cushion the impacts of these fluctuations.

Flotek's performance in Q1 2024 illustrates a resilient operational strategy amid challenging market conditions. The company's focus on cost management and efficiency improvements has begun to yield substantial benefits to its profitability metrics, setting a positive tone for the fiscal year. As Flotek continues to navigate the complexities of the energy sector, its commitment to innovation and sustainability remains key to its strategic positioning and long-term success.

For more detailed information and discussion on Flotek's Q1 2024 results, stakeholders and interested parties are encouraged to join the earnings conference call scheduled for May 8, 2024.

Explore the complete 8-K earnings release (here) from Flotek Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance