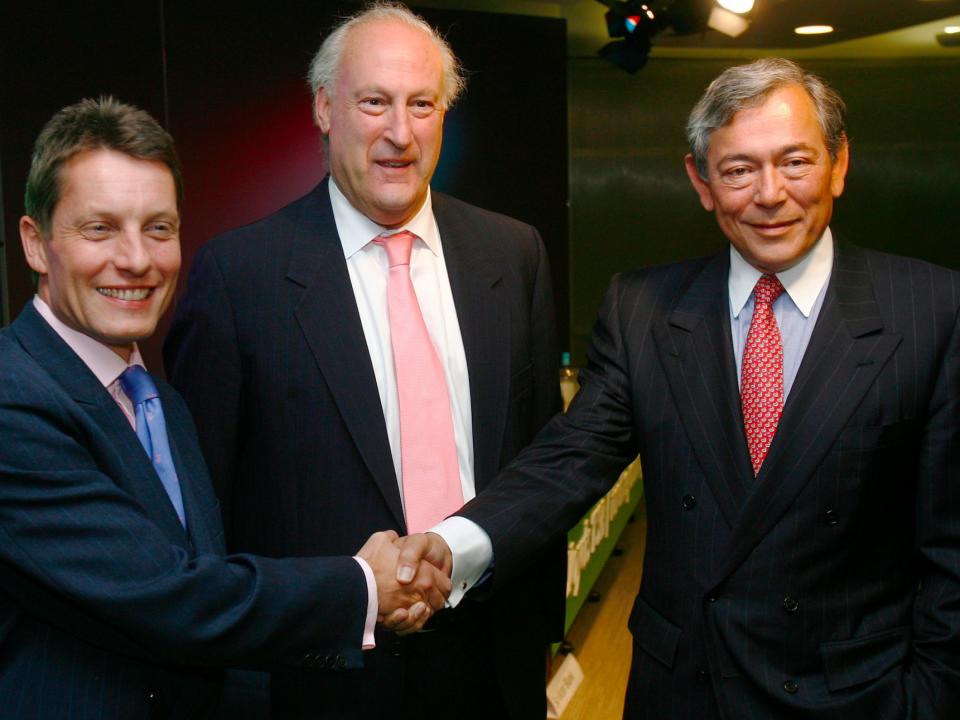

Former top Lloyds executives are suing the lender over unpaid bonuses

REUTERS/Luke MacGregor

LONDON – Two former top employees of Lloyds Banking Group are suing the lender over unpaid bonuses, dating back several years.

Former Chief Executive Eric Daniels and former head of Lloyds' wholesale banking arm Truett Tate filed claims with the High Court, for what they allege was an unfair decision not to pay them part of a bonus in 2012.

Daniels is thought to be seeking about £500,000, while Tate's claim is as yet unknown.

Daniels was the lender's chief executive in the lead up to the 2008 financial crisis and subsequent £20 billion bailout

As a result of the bailout, Lloyds merged with HBOS and the state took 43% ownership, the last of which it sold earlier this year.

A source with knowledge of the claim told The Times that the bonuses had allegedly been based on performance targets, which both men had met and yet had not been paid. Both have already had been forced to hand back money in relation to settlements made by the bank relating to PPI mis-selling.

Daniels and other senior Lloyds officials will also appear as defendants in a £350 million legal case, due to start in October, brought by shareholders who say the lender misled them over its acquisition of HBOS.

Executive pay has been increasingly challenged since the crisis. On Monday, auditor Deloitte reported that there had been a drop in FTSE 100 chief executives' pay and bonuses, in response to "shareholders' concerns." This follows a 2013 change in the law, which forced companies to be more transparent about what they pay top employees, and hold a binding shareholder vote over pay every three years.

Daniels is currently a non-executive Director of Funding Circle, one of the UK's biggest peer-to-peer lenders, and has worked as a top City advisor and partner at a private equity firm since leaving Lloyds. Tate is also a City advisor and continues to work in commercial banking.

A spokesperson for Lloyds told The Times, "As this matter is a live legal issue, it would be inappropriate to comment."

NOW WATCH: THE BOTTOM LINE: New record highs for stocks and a deep dive into Apple's iPhone

See Also:

Wall Street still acts like it hasn't learned any lessons from the financial crisis

The risky product blamed for worsening the financial crisis is back on the rise

SEE ALSO: Salaries of FTSE 100 bosses dropped almost 20% in a year

Yahoo Finance

Yahoo Finance