Forrester Research Inc (FORR) Misses Q1 Revenue Forecasts and Reports Widened Net Loss

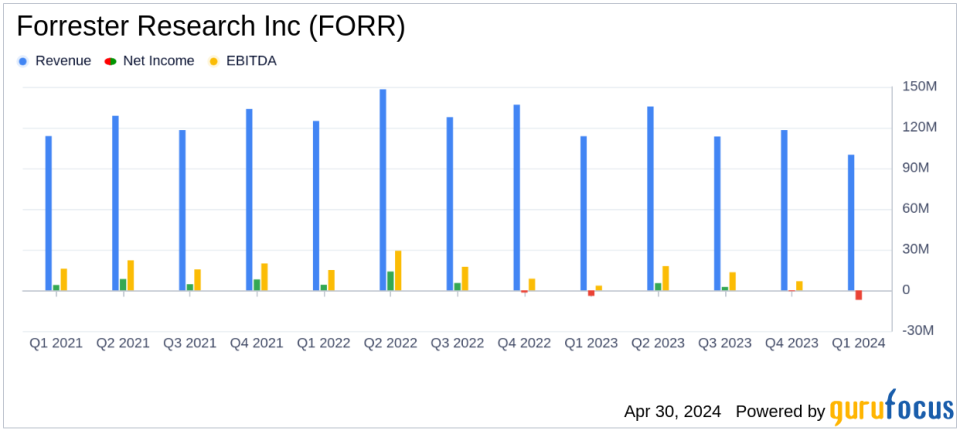

Revenue: Reported at $100.1 million for Q1 2024, down 12% year-over-year, falling short of estimates of $104.21 million.

Net Loss: Increased to $6.7 million in Q1 2024 from $4.1 million in Q1 2023, with a loss per share of $0.35, below the estimated earnings per share of $0.22.

Adjusted Net Income: Stood at $2.8 million, or $0.14 per diluted share, down from $5.1 million, or $0.27 per diluted share in the previous year.

Stock Repurchase Program: Board authorized a $25 million increase, bringing the total available repurchase authorization to approximately $89 million.

Contract Value (CV): Decreased by 4% to $323.1 million, with a client retention rate of 72% and wallet retention of 88%.

Cash Flow: Net cash provided by operating activities was $611 thousand, significantly lower compared to $12.28 million in the prior year.

Guidance: Maintains full-year 2024 guidance, expecting momentum from Forrester Decisions as the year progresses.

Forrester Research Inc (NASDAQ:FORR) disclosed its financial outcomes for the first quarter of 2024 on April 30, revealing a revenue shortfall and an increase in net loss compared to the prior year. According to the 8-K filing, the company reported a decline in total revenues to $100.1 million from $113.7 million in the first quarter of 2023, missing the analyst estimates of $104.21 million. The net loss also widened to $6.7 million, or $0.35 per diluted share, from a net loss of $4.1 million, or $0.21 per diluted share, in the same period last year.

About Forrester Research Inc

Forrester Research Inc is a prominent provider of advisory and research services, aiming to help organizations effectively position themselves in the market. The company operates through three main segments: Research, Consulting, and Events. Each segment contributes uniquely to Forrester's comprehensive service offerings, from in-depth market insights to hands-on engagements.

Performance Insights and Strategic Shifts

The first-quarter results reflect ongoing challenges within the consulting segment, which saw significant revenue declines. The company is in the final stages of its strategic migration to the Forrester Decisions platform, with 70% of its contract value now integrated. Despite the current headwinds, Forrester's management remains optimistic about future growth, driven by new business and the rollout of Izola, their new generative AI tool.

CEO and Chairman George F. Colony highlighted the stabilization in key contract value retention metrics and an uptick in new business, which are seen as positive indicators amidst the broader strategic transition. However, the financial strain from restructuring costs, which significantly increased to $6.6 million from $1.6 million in the previous year, has impacted profitability.

Financial Position and Future Outlook

Forrester's balance sheet remains robust with $118.5 million in cash, cash equivalents, and marketable investments. The company has also increased its stock repurchase program by $25 million, bringing the total available repurchase authorization to approximately $89 million. Looking ahead, Forrester maintains its full-year 2024 guidance, anticipating a stronger performance as the Forrester Decisions platform gains traction.

The company's forward-looking statements suggest a strategic focus on enhancing their service offerings and adapting to market demands through innovative solutions like generative AI. However, the actual future performance will depend on various factors including market conditions and the successful execution of its ongoing strategic initiatives.

Conclusion

Forrester Research Inc faces a pivotal year as it navigates through significant internal changes and external market pressures. The company's ability to turn around its performance and leverage new technologies for growth will be critical in determining its trajectory in the competitive research and advisory market. Investors and stakeholders will be watching closely as Forrester continues to execute its strategic plans in 2024.

Explore the complete 8-K earnings release (here) from Forrester Research Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance