Fluor's (FLR) JV ALSEEN Wins A27 Roadway Extension Project

Fluor Corporation FLR announced that its joint venture company, ALSEEN, received a design, construction and maintenance services contract from the Ministry of Public Works and Water Management (Rijkswaterstaat). Fluor will book its share of this $436-million A27 motorway project contract in the first quarter of 2023.

Per the contract, ALSEEN will widen nearly 25 miles (40 kilometers) of the existing A27 motorway, repair the Hooipolder junction, replace the Merwede and Keizersveer bridges, and connect the roadway with the Groote Haar business park in Gorinchem. The A27 is one of the 10 busiest motorways in the Netherlands. The project will ease traffic congestion and allow more than 100,000 vehicles to commute hassle-free every day.

Shawn West, president of Fluor’s Infrastructure business, said, “This is the first project in the region to use a new two-phase approach between the joint venture and Rijkswaterstaat to limit project risks. We expect this unique approach to result in better project outcomes and a more stable execution phase for all parties.”

Rijkswaterstaat will finalize two-thirds of the design work done by ALSEEN within the first phase of the deal and then allow for full site investigations, complete design packages, advanced work packaging and negotiated subcontracts. This will lead to a more refined scope of work, better division of project risks and a more predictable second phase.

The work is likely to begin in 2023 and is anticipated to be completed within 2029-2031. Post-completion, the JV partners — Ballast Nedam and Fluor — will be responsible for the maintenance of the highway for 15 years.

Solid Contract Flow & Strategic Moves Aid FLR Business

Fluor’s market diversity remains a key strength that helps the company mitigate the cyclicality of the markets in which it operates. The company’s strategy of maintaining a good business portfolio mix permits it to focus on more stable business markets and capitalize on developing cyclical markets at suitable times.

Fluor has been focusing on the “Building a Better Future” strategy, which includes four strategic priorities for driving shareholder value. The first strategy is to drive growth across portfolios by enhancing markets outside the traditional oil and gas sector, including energy transition, advanced technology and life sciences, high-demand metals, infrastructure and mission solutions. The second one aims to pursue contracts with fair and balanced commercial terms that reward value, with a bias toward reimbursable contracts. Third, it intends to reinforce financial discipline and maintain a solid balance sheet by generating predictable cash flow and earnings. The last strategy is fostering a high-performance culture with purpose by advancing diversity, equity and inclusion efforts, and promoting social progress and sustainability.

The company has been working for more than 20 years in the Netherlands.

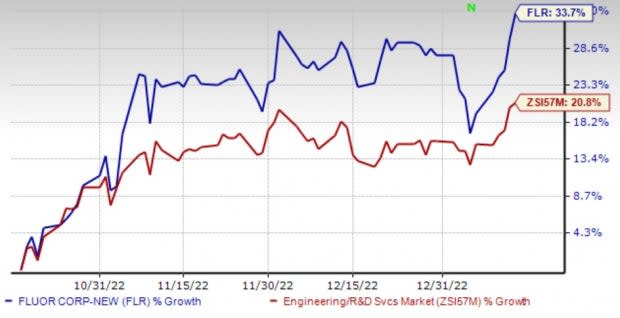

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have gained 33.7% in the past three months, outperforming the Zacks Engineering - R and D Services industry’s 20.8% growth. Its solid prospect is testimony to the same.

For 2023, the Zacks Consensus Estimate is pegged at $1.76 per share, reflecting 83.1% year-over-year growth on 7.2% higher revenues. Also, for the fourth quarter, it is likely to generate 64.5% higher earnings on 23.3% stronger revenues. FLR is stated to release its results for fourth-quarter 2022 on Feb 21.

Key Picks

Altair Engineering Inc. ALTR, holding a Zacks Rank #2 (Buy) at present, provides software and cloud solutions in simulation, high-performance computing, data analytics, and artificial intelligence worldwide. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALTR’s expected earnings growth rate for 2023 is 21.5%.

Sterling Infrastructure, Inc. STRL, currently carrying a Zacks Rank #2, provides transportation, e-infrastructure and building solutions. Shares of STRL have gained 35.7% in the past six months.

STRL’s expected earnings growth rate for 2023 is 8.7%.

Willdan Group, Inc. WLDN, carrying a Zacks Rank #2 at present, is a nationwide provider of professional, technical, and consulting services to utilities, government agencies and private industry.

WLDN’s expected earnings growth rate for 2023 is 18.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

Fluor Corporation (FLR) : Free Stock Analysis Report

Willdan Group, Inc. (WLDN) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance