The FTSE 100 had its best week in almost 5 years

REUTERS/Dylan Martinez

European stocks extended their rally into a fourth day as investors continued to shrug off the initial shock of Britain's vote to leave the European Union.

Stocks initially tanked after the Brexit vote but have now roared back and went into the weekend in positive territory.

In Britain, the FTSE 100 — which on Thursday closed at its highest level since August 2015 — was higher by another 1.1% at the close to trade at 6,577 points. The index is now almost 250 points higher than it was prior to the referendum, and enjoyed its biggest weekly gain since 2011, up 7.2% since Monday.

On the day stocks benefitted from comments made by Bank of England governor Mark Carney on Thursday afternoon. Carney assured the markets that the BoE is prepared to deal with any shocks to the economy post-Brexit and hinted that more quantitative easing may be implemented in the summer.

Here is the chart of the FTSE's performance this week:

REUTERS/Dylan Martinez

It should be noted that Britain's blue-chip index is disproportionately filled with companies that denominate their assets in dollars and as a result are not hugely affected by the massive drop in the pound since the vote to leave the EU.

Elsewhere, the FTSE 250 — which paints a more accurate picture of UK investor sentiment as the vast majority of firms in the index are UK-based — also rallied on the day, gaining 1.19%. Despite four days of gains, the index still remains around 800 points below its pre-referendum level however. Here is how that looks:

REUTERS/Dylan Martinez

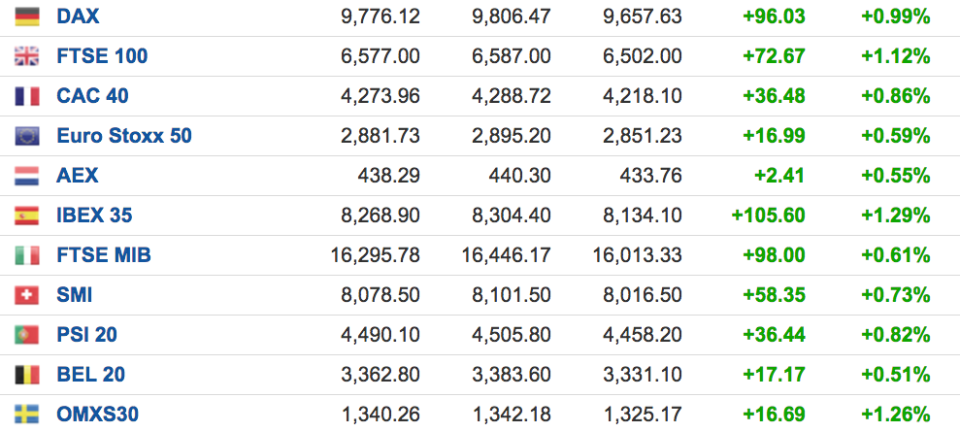

In the broader European markets, there were gains across the board, although gains were generally smaller than in the UK. Here is how the European markets looked ahead of the weekend:

REUTERS/Dylan Martinez

See Also:

Yahoo Finance

Yahoo Finance