FOMC decision: What to know in the week ahead

The markets will face another big test this week as the Federal Open Market Committee (FOMC) holds its two-day meeting.

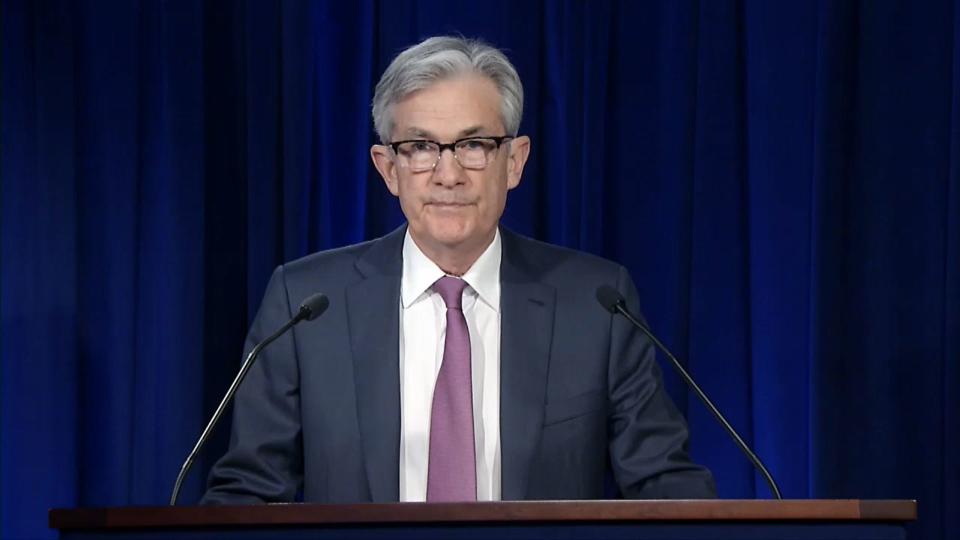

This month’s FOMC meeting will yield a new policy statement, updated dot plot and a summary of economic projections. Fed Chair Jerome Powell will hold a virtual press conference at the conclusion of the event on Wednesday.

“Given the consistency of Fed comments since the April meeting, we expect few new policy developments at the June FOMC meeting,” Nomura economist Lewis Alexander wrote in a note June 5. “Instead, the Committee will likely focus on successfully implementing their already-announced credit facilities and continue discussions on the longer-term outlook for asset purchases and forward guidance.”

Economists predict few changes to the Fed’s policy following this week’s meeting. The central bank will likely keep its target range for the federal funds rate between 0% to 0.25%.

“We believe the Committee’s forward guidance on the path for the target range will be unchanged from the April FOMC statement. However, next week’s new interest rate forecast ‘dots’— the first since December—could be seen as a soft way of reinforcing that guidance,” JPMorgan economist Michael Feroli wrote in a note June 5. “We look for the median dot to show no hikes through late 2022, the end of the forecast horizon. While we believe the Committee will eventually refine the guidance in the FOMC statement, recent comments from Vice Chair Clarida suggest this step won’t be taken until the fall.”

In response to the COVID-19 pandemic, the Fed deployed a slew of emergency actions over the past few months to support markets, and Powell has stated that the Fed still has more that it could do if necessary.

In addition, there has been recent speculation that the Fed would do yield-curve control (YCC), which is a program to keep short-term interest rates capped at a certain level. Despite the chatter, Wells Fargo argued that YCC will be unlikely in June.

“In our view, the current conditions do not signal an immediate need for the FOMC to implement an explicit yield target at any point on the curve,” the firm wrote in a June 1 note. “The Federal Reserve is still working to get all of its previously-announced facilities fully operational. We think the committee may want to allow some time for all of these facilities to help the flow of credit to households, businesses and state & local governments before considering yield curve control.”

The earnings calendar remains light this week. Stitch Fix, Lululemon, Adobe, Tiffany & Co and Chewy are among the biggest names gearing up to report earnings this week.

Economic calendar

Monday: N/A

Tuesday: NFIB Small Business Optimism, May (92.2 expected, 90.9 in April); JOLTS Job Openings, April (5750 expected, 6191 in March); Wholesale Inventories month-on-month, April final (+0.4% expected, +0.4% prior)

Wednesday: MBA Mortgage Applications, week ended June 5 (-3.9% prior); CPI month-on-month, May (0.0% expected, -0.8% in April); CPI excluding Food & Energy, May (0.0% expected, -0.4% in April); CPI year-on-year, May (+0.3% expected, +0.3% in April); Monthly Budget Statement, May (-$625 billion expected, -$737.9 billion in April)

Thursday: PPI Final Demand month-on-month, May (+0.1% expected, -1.3% in April); PPI excluding Food & Energy month-on-month, May (-0.1% expected, -0.3% in April); PPI Final Demand year-on-year, May (-1.3% expected, -1.2% in April); Initial Jobless Claims, week ending June 6 (1.55 million expected, 1.88 million prior); Continuing Claims, week ending May 30 (20.6 million expected, 21.49 million prior); Bloomberg Consumer Comfort, week ending June 7 (37.0 prior)

Friday: Import Price Index month-on-month, May (+0.6% expected, -2.6% in April); University of Michigan Sentiment, June preliminary (75.0 expected, 72.3 in May)

Earnings calendar

Monday: Stitch Fix (SFIX) after market close

Tuesday: Signet Jewelers (SIG), Tiffany & Co (TIF) before market open; Chewy (CHWY), GameStop (GME) after market close

Wednesday: N/A

Thursday: Children’s Place (PLCE) before market open; Adobe (ADBE), Dave & Buster’s (PLAY), Lululemon (LULU), PVH Corp (PVH) after market close

Friday: Party City (PRTY)

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance