Franklin BSP Realty Trust Inc. Reports First Quarter 2024 Earnings, Aligns Closely with Analyst ...

Reported Net Income: $35.8 million for Q1 2024, below the estimated $36.37 million.

Earnings Per Share (EPS): Reported at $0.35, falling short of the estimated $0.39.

Distributable Earnings: Increased to $41.0 million, or $0.41 per diluted common share, from $39.3 million in the previous quarter.

Dividend: Declared a quarterly cash dividend of $0.355 per share, representing a 9.1% annualized yield on book value.

New Loan Commitments: Closed $591 million in new loan commitments during the quarter.

Portfolio Growth: Core portfolio principal balance grew to $5.2 billion, an increase of $199 million.

Liquidity: Maintained strong liquidity with $1.0 billion available, including $240 million in cash and cash equivalents.

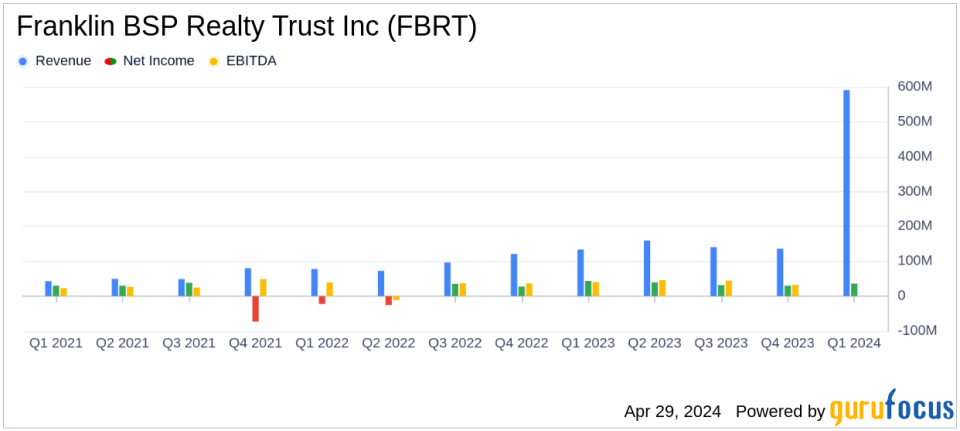

On April 29, 2024, Franklin BSP Realty Trust Inc (NYSE:FBRT) announced its financial results for the first quarter ended March 31, 2024. The company reported a GAAP net income of $35.8 million and diluted earnings per share (EPS) of $0.35, aligning closely with analyst estimates of $0.39 per share and a net income of $36.37 million. These results reflect a solid performance compared to the previous quarter's net income of $30.0 million and EPS of $0.28. For detailed insights, refer to FBRT's 8-K filing.

Franklin BSP Realty Trust Inc is a real estate investment trust that specializes in originating, acquiring, and managing a diversified portfolio of commercial real estate debt, primarily secured by properties in the United States. As of the latest quarter, FBRT manages assets totaling approximately $6.0 billion.

Quarterly Financial Highlights

The company's distributable earnings, a non-GAAP financial measure, stood at $41.0 million, or $0.41 per diluted common share, showing an improvement from $39.3 million, or $0.39 per share in the previous quarter. This growth is indicative of FBRT's robust operational strategies and its focus on multifamily property loans, which constitute 75% of its portfolio. The company's commitment to this sector is evident in its stable performance and strategic positioning for long-term success.

During the quarter, FBRT declared a common stock cash dividend of $0.355 per share, which annualizes to a yield of 9.1% on the book value per share. This dividend payout is supported by a dividend coverage ratio of 99% on GAAP earnings and 115% on distributable earnings, underscoring the trust's efficient capital management and strong cash flow generation capabilities.

Operational and Portfolio Developments

FBRT closed $591 million in new loan commitments and funded $487 million towards new and existing loans during the quarter. The core portfolio saw a net increase, with the total principal balance reaching approximately $5.2 billion across 145 loans. The trust has maintained a conservative approach with over 99% of its portfolio in senior mortgage loans and a minimal exposure of only 6% to office loans, reflecting a strategic focus on reducing risk and enhancing portfolio quality.

The trust also actively manages its capital through share repurchases. Under its $65 million share repurchase program, FBRT bought back 151,123 shares at an average price of $12.42, enhancing shareholder value by increasing the book value per share.

Challenges and Forward Movements

Despite a robust performance, FBRT recognized an additional provision for credit losses of approximately $2.9 million during the quarter, highlighting the ongoing challenges in the commercial real estate sector, particularly in the context of economic uncertainties. However, with total liquidity of $1.0 billion, including $240 million in cash and cash equivalents, FBRT is well-prepared to navigate potential market fluctuations and capitalize on new opportunities.

Looking ahead, FBRT's management remains focused on growing the loan portfolio and leveraging market opportunities to ensure sustained profitability and shareholder returns. The trust's strategic initiatives, combined with a strong liquidity position, position it well to manage any upcoming challenges effectively.

For further details on FBRT's financial performance and strategic initiatives, investors and interested parties are encouraged to review the supplemental earnings presentation available on the company's website and join the upcoming conference call scheduled for April 30, 2024.

Explore the complete 8-K earnings release (here) from Franklin BSP Realty Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance