New Forecasts: Here's What Analysts Think The Future Holds For Denbury Resources Inc. (NYSE:DNR)

Celebrations may be in order for Denbury Resources Inc. (NYSE:DNR) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The stock price has risen 4.6% to US$0.25 over the past week, suggesting investors are becoming more optimistic. Whether the upgrade is enough to drive the stock price higher is yet to be seen, however.

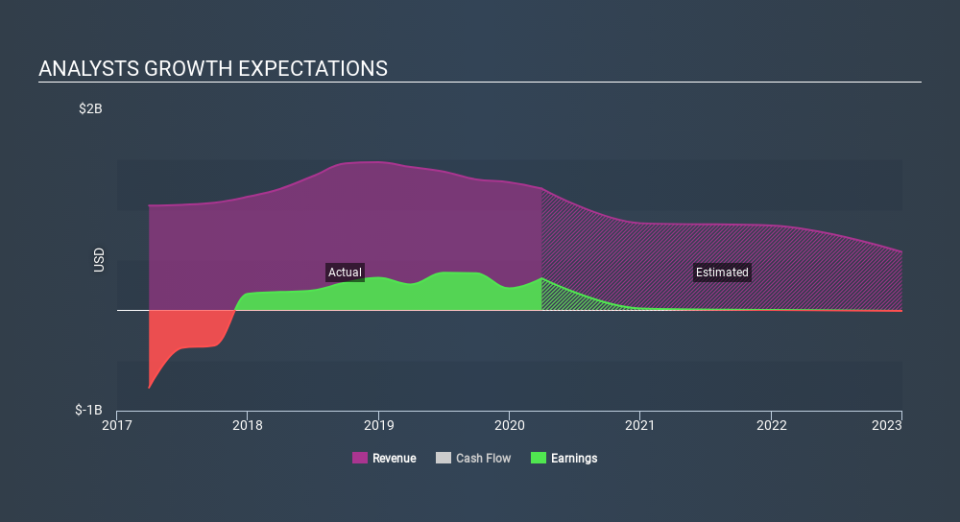

Following the latest upgrade, the current consensus, from the three analysts covering Denbury Resources, is for revenues of US$867m in 2020, which would reflect a substantial 28% reduction in Denbury Resources' sales over the past 12 months. Statutory earnings per share are supposed to tumble 99% to US$0.01 in the same period. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$772m and losses of US$0.082 per share in 2020. It looks like there's been a definite improvement in business conditions, with a revenue upgrade supposed to lead to profitability sooner than previously forecast.

View our latest analysis for Denbury Resources

As a result, it might be a surprise to see that the analysts have cut their price target 23% to US$0.32, which could suggest the forecast improvement in performance is not expected to last. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Denbury Resources, with the most bullish analyst valuing it at US$0.50 and the most bearish at US$0.25 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. One more thing stood out to us about these estimates, and it's the idea that Denbury Resources'decline is expected to accelerate, with revenues forecast to fall 28% next year, topping off a historical decline of 2.5% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 9.0% per year. So while a broad number of companies are forecast to decline, unfortunately Denbury Resources is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away from this upgrade is that there is now an expectation for Denbury Resources to become profitable this year, compared to previous expectations of a loss. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. A lower price target is not intuitively what we would expect from a company whose business prospects are improving - at least judging by these forecasts - but if the underlying fundamentals are strong, Denbury Resources could be one for the watch list.

Analysts are definitely bullish on Denbury Resources, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including a weak balance sheet. You can learn more, and discover the 4 other risks we've identified, for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance