Fresenius Medical (FMS) Launches Campaign to Boost Kidney Care

Fresenius Medical Care AG & Co. KGaA FMS recently announced that its Global Medical Office has introduced the My Reason campaign to boost patient enrollment in the company’s kidney-focused genomics registry, which was first launched last year.

The campaign, with a goal to enroll above 100,000 participants within five years, will aid in creating a registry, which is one of the biggest of its kind, by making participation a standard offering to patients in Fresenius Kidney Care dialysis centers in the United States. The collected data from this campaign will serve as an important research tool that can help connect genomic and clinical data of chronic kidney disease (CKD) and end-stage kidney disease (ESKD) participants, thereby allowing scientists to understand genetic variations in patients effectively.

It is important to mention that this renal-focused genomic registry was opened in select Fresenius Kidney Care dialysis centers in January 2021.

This announcement is likely to further boost the company’s Health Care Services segment.

More on the News

Per management at Fresenius Medical, the My Reason campaign will help the company develop a groundbreaking registry of people with advanced kidney disease from various ethnic and cultural backgrounds.

The data collected, when paired with existing clinical data, can enable scientists to sort out the complicated interactions that result in kidney injury and use genetic sequencing to better understand pathways of injury in kidney disease.

Image Source: Zacks Investment Research

Patients and their family members staying in the United States are eligible to participate in the My Reason campaign unveiled at the beginning of April.

Market Prospects

Per a report by Research and Markets, the global CKD market was worth $12.4 billion in 2016 and is anticipated to reach $17.4 billion by 2025, at a CAGR of 3.9% from 2017 to 2025. Hence, this announcement comes at an opportune time for Fresenius Medical.

Another Notable Development

In March, the company announced that it inked a binding deal to build an independent new company that brings together Fresenius Health Partners, which is the value-based care division of Fresenius Medical Care North America, and InterWell Health and Cricket Health. Per management, this announcement is crucial in advancing Fresenius Medical’s growth strategy 2025, which aims to extend its presence along the renal care continuum.

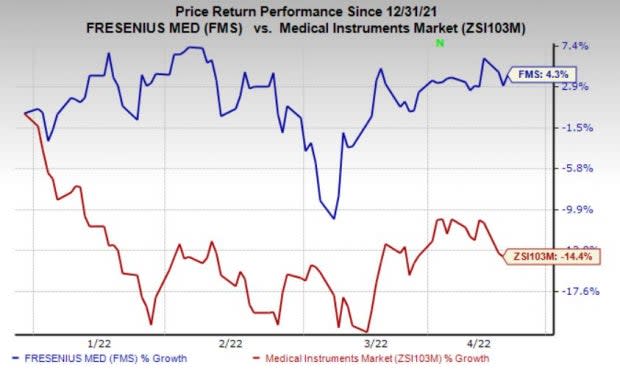

Price Performance

Shares of this Zacks Rank #3 (Hold) company have gained 4.3% on a year-to-date basis against the industry’s decline of 14.4%.

Stocks to Consider

Some better-ranked stocks from the broader medical space are AMN Healthcare Services, Inc. AMN, Henry Schein, Inc. HSIC and Abiomed, Inc. ABMD.

AMN Healthcare surpassed earnings estimates in each of the trailing four quarters, the average surprise being 20%. The company currently sports a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 16.2%. AMN’s earnings yield of 8.9% compares favorably with the industry’s (0.3%).

Henry Schein beat earnings estimates in each of the trailing four quarters, the average surprise being 25.5%. The company currently carries a Zacks Rank #2 (Buy).

Henry Schein’s long-term earnings growth rate is estimated at 11.8%. HSIC’s earnings yield of 5.3% compares favorably with the industry’s 3.6%.

Abiomed surpassed earnings estimates in each of the trailing four quarters, the average surprise being 9.2%. The company currently carries a Zacks Rank #2.

Abiomed’s long-term earnings growth rate is estimated at 20%. ABMD’s earnings yield of 1.5% compares favorably against the industry’s (6.4%).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Fresenius Medical Care AG & Co. KGaA (FMS) : Free Stock Analysis Report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance