Forget Leggett (LEG), Buy These Furniture Stocks Instead in 2022

Things didn’t go well for Leggett & Platt, Incorporated LEG in 2021. This global manufacturer of various engineered components and products suffered from a lack of sufficient chemicals (especially for specialty foam operations), shortage of semiconductors, labor constraints and transportation issues. In third-quarter 2021, volume declined 6% from the prior year. In fact, volumes were down from both one- and two-year periods across most of its product categories. The company expects these challenges to continue through first-half 2022.

The furniture industry is highly competitive, with home furnishing retailers, department stores and antique dealers giving it a hard time. Also, industry-wide production declined as many Original Equipment Manufacturers or OEMs reduced or completely shut down production for extended periods.

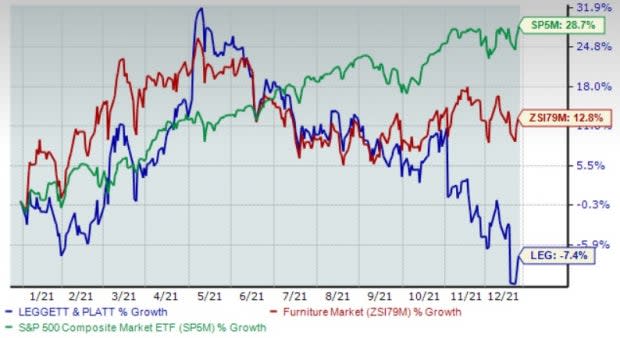

Owing to the above-motioned headwinds, Leggett narrowed its full-year guidance for both sales and earnings per share (EPS). The Zacks Consensus Estimate for 2022 EPS has moved 2.6% downward in the past 60 days, indicating just 10.7% year-over-year growth. Also, LEG has an unimpressive Growth Score of D. Additionally, investors seem quite jittery as shares of this Zacks Rank #4 (Sell) stock have dropped 7.4% in the year-to-date period against the Zacks Furniture industry’s growth of 12.8% and S&P 500 index’s 28.7% rally.

Image Source: Zacks Investment Research

Though Leggett’s prospects may not appear appealing at the moment, there are two Furniture stocks — WillScot Mobile Mini Holdings Corp. WSC and La-Z-Boy Incorporated LZB — that offer good investment opportunities. These Zacks Rank #2 (Buy) stocks have solid prospects for 2022. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Why Invest in Furniture Stocks?

Similar to Leggett, WillScot Mobile Mini and La-Z-Boy are also grappling with the above-mentioned headwinds. Nonetheless, these companies look well positioned on the back of their impressive prospects. The two companies have been driving growth on solid innovative products, diversified portfolio and marketing techniques as well as geographic expansion.

Additionally, solid homebuilding demand backed by low mortgage rates, increased work-from-home trends and an improving economy will drive demand for furniture products in the near term. (Read more: 5 Construction Stocks Set to Continue Winning Streak in 2022)

Let us dig deeper into these stocks to gauge the underlying metrics that reflect their inherent financial strengths.

WillScot Mobile Mini: This Phoenix, AZ-based company provides modular space and portable storage solutions. Increased core leasing revenues in the NA Modular segment, the addition of Mobile Mini's revenues and higher deliveries of all its four products across most of the end markets served by the company have been driving performance.

Also, its strategy to compound robust organic growth with highly accretive M&A is commendable. So far in 2021, WillScot Mobile Mini has acquired seven businesses which are likely to enhance its product portfolio and expand reach. Notably, the company has raised its 2021 guidance and remains confident for margins expansion in 2022 supported by steadily compounding revenue growth and bolt-on acquisitions.

The company has gained 75.1% so far this year. It has an expected earnings growth rate of 54.1% for 2022. WillScot Mobile Mini has seen an upward estimate revision of 10.8% to $1.23 per share for 2022 earnings over the past 60 days, depicting analysts’ optimism over the stock’s prospects.

La-Z-Boy: Based in Monroe, MI, this company manufactures, markets, imports, exports, distributes, and retails upholstery furniture products, accessories, and casegoods furniture products. The company has been benefiting from strong demand trends across all business units. Further, its solid cash position and investment in business bode well. The company has been navigating well through challenges like escalating commodity and freight costs.

La-Z-Boy has been making strategic investments to increase capacity and improve capabilities. Also, its introduction of Project Century, which includes three key pillars — strengthen the La-Z-Boy brand; increase digital marketing spend for Joybird; and leverage and enhance its enterprise capabilities — is gaining traction.

The company’s earnings are expected to grow 43.5% to $3.76 per share in fiscal 2022. La-Z-Boy has seen an upward estimate revision of 11.9% for fiscal 2022 earnings over the past 60 days, depicting analysts’ optimism over the stock’s prospects. Although its shares have declined in the year-to-date period, the same has gained 8.3% in the past three months period. The uptrend signifies strengthening investors’ optimism in the stocks fundamentals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Leggett & Platt, Incorporated (LEG) : Free Stock Analysis Report

WillScot Mobile Mini Holdings Corp. (WSC) : Free Stock Analysis Report

LaZBoy Incorporated (LZB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance