Former Carillion bosses to give explosive tesimony to MPs this week and pin blame on Qataris

Zafar Khan, Carillion’s former finance chief, is preparing to give explosive testimony to MPs on Tuesday shining a light on how spiralling debts and missed payments by its clients took down the company.

Mr Khan is among six former Carillion bosses – including ex-boss Richard Howson and chairman Philip Green – being hauled in front of a joint inquiry by the business and the work and pensions select committees.

The senior directors are expected to pin some of the blame for the outsourcer’s collapse on an outstanding £200m bill for a development project in downtown Doha. Industry sources suggest payments to the company were more than a year late.

The money was so desperately needed that Mr Howson was kept on in a less senior role after he had stepped down with the sole purpose of brokering a deal with the Qatari client Msheireb Properties, which is overseeing a vast regeneration project in the Qatari capital Doha.

It is understood that the money has not been retrieved. Industry sources told The Sunday Telegraph Mr Khan’s evidence was particularly keenly anticipated.

He was seen as an influential financial director who helped lift the lid on the extent of Carillion’s problems during his nine months in the role.

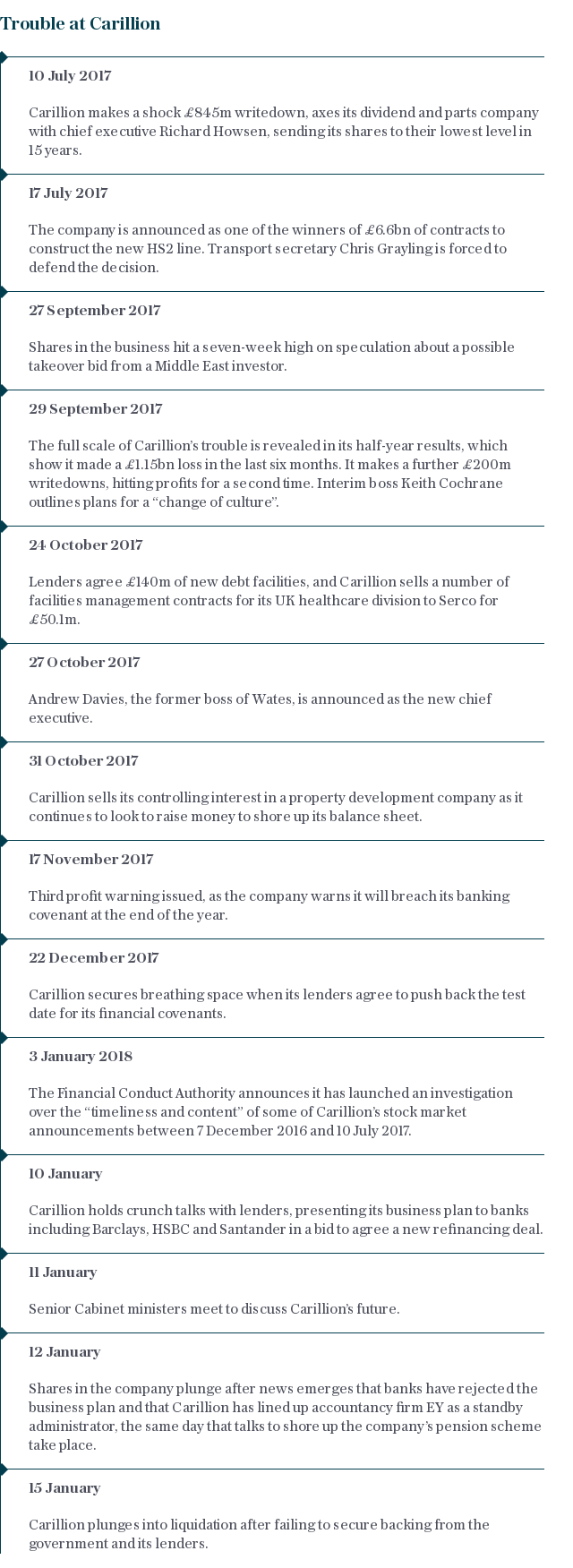

As finance director, Mr Khan ordered a review of Carillion’s biggest contracts, carried out by KPMG. The accountancy firm uncovered huge losses, which led to a dire £845m profit warning in July last year.

Mr Khan left the company two months later. Mr Khan’s role is likely to be probed further. A boss at a rival contractor and former Carillion employee said he gained a reputation as “the person calling the shots”.

“The FD was very dominant,” the source said. “Because Howson was weak on the financials he had a lot of influence at the firm.”

Other former bosses set to give evidence include Keith Cochrane, Carillion’s interim boss, and Mr Khan’s predecessor and successor as CFO, Richard Adam and Emma Mercer.

They are likely to face questions on Carillion’s “reverse factoring” agreements, a complex financing arrangement that allowed suppliers to be paid in advance by banks for a fee, with Carillion settling up later. MPs are expected to press for answers on whether Carillion kept investors and the Government in the dark on the worsening state of its finances.

They will also face questions on whether Carillion “wriggled out” of its pension obligations by “falling short” on contributions for 10 years, as alleged by Frank Field, chairman of the work and pensions committee, last week.

Carillion’s liquidation left a pension deficit of up to £990m. It had just £29m in the bank when it collapsed.

Yahoo Finance

Yahoo Finance