Francis Menassa, JAR Capital: You Can’t Always Get What You Want

The factors pointing towards more accommodative monetary policy from the Fed this year. The domestic economy seems to have remained relatively robust, however, with strong consumer spending growth and a fifty-year low in the unemployment rate.

It is these competing economic forces that have been confounding policymakers, eventually leading to the July cut in rates. Judging by recent historical standards, that should drive US equities higher for a while longer, but with markets up over 20% already year to date, and brushing up against all-time highs, how much more should we expect?

Low unemployment rates and inflation

If softer growth expectations are allowing for easier monetary policy, should that really be super bullish for US stocks? With interest rates close to zero can we really expect fixed income investments to diversify away equity risk when the equity bull market comes to an end? These are the issues that investors should be tackling now, considering a rebalance of their portfolios while equity markets are in good shape.

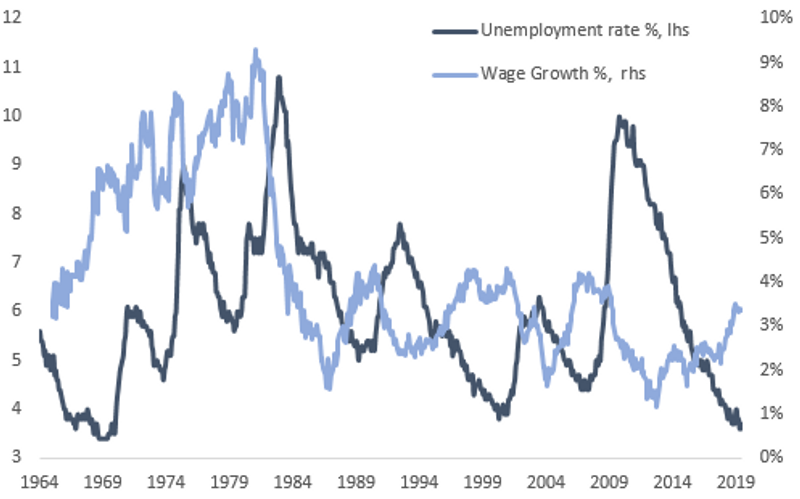

Starting with the economic fundamentals, this cycle so far has been marked out by low-interest rates and a supposed breakdown in the Phillips Curve (Figure 2). That is the relationship between unemployment and inflation. The idea being that lower levels of unemployment tighten the labor market which adds to rising wage pressure which in turn pushes up price inflation.

So far this cycle, we have seen the unemployment rate fall to historic lows, pushing up wage growth (although by less than we would normally expect, Figure 2) but having no effect on inflation. In fact, one of the factors concerning US policymakers has been the fall in core PCE inflation (the Feds preferred measure) at a time when it really should be rising.

That reaction function of policymakers is instructive. It suggests that they are more concerned about the risks for deflation (falling prices) than about inflation running hot above their target. That could be because the normal Fed rate-cutting cycle would usually mean interest rates falling by 5% or so in order to stabilize growth or to push the economy out of recession and back into growth.

This time around there is just half that degree of firepower available to the Fed assuming that interest rates will not fall below zero. Therefore, policymakers are prepared to be proactive and to provide insurance against the possibility of a broad economic slowdown.

Is it the last rate cut?

That to us suggests that it is more likely than not that this cut in rates will be the last for a while, and that the Fed may even be prepared to let the economy run hot for a while in order to shore up the growth situation before adjusting policy again. That would be our central case but let us consider a couple of scenarios around that.

First, the Fed could be successful in reigniting an acceleration in economic growth which would almost certainly drive up bond yields from here. Given the revealed preference of policymakers for insuring growth, that could mean inflation running around 1% above target next year and a significant steepening of the yield curve.

On the other side of the coin, if the growth fundamentals have already deteriorated to the point where policymakers are unable to reignite growth, then the possibility of recession will likely take bond yields below zero, but probably not by much.

In our bullish scenario, where growth reaccelerates, bond yields are likely to rise, making them unattractive to investors today. In our bearish scenario, bond yields are unlikely to fall by enough in order to offer the kind of diversification benefits that balanced multi-asset investors have come to expect. For investors to protect their wealth within a multi-asset context therefore, they will need to look elsewhere in order to diversify away from equity risk. One obvious alternative is the now deep and liquid market for derivatives.

Instead of buying bonds for diversification, investors could buy put options on the equity market, maybe cheaper out of the money contracts which would rally significantly should equity market volatility pick up. The VIX is now towards the lows for the year making this a good opportunity to put in place that kind of portfolio protection, but this approach comes with a cost With bond yields looking so unattractive in either of our scenarios, however, it may be that investors really should consider the prospect of lower portfolio returns or accept a higher level of risk. Either way, investors should make an active choice, and now it seems the time to do it. You can’t always get what you want!

This article was originally posted on FX Empire

More From FXEMPIRE:

Natural Gas Price Forecast – Natural gas markets run into resistance

POTUS wanted lower rates, the outcome on the USD, not so much.

Gold Price Forecast – Gold markets break through trend line only to find buyers again

Francis Menassa, JAR Capital: You Can’t Always Get What You Want

Gold Price Futures (GC) Technical Analysis – August 1, 2019 Forecast

USD/JPY Price Forecast – US dollar breaks major level before turning around

Yahoo Finance

Yahoo Finance