Forget Rolls-Royce shares! I’d rather buy these popular FTSE 100 stocks

Rolls-Royce (LSE:RR.) shares remain significantly more expensive than they were at the start of 2024. The enginebuilder’s up 60%, in fact. But price turbulence in recent weeks has seen surging interest from dip buyers.

According to Hargreaves Lansdown, the FTSE 100 company was the second-most purchased stock by its customers in the last seven days. Only US tech giant Nvidia has attracted more buying interest.

I can understand why investors are seizing this opportunity to open a position or build on existing holdings. The company is an attractive long-term play on the growing civil aviation market. It can also look forward to rising engine demand from defence customers.

However…

However, I haven’t joined in and bought the business for my portfolio. With a forward price-to-earnings (P/E) ratio of 27.8 times, I think the Rolls-Royce share price remains far too expensive.

Huge risks to the company’s earnings include ongoing supply chain problems and worsening economic conditions in the US. We might see less exciting restructuring news ahead, which could dampen some of the enthusiasm around the Footsie stock.

So which FTSE 100 shares would I buy if not Rolls-Royce? Here are two I’d rather snap up if I had cash to invest.

Glencore

Mining giant Glencore (LSE:GLEN) was the fifth most popular stock with Hargreaves Lansdown clients last week. It’s slumped in value as worries over commodities demand have intensified.

Not only are profits in danger as the US economy flirts with recession. Trouble in China’s economy — and in particular in its real estate sector — are also darkening the outlook for metals producers like this.

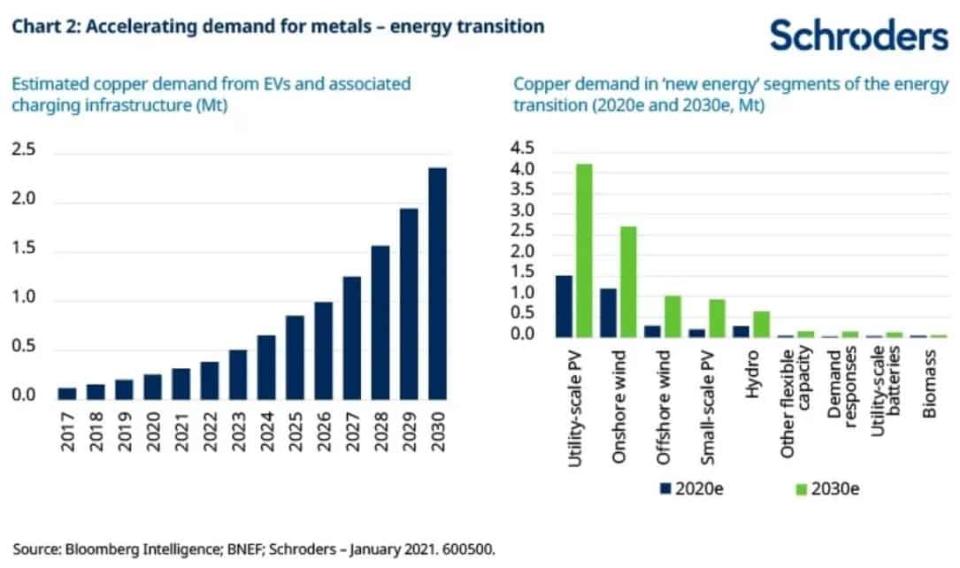

However, the long-term picture here remains pretty exciting, in my opinion. Glencore produces and markets a range of raw materials like copper, cobalt, nickel, zinc and lead. It is therefore well placed to capitalise on growing sectors like renewable energy and electric vehicles.

Glencore shares now trade on an undemanding forward P/E ratio of 11.9 times. I’d be very tempted to buy the company at today’s prices.

M&G

I’d also prefer to invest in M&G (LSE:MNG) than buy Rolls-Royce shares today. This is thanks chiefly to its stunning all-round value for money.

Okay, the financial services giant may struggle if the UK economy fails to grow. But I think this is more than reflected in its rock-bottom P/E ratio of 7.6 times for 2024.

M&G shares also offer a 9.7% dividend yield for this year, one of the largest on the FTSE 100. This is supported by the firm’s strong balance sheet (its Solvency II capital ratio rose to 210% as of June).

Like Glencore, this is a blue-chip stock I’d buy to hold for the long haul. With Britain’s population rapidly ageing, and peoples’ interest in financial planning growing, I expect demand for its life insurance products and wealth management services to strongly improve.

M&G was the 12th most-purchased stock with Hargreaves Lansdown customers in the last week.

The post Forget Rolls-Royce shares! I’d rather buy these popular FTSE 100 stocks appeared first on The Motley Fool UK.

More reading

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Hargreaves Lansdown Plc, M&g Plc, Nvidia, and Rolls-Royce Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024