France Demands £1.3bn Back Taxes From Google

The French government has demanded that US internet giant Google pays £1.3bn (€1.6bn) in back taxes, it has been reported.

It comes on the same day that a report by MPs (BSE: MPSLTD.BO - news) criticised an agreement for the firm to pay £130m in UK taxes to cover the last 10 years - saying the amount seemed "disproportionately small".

Reuters has told a French official as saying: "As far as our country is concerned, back taxes concerning this company amount to €1.6bn."

A spokeswoman for Google France declined to comment.

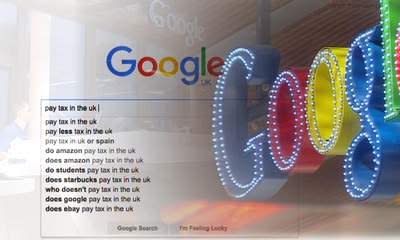

Google has been criticised over the apparent low levels of tax it pays, amid wider criticism of multinational firms that use complex corporate structures to minimise their tax bills. It maintains that it obeys tax rules in all countries where it operates.

Earlier this month, France's finance minister Michel Sapin ruled out striking a deal with Google as the UK did, saying the sums at stake were "far greater" than those in Britain.

Tax advisers say the French tax authority usually issues at least one preliminary assessment before its final judgement, which can be challenged in court if not accepted.

Elsewhere, Google is facing a demand for more than £160m (€200m) in back taxes in Italy.

Meanwhile in the UK, the Commons Public Accounts Committee (PAC) said its investigation into the UK deal had reinforced its concerns that rules governing where corporation tax is paid by multinational firms "do not produce a fair outcome".

The deal was hailed as a "victory" by the Chancellor at the time it was announced last month - with George Osborne arguing it could open the door to further agreements with other companies.

However, Labour described the sum as "derisory" given the size of Google's business in the UK.

Meg Hillier MP, the PAC's chair, said: "The company has chosen to set up a complicated tax strategy specifically designed to minimise its tax bill."

She (Munich: SOQ.MU - news) took a top Google executive to task on the issue earlier this month as he gave evidence to the committee's inquiry, accusing Matt Brittin of "living on a different planet to most of our constituents" as he defended the bill.

Mr Brittin confirmed then Google had made profits of £106m on revenues of £1.18bn in the UK over the past 18 months, and said 11% of the company's global sales to customers occurred in the UK.

He said the £130m figure was "the conclusion of a six-year rigorous, independent tax audit in which we are paying tax at 20% like every other UK company".

Yahoo Finance

Yahoo Finance