France’s Dominance in Euro Credit Leaves Market at Vote’s Mercy

(Bloomberg) -- President Emmanuel Macron’s surprise election call last week has highlighted France’s prominence in European credit markets.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Stocks Climb on Bullish Nvidia Call as Yields Sink: Markets Wrap

Citi Pitches Money-Moving ‘Crown Jewel’ as Central to Revamp

Ex-Trump Adviser Urges Him to Cut Ties With China, Restart Nuclear Tests

Whether it’s blue-chip, junk bonds or collateralized loan obligations, euro-denominated credit markets have been battered after the French president’s June 9 decision threw the country into political chaos. IHS Markit’s crossover index of credit default swaps, a key indicator of European credit risk, had its biggest spike in well over a year last week, rising 42 basis points.

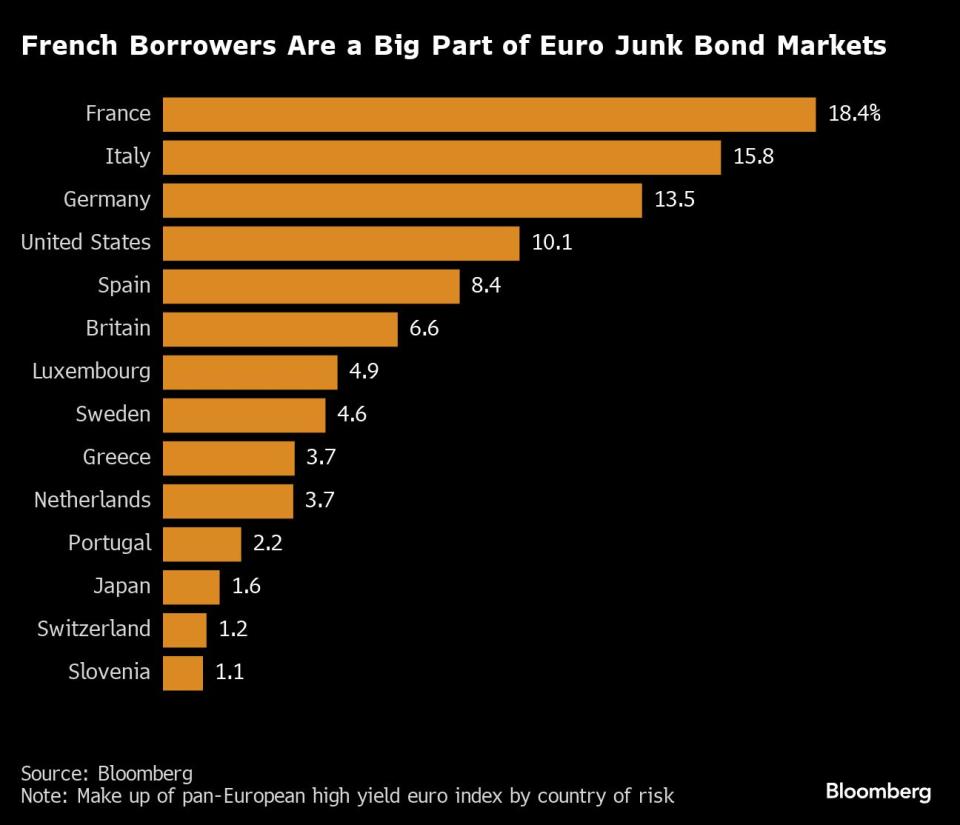

The driver of this rout, in large part, is France. The nation’s firms account for the biggest component in the main categories of the region’s debt, so any damage in the Republic’s corporate loans and bonds will drag the whole index down.

Investors are worried that public spending in France would spiral out of control if the poll-leading party of Macron’s far-right rival, Marine Le Pen, gets to dominate parliament. French Finance Minister Bruno Le Maire warned that such a scenario would be reminiscent of former UK Prime Minister Liz Truss, whose expansionary policies upended markets and prompted a meltdown in sterling corporate bonds.

Still, Le Pen’s closest ally, Jordan Bardella, insists that the National Rally party would stabilize France’s public finances.

The French left-wing has also been making inroads, with an alliance of leftist parties pledging to pick apart Macron’s seven years of reforms, setting the country on a potential collision course with the European Union over fiscal policy.

“The current repricing is rational and cold-blooded,” said Gilles Pradere, senior fixed income manager at RAM Active Investments. “What is very likely is that France public finances will continue to deteriorate. The speed is unclear, the direction seems clear. The impact on the French economy is likely negative,” he added.

Engie SA, Emeria Sasu and Societe Generale SA were among those companies whose bonds were the hardest hit.

Data compiled by Bloomberg shows that companies operating in France comprise 20% of a key index of euro-denominated investment grade debt and more than 18% of a euro high-yield index, the highest share by country in the latter case. In addition, French issuers have the biggest share in European CLOs, with around 19% exposure on average, according to Morgan Stanley strategists Vasundhara Goel and Samyuktha Gopal.

The shock from the political decision hit all the harder because European credit had recently been on a tightening trend as investors piled into higher yielding debt. A euro high-yield index, for example, had tightened by 100 basis points to 323 basis points leading into last week’s selloff.

“French risk comprises nearly 20% of both investment grade and high-yield markets in Europe and therefore had an outsized impact on spreads,” said Mahesh Bhimalingam, chief European credit strategist at Bloomberg Intelligence. “Spreads were quite rich by early June and were not pricing any such external unknowns and were ripe for such a correction.”

He said he could see further pain if a far-right victory in the French election fueled further concerns over fiscal loosening.

While Le Pen’s National Rally hasn’t yet set out its policy proposals in detail, it has said it would slash sales taxes on fuel and energy at a cost of about €20 billion ($21 billion) and pledged to take back control of energy policy from the EU. It has also promised to lower the retirement age to 60 and increase wages for some public servants.

On the opposite end of the political spectrum, the leftist group similarly wants to undo the government’s pension reform, raise the minimum wage and impose an extra tax on the profits of certain industrial firms.

Banking woes

French banks such as BNP Paribas SA, Societe Generale SA and Credit Agricole SA are especially vulnerable. As in other nations, they tend to be viewed as a proxy for the country’s economy. They also have a hefty holding of government bonds that were hit hard in the recent selloff, though have recently rebounded.

The cost of protection against defaults on the senior debt of some of the largest banks has jumped more than that of euro area peers since the election was called, according to data compiled by Bloomberg.

“We believe financials could be under further pressure into the French general election,” said Elisa Belgacem, a credit strategist at Generali Investments. She prefers exposure to non-financial high-grade companies, but cautions against utility issuers with close ties to the French state and renewables-focused firms.

“The far-right is said to be hostile to renewable energy generation,” she said.

--With assistance from Francesca Veronesi.

Most Read from Bloomberg Businessweek

Google DeepMind Shifts From Research Lab to AI Product Factory

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Trump’s Planned Tariffs Would Tax US Households, Economists Warn

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance