Forum Energy Technologies Reports Q1 2024 Results: A Closer Look Against Analyst Estimates

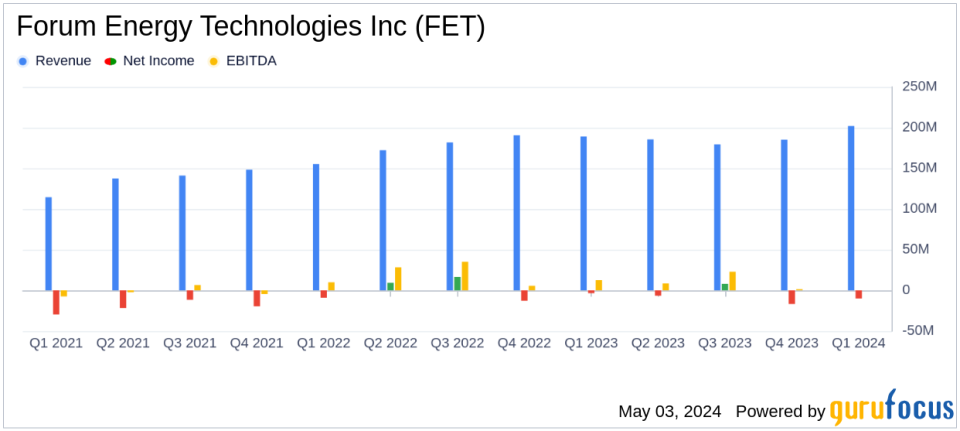

Revenue: Reported at $202 million, marking a 9% sequential increase, slightly below estimates of $212.05 million.

Net Loss: Recorded a net loss of $10 million, significantly above the estimated net loss of $1.70 million.

Earnings Per Share (EPS): Reported a diluted EPS of -$0.85, falling short of the estimated -$0.21.

Adjusted EBITDA: Achieved $26 million, reflecting a substantial 69% sequential increase and expanded EBITDA margins by 460 basis points.

Free Cash Flow: Generated $2 million in free cash flow, indicating progress towards liquidity and financial flexibility.

Orders and Book-to-Bill Ratio: Orders totaled $204 million with a book-to-bill ratio of 101%, suggesting a healthy demand for products.

Full Year Guidance: Reaffirmed, projecting adjusted EBITDA between $100 to $120 million and free cash flow of $40 to $60 million.

On May 2, 2024, Forum Energy Technologies Inc (NYSE:FET) disclosed its first quarter results through its 8-K filing, revealing a mix of challenges and strategic growth from the Variperm acquisition. The company, a key player in the oil, natural gas, and renewable energy industries, reported a revenue of $202 million, marking a 9% sequential increase but falling short of the analyst's expectation of $212.05 million for the quarter.

Despite the revenue miss, FET demonstrated a significant improvement in its adjusted EBITDA, which soared by 69% sequentially to $26 million. This growth is largely attributed to the recent acquisition of Variperm, an initiative that has started to yield financial benefits despite a softer market forecast in Canada for the first half of the year. The net loss stood at $10 million, or $0.85 per diluted share, which, when adjusted for special items, results in a loss of $0.12 per diluted sharethis figure is notably better than the previous quarter's adjusted net loss of $0.39 per diluted share, yet it missed the estimated loss per share of $0.21.

Company Overview and Market Positioning

Forum Energy Technologies designs, manufactures, and distributes products essential for the drilling, well construction, production, and transportation of oil and natural gas. With its headquarters in Houston, Texas, FET operates through two main segments post-Variperm acquisition: Drilling and Completions, and Artificial Lift and Downhole. These segments cater to a diverse customer base, aligning with business activity drivers and operational performance metrics.

Financial and Operational Highlights

The Drilling and Completions segment experienced a slight revenue decline due to the completion of two ROV projects and lower demand for drilling capital equipment. However, this was partially offset by increased sales in stimulation-related equipment. The Artificial Lift and Downhole segment, boosted by the Variperm acquisition, saw a remarkable 42% increase in revenue. This segment's success underscores the strategic value of the acquisition, contributing significantly to the company's overall financial health.

Strategic Moves and Future Outlook

Neal Lux, President and CEO of FET, highlighted the transformative impact of Variperm on the company's portfolio. Despite initial challenges, the integration aligns with FET's strategic goals, enhancing its product offerings and market reach. The company reaffirmed its full-year 2024 guidance, expecting adjusted EBITDA to be between $100 and $120 million and free cash flow to range from $40 to $60 million. This outlook is supported by a robust book-to-bill ratio of 101%, indicating healthy order inflows which may lead to revenue growth in upcoming quarters.

Financial Statements Analysis

The balance sheet reflects a strengthened position with total assets increasing to $1,021.4 million from $821.1 million in the previous quarter, primarily due to the Variperm acquisition. The cash flow statements show an improvement in operating cash flow to $5 million, up from a cash use in the prior period, highlighting effective working capital management and operational efficiency.

Conclusion

Forum Energy Technologies' first quarter of 2024 encapsulates a period of strategic repositioning and operational adjustments. While the company faced a revenue shortfall against analyst expectations, its strategic acquisitions and improved operational metrics across key segments paint a promising picture for future stability and growth. Investors and stakeholders will likely watch closely how FET navigates the evolving market dynamics and leverages its recent acquisitions to fuel its long-term growth trajectory.

Explore the complete 8-K earnings release (here) from Forum Energy Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance