Food Encapsulation Market Report 2023: Increase in Consumption of Nutritional Convenience and Functional Foods Bolsters Growth

Global Food Encapsulation Market

Dublin, March 08, 2023 (GLOBE NEWSWIRE) -- The "Food Encapsulation Market by Shell Material (Lipids, Polysaccharides, Emulsifiers, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase and Region - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

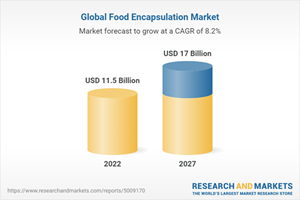

The global market for food encapsulation has been estimated to be USD 11.5 billion in 2022 and is projected to grow at a rate of 8.2% between 2022 and 2027.

The food encapsulation market is projected to grow at an exponential rate due to factors such as rising demands for encapsulated colours and flavours in ready to eat foods, growing demand for dietary supplements that use encapsulated bioactive and advancements in technology.

Nanoencapsulation segment is estimated to account for the largest share in 2021 with a CAGR of 9.1%.

Nanoencapsulation technology is a process of packaging or covering food ingredients in a miniature form. It helps in the protection of bioactive agents, such as proteins, lipids, vitamins, antioxidants, and carbohydrates. It helps in providing improved functionality and stability to produce functional foods and beverages. The size of the nanocapsule is within a range of 1 to 100 nanometers. The technology helps enhance solubilization, improve odor and taste masking, and enhance the bioavailability of poorly absorbable function ingredients.

Nanotechnology is a very promising area in the food industry. It is used for various products, such as functional foods, packaging, preservatives, antioxidants, flavors, and fragrances. Its advantages include wide equipment availability, large-scale production, continuous unit operation, ease of manipulation, and low process cost. It is one of the most used encapsulation methods in the food industry.

Dietary supplement application is projected to witness a growth of 7.8% during the forecast period.

Ensuring the bioavailability of ingested active ingredients is one of the key objectives of any supplement formulator. Dietary supplements are available in various formats, such as capsules, pills, liquids, and tablets. They focus on reducing the risk of diseases and improving human health. They contain active substances or mixtures of active agents in low concentrations.

Due to their instability, bioactive agents are prone to environmental degradation, which reduces their potency and the associated health benefits they provide. Encapsulation of dietary supplements helps enhance the bioavailability and solubility of these bioactive agents. It protects these agents from reacting with chemicals and the external environment. Encapsulated dietary supplements are of hypoallergenic quality, which makes them ideal supplements. Encapsulated dietary supplements are manufactured without adding artificial flavors, fragrances, binders, or other added coatings to avoid disrupting the ingredients' bioavailability. These advantageous improvements in dietary supplements are driving the demand for encapsulation in the dietary supplements industry.

Polysaccharides dominate the food encapsulation market in 2022.

Polysaccharides are types of natural polymers. They are preferred to synthetic polymers because they are safe, inert, biocompatible, non-toxic, biodegradable, eco-friendly, low in cost, and abundantly available in nature. Polysaccharides have numerous resources, including plant resources, such as starch, pectin, and guar gum; algal resources, such as alginate; animal resources, such as chitosan; and microbial resources, such as dextran and xanthan gum. Polysaccharides are a composition of repeating monosaccharide units connected by glycoside bonds.

The structure and properties of polysaccharides are extensively diverse and contain a wide range of chemical compositions and molecular weights. They contain many molecular chains, such as carboxyl, hydroxyl, and amino groups. Polysaccharides are easily chemically modifiable and provide numerous textures and viscosities. Because of their enormous molecular structure and ability to entrap bioactive, polysaccharides are considered the appropriate building blocks for delivery systems. Therefore, they are widely used as inexpensive and safe shell materials for encapsulation. There are numerous types of polysaccharides available in the market for the encapsulation process

Market Dynamics

Drivers

Increase in Consumption of Nutritional Convenience and Functional Foods

Innovative Food Encapsulation Technologies Enhance Market Penetration

Restraints

More Inclination Toward Traditional Preservation Methods Over Encapsulation Techniques

High Costs of Food Products Using Encapsulated Ingredients

Opportunities

Development of Enhanced Techniques for Food Encapsulation to Bridge Various Gaps in the Food Industry

Reducing Capsule Size and Increasing Bioavailability

Multicomponent Delivery System

Government Support and Improving Economic Conditions in Developing Nations

Challenges

Poor Stability of Microencapsulated Ingredients in Varying Atmosphere

Key Attributes:

Report Attribute | Details |

No. of Pages | 388 |

Forecast Period | 2022 - 2027 |

Estimated Market Value (USD) in 2022 | $11.5 Billion |

Forecasted Market Value (USD) by 2027 | $17 Billion |

Compound Annual Growth Rate | 8.2% |

Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Industry Trends

7 Food Encapsulation Market, by Core Phase

7.1 Introduction

7.2 Vitamins & Minerals

7.2.2 Fat-Soluble Vitamins

7.2.2.2 Vitamin A

7.2.2.3 Vitamin D

7.2.2.4 Vitamin E

7.2.2.5 Vitamin K

7.2.3 Water-Soluble Vitamins

7.2.3.2 Vitamin B Complex

7.2.3.3 Vitamin C

7.3 Enzymes

7.3.2 Carbohydrases

7.3.3 Protease

7.3.4 Lipases

7.3.5 Other Enzymes

7.4 Organic Acids

7.4.2 Citric Acid

7.4.3 Acetic Acid

7.4.4 Malic Acid

7.4.5 Fumaric Acid

7.4.6 Lactic Acid

7.4.7 Propionic Acid

7.4.8 Ascorbic Acid

7.4.9 Other Organic Acids

7.5 Probiotics

7.5.2 Bacteria

7.5.3 Yeast

7.6 Sweeteners

7.7 Nutritional Lipids

7.8 Preservatives

7.8.2 Antimicrobials

7.8.3 Antioxidants

7.8.4 Other Preservatives

7.9 Prebiotics

7.9.2 Oligosaccharides

7.9.3 Inulin

7.9.4 Polydextrose

7.9.5 Other Prebiotics

7.10 Colors

7.10.2 Natural

7.10.3 Artificial

7.11 Amino Acids

7.12 Flavors

7.12.2 Chocolates & Browns

7.12.3 Vanilla

7.12.4 Fruits & Nuts

7.12.5 Dairy

7.12.6 Spices

7.12.7 Other Flavors

7.13 Proteins

7.14 Other Core Phases

8 Food Encapsulation Market, by Technology

8.1 Introduction

8.2 Microencapsulation

8.3 Nanoencapsulation

8.4 Hybrid Encapsulation

9 Food Encapsulation Market, by Shell Material

9.1 Introduction

9.2 Polysaccharides

9.3 Proteins

9.4 Lipids

9.5 Emulsifiers

10 Food Encapsulation Market, by Method

10.1 Introduction

10.2 Physical Method

10.2.2 Atomization

10.2.3 Spray Drying

10.2.4 Spray Chilling

10.2.5 Spinning Disk

10.2.6 Fluid Bed Coating

10.2.7 Extrusion

10.2.8 Other Physical Methods

10.3 Chemical Method

10.3.2 Polymerization

10.3.3 Sol-Gel Method

10.4 Physico-Chemical Method

10.4.2 Coacervation

10.4.3 Evaporation-Solvent Diffusion

10.4.4 Layer-By-Layer Encapsulation

10.4.5 Cyclodextrins

10.4.6 Liposomes

10.4.7 Other Physicochemical Methods

11 Food Encapsulation Market, by Application

11.1 Introduction

11.2 Dietary Supplements

11.3 Functional Food Products

11.4 Bakery Products

11.5 Confectionery Products

11.6 Beverages

11.7 Frozen Products

11.8 Dairy Products

11.9 Other Applications

12 Food Encapsulation Market, by Region

13 Competitive Landscape

14 Company Profiles

15 Adjacent & Related Markets

16 Appendix

Companies Mentioned

Advanced Bionutrition Corp

Anabio Technologies

Aveka

Balchem Inc.

BASF SE

Blue California

Cargill, Incorporated

Clextral

DSM

Encapsys LLC

Firmenich SA

Frieslandcampina

Givaudan

Ingredion

Innov'Ia

International Flavors & Fragrances Inc.

Kerry

Lycored Corp

Reed Pacific

Ronald T. Dodge Company

Sensient Technologies Corporation

Sphera Encapsulation

Symrise

Tastetech

Vitablend

For more information about this report visit https://www.researchandmarkets.com/r/5hllix

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance